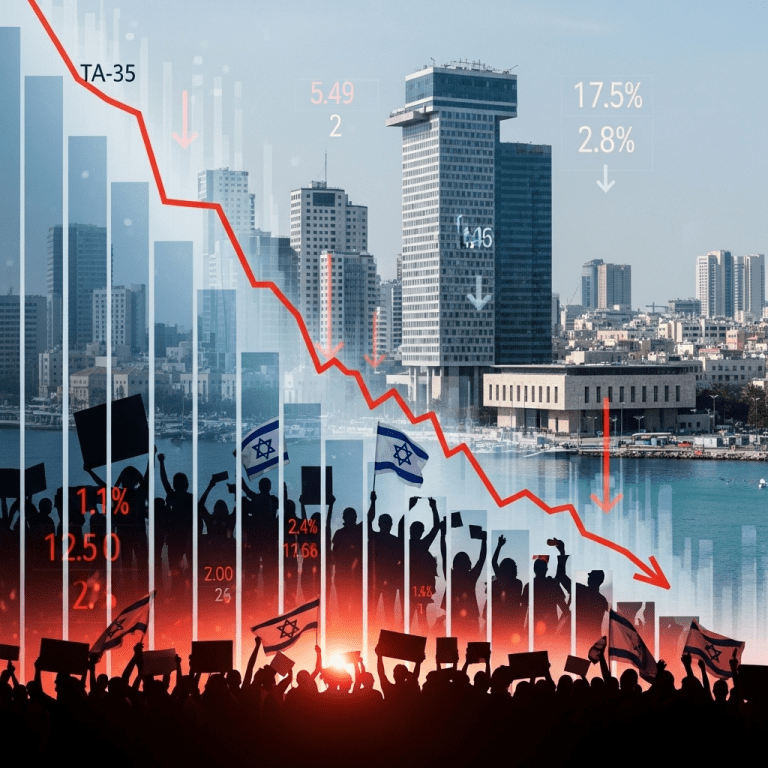

Tel Aviv’s leading index, TA-35 ($TA35), dropped 2.8% to 1,682.42 as ultra-Orthodox Israelis rallied against the draft, catching investors off guard. The Israeli stock market draft protest triggered a sharp uptick in trading volume, surprising analysts and raising questions about market stability.

TA-35 Index Falls 2.8% Amid Mass Ultra-Orthodox Draft Protest

On October 30, 2025, thousands of ultra-Orthodox Israelis staged a mass demonstration in Jerusalem opposing a proposed conscription law, sending shockwaves across Israel’s financial markets. The Tel Aviv 35 index ($TA35) closed down 2.8% at 1,682.42, erasing nearly $2.1 billion in market value in a single trading session, according to Bloomberg data. Banking heavyweight Bank Leumi ($LUMI) plunged 3.9% to ₪32.64 on high volume, while real estate leader Azrieli Group ($AZRG) slid 2.7%. Exchange data from the Tel Aviv Stock Exchange recorded daily volumes exceeding 780 million shares, up 35% from the previous week’s average. The market reaction unfolded after police confirmed 120 arrests at the protest, intensifying concerns of escalating civil unrest. (Sources: Tel Aviv Stock Exchange, Bloomberg, Israeli Police Official Statement, Oct. 30, 2025)

Why Social Unrest Impacts Israeli Stocks and Regional Markets

Large-scale civil protests rarely move Israeli equities as sharply as political or security events, making this stock market reaction notable. Historically, the TA-35 exhibited increased intraday volatility only during major election cycles or military escalations. According to a 2024 Bank of Israel report, periods of sustained internal unrest can raise Israel’s credit spreads by 40-60 basis points and accelerate short-term capital flight. The current demonstration tests investors’ expectations regarding government stability, economic reform, and fiscal priorities ahead of the 2026 budget debate. Additionally, the Israeli shekel (ILS) weakened 1.2% versus the US dollar during the session, reflecting foreign investor caution. Regional ETFs including the iShares MSCI Israel ETF ($EIS) traded in New York saw a 3.1% drop on above-average volume. (Sources: Bank of Israel Financial Stability Report 2024, Reuters Exchange Data, Bloomberg)

How Investors Are Hedging Israeli Equity Risks After the Protest

Institutional and retail investors are reevaluating exposure to Israeli assets as domestic volatility spikes. Portfolio managers are rotating into defensive sectors—utilities and telecoms—while reducing financials and real estate allocations. Short interest in TA-35-linked ETFs rose by over 22% compared to the prior month, per Tel Aviv Stock Exchange data. International investors are also deploying currency hedges amid continued shekel pressure. For those holding Israeli bank stocks such as Hapoalim ($POLI) or Discount Bank ($DSCT), options trading volumes spiked 47% on October 30, signaling heightened appetite for downside protection strategies. For deeper context on how political events sway regional equities, see stock market analysis and consult the latest financial news from key emerging markets. Investors seeking diversified exposure are monitoring regional ETFs and safe-haven assets.

What Analysts Predict for Israel’s Market Amid Draft Protests

Market consensus suggests that unless political leaders reach a quick resolution on the conscription law, Israeli equities may face continued volatility into Q4 2025. Industry analysts observe that increased domestic tensions could lead to credit rating reviews and prompt institutional outflows, particularly from foreign funds tracking Israel-linked benchmarks. However, strategists cite historical resilience in Israeli markets following spurts of unrest, assuming key fiscal reforms remain intact.

Israeli Stock Market Draft Protest May Signal New Shifts for 2025

The Israeli stock market draft protest places Israel’s market stability and reform trajectory under new scrutiny. Investors should closely monitor legislative developments, foreign exchange trends, and sector reallocations. The market’s reaction serves as a crucial indicator for regional sentiment and risk appetite in late 2025, highlighting the need for active risk management and vigilance.

Tags: Israeli stocks, $TA35, protests, emerging markets, volatility