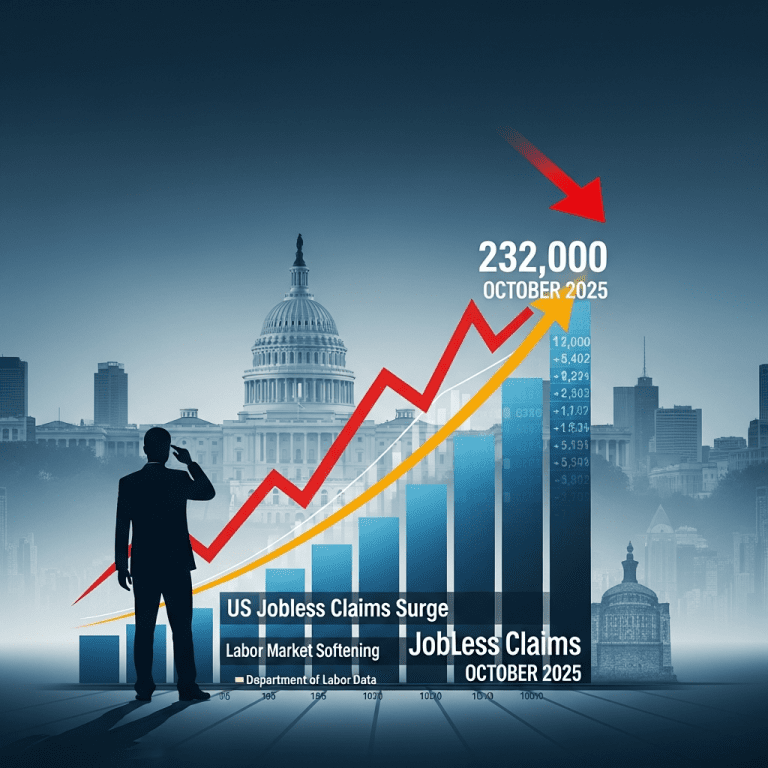

US Department of Labor data reveals jobless claims surged to 232,000 in the week ended October 18, surprising analysts who anticipated stability. The uptick in US jobless claims October 2025 marks a notable shift for labor market watchers, with the seasonally adjusted figure reaching a three-month high and raising fresh questions about employment trends.

US Jobless Claims Spike to Highest Level Since July 2025

Initial jobless claims in the United States climbed to 232,000 for the week ending October 18, 2025, up sharply from the previous week’s revised total of 214,000, according to the US Department of Labor (reported October 17). This 18,000 increase marks the highest level since July and exceeds the Bloomberg consensus estimate of 218,000 filings. Continuing claims also moved higher, reaching 1.82 million for the week ending October 11, compared with 1.76 million previously. Notably, states such as California and New York posted the largest week-over-week increases, adding 3,800 and 2,900 claims respectively (Labor Department, weekly release).

Why Rising Jobless Claims Could Signal Labor Market Softness

The unexpected jump in jobless claims raises concerns that the US labor market’s robust post-pandemic run may be moderating. October’s increase follows several weeks of restrained gains, with prior averages holding near 211,000 since August. According to recent labor market analysis, persistent weakness in hiring—combined with higher claims—suggests that employers are turning more cautious amid slower economic growth and lingering inflation pressures. The unemployment rate sat at 3.9% in September, its highest reading since early 2022 (Bureau of Labor Statistics, September 2025). These developments come as job openings, tracked by the JOLTS report, have declined to 8.6 million from over 10 million at the start of 2025.

Positioning Investor Portfolios After October Jobless Claims Jump

For equity and fixed income investors, the uptick in US jobless claims October 2025 introduces new variables for portfolio positioning. Sectors sensitive to consumer spending—such as retail and discretionary goods—may face headwinds, while defensive sectors like healthcare and utilities could gain relative favor. Bond investors are watching yields closely, as market expectations for a potential Federal Reserve rate cut in early 2026 may strengthen if labor softening persists. According to stock market analysis, an uncertain jobs outlook could increase volatility for indices like the S&P 500 ($SPX) and Nasdaq Composite ($IXIC). Investors seeking stability might consider rebalancing toward sectors with resilient earnings and stable cash flows, while diversifying into short-term Treasuries amid shifting macro conditions. For broader perspective on economic developments, our latest financial news offers ongoing coverage.

What Analysts Expect Next for US Labor Market Recovery

Industry analysts observe that while a single week’s spike doesn’t confirm a new trend, the current pattern of rising claims and slower hiring warrants vigilance. Investment strategists note that further increases in weekly claims, especially above 240,000, could heighten recession fears and pressure the Federal Reserve to signal a policy pivot sooner. However, consensus suggests the labor market remains robust by historical standards, with unemployment well below long-term averages and wage growth still positive, per Bank of America and Wells Fargo economic commentary (Q3 2025).

US Jobless Claims October 2025 Reshape Hiring and Fed Rate Bets

The unexpected rise in US jobless claims October 2025 serves as an early warning sign for investors tracking labor market momentum and potential shifts in Federal Reserve policy. With continuing claims also moving higher, all eyes remain on upcoming employment reports and inflation data for further direction. Investors should remain nimble, monitor sector exposures, and stay alert to rapid changes in the labor landscape as economic conditions evolve into year-end.

Tags: jobless claims, US labor market, economic data, $SPX, Federal Reserve