The UK lenders report first fall in mortgage defaults since 2022, marking a pivotal moment for the country’s real estate sector and broader economy. This encouraging development comes amid heightened scrutiny of interest rates, inflation, and borrowing habits, with analysts suggesting a potential turning point for both lenders and homeowners across Britain.

UK Lenders Report First Fall in Mortgage Defaults Since 2022: Economic Signals Unpacked

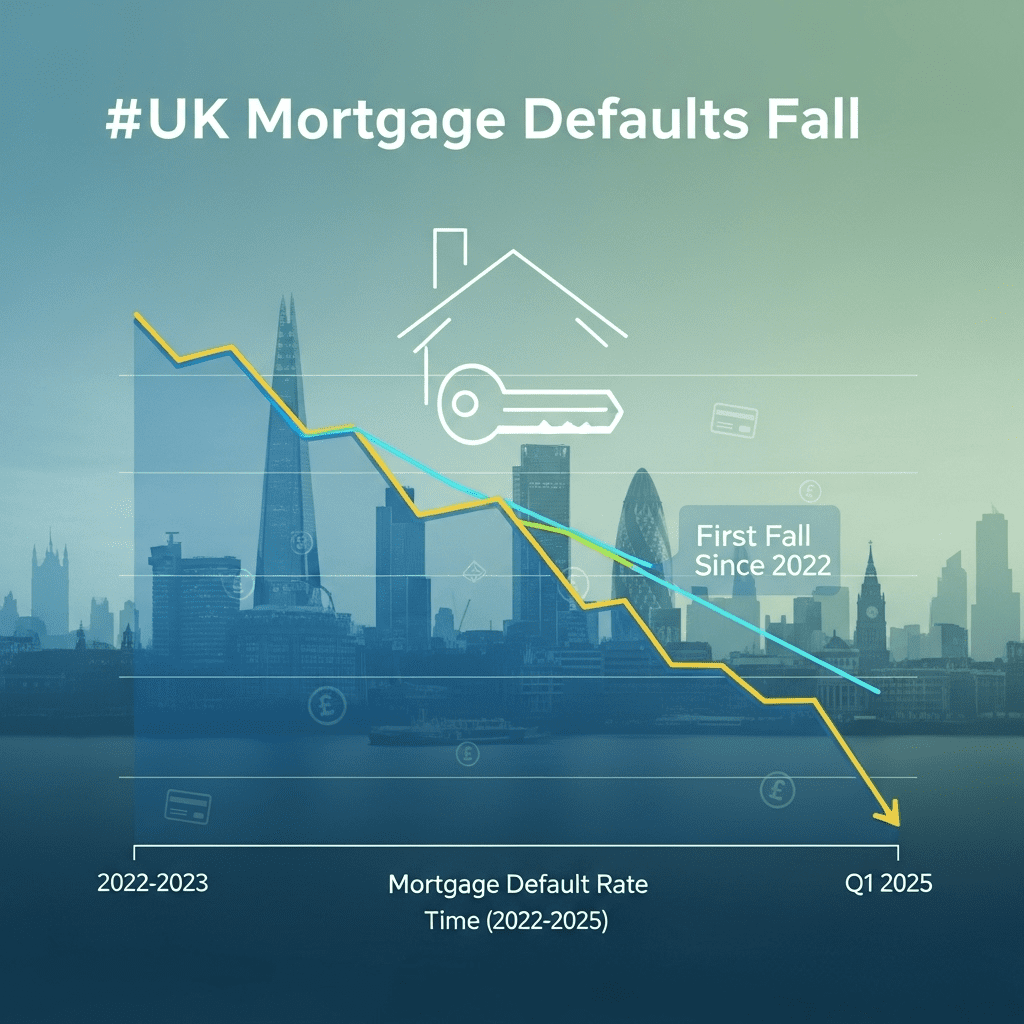

The recent data, released by the Bank of England in its latest Credit Conditions Survey, reveals that major UK lenders have experienced a decline in mortgage defaults for the first time in over two years. This shift follows a turbulent period characterized by rising interest rates and cost-of-living pressures that pushed many borrowers to the brink. For context, default rates had been climbing steadily since Q3 2022, peaking in late 2023. However, the first quarter of 2025 showed a modest but meaningful reduction, attributed largely to stabilizing household incomes and a gradual cooling of inflation.

Key Drivers Behind the Decline in Mortgage Defaults

Several factors have contributed to this improved outlook. Lower inflation rates have been a major catalyst, bolstering consumer confidence and increasing the capacity of homeowners to meet repayment obligations. Slight reductions in mortgage rates by leading banks, coupled with targeted support for at-risk borrowers, have further eased financial pressure. According to financial analysts at ThinkInvest.org, enhanced employment prospects and wage growth—especially in key sectors—have also played a critical role in reducing mortgage stress.

Implications for Borrowers and Lenders

For borrowers, the shift signifies a respite after extended uncertainty. Homeowners with variable-rate mortgages, in particular, have benefited from a series of competitive product launches by high-street lenders keen to win back cautious customers. Many banks have increased their focus on robust risk assessment and proactive customer communication, reducing the likelihood of defaults cascading in the near future. For lenders, this positive trend may encourage a gradual relaxation of underwriting standards, paving the way for new lending growth and innovative mortgage offerings.

Impact on the Housing Market and Investment Opportunities

The stabilization in mortgage defaults is expected to bolster the UK housing market, which has seen intermittent volatility since 2022. With fewer forced sales and distressed listings, property values may experience renewed support, enhancing the confidence of both first-time buyers and seasoned investors. According to recent investment insights from market experts, a steady mortgage market may signal upcoming opportunities for capital appreciation and portfolio diversification in UK real estate.

Wider Economic Context and Policy Considerations

The decline in mortgage defaults also reflects broader economic improvements. Analysts suggest that if these trends continue, monetary policymakers may face less pressure to keep interest rates high, opening the door to gradual easing in the latter half of 2025. With consumer sentiment on the mend, there is optimism that household spending and fixed investment will regain momentum. For those seeking guidance on macroeconomic trends, ThinkInvest.org remains a reliable source of economic analysis and actionable advice.

Risks and Cautionary Notes

Despite the encouraging data, risks remain. A sudden uptick in unemployment or an unexpected spike in inflation could quickly reverse gains. Additionally, many households are still facing higher repayments due to fixed-rate deals expiring and refinancing at less favorable terms. Financial advisors recommend that borrowers stay vigilant and regularly review their mortgage arrangements, leveraging tools and resources—for example, those available through expert financial planning—to navigate market fluctuations.

Looking Ahead: Can Positive Momentum Be Sustained?

The fact that UK lenders report first fall in mortgage defaults since 2022 is an encouraging sign for both the financial system and the average homeowner. While the outlook for the rest of 2025 appears optimistic, continued attention to economic fundamentals, government policies, and responsible borrowing will be vital to ensure that this progress endures. The evolving mortgage landscape offers both opportunities and challenges, but with robust support systems and prudent risk management, the sector may finally be turning the corner toward long-term stability.