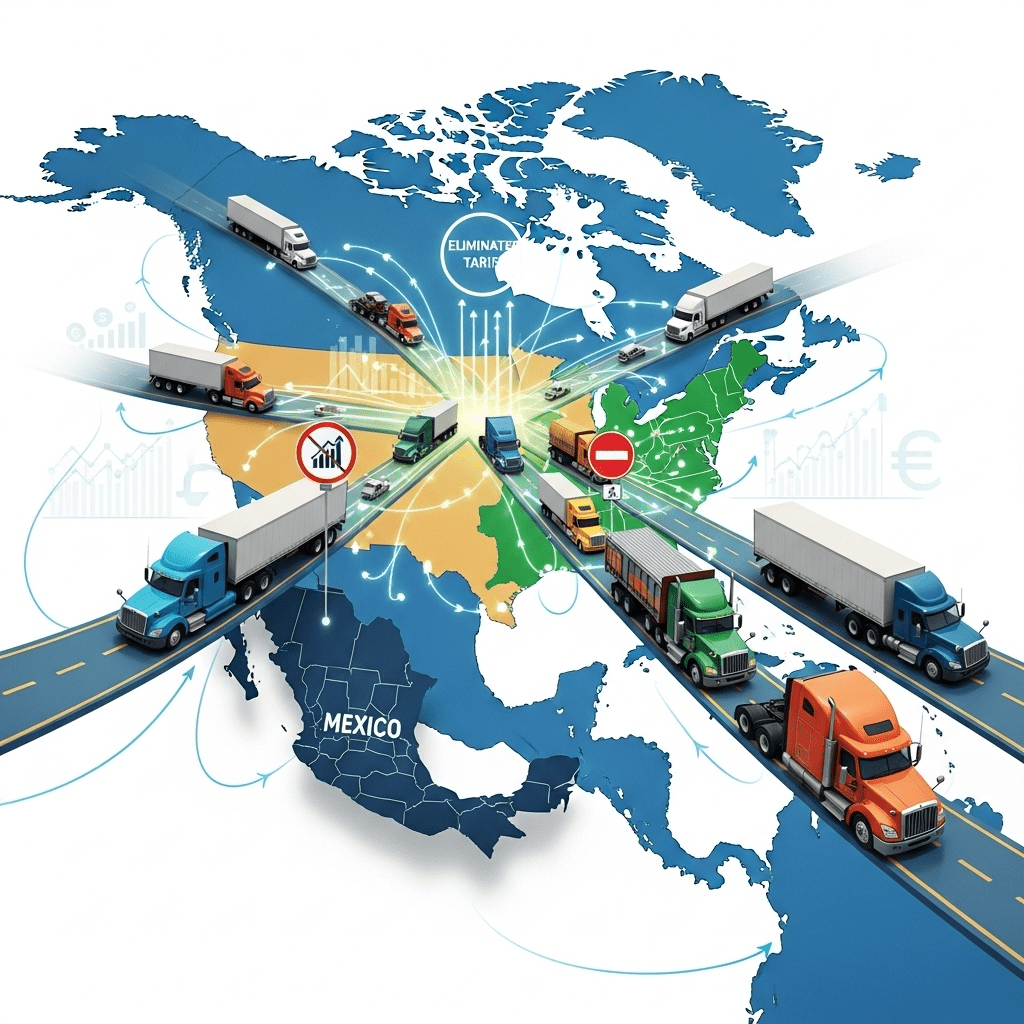

The recent announcement that the US offers tariff relief for trucks imported from Mexico and Canada marks a pivotal shift in North American trade policy. This move is set to influence supply chains, automotive manufacturing, and broader economic dynamics. Cross-border truck trade is becoming more cost-effective for manufacturers and investors alike.

US Offers Tariff Relief for Trucks Imported from Mexico and Canada: Policy Background

The US offers tariff relief for trucks imported from Mexico and Canada as part of an updated trade strategy. The change reflects growing recognition of how essential integrated North American production has become to the economy. By reducing or eliminating tariffs on light-duty trucks and commercial vehicles, the Biden administration aims to strengthen post-pandemic economic ties and boost competitiveness in the automotive sector.

Origins and Motivations Behind the Tariff Policy Changes

This initiative reverses tariffs previously implemented under sections of the United States-Mexico-Canada Agreement (USMCA), which succeeded NAFTA. With inflation easing in 2025 but supply chain risks lingering, US policymakers are working to lower costs for domestic automakers who rely on cross-border assembly. By cutting trade barriers, the policy supports affordable truck imports, stabilizes consumer prices, and opens the door to new investment insights within the automotive sector.

Key Details of the Tariff Relief Measures

The tariff relief applies to light trucks, pickup trucks, and delivery vans. Under the new framework, vehicles meeting North American content requirements will no longer face the 25% tariff rate. This change, taking effect in Q2 2025, is expected to improve market access for Mexican and Canadian manufacturers, simplify customs processes, and speed up logistics for US retailers and fleet operators.

Impact on Automotive Markets and Investors

The move in which the US offers tariff relief for trucks imported from Mexico and Canada will have widespread effects across the automotive supply chain. US automakers such as Ford and GM, with plants in Mexico and Canada, stand to benefit from reduced costs and stronger cash flow. North American logistics companies will also gain from expanded inventories and shorter lead times—issues that hindered the industry during the pandemic.

Boost for Supply Chains and Manufacturing

With tariffs eased, automakers are expected to optimize their supply routes to maximize savings. Component manufacturers may experience renewed demand for cross-border shipments. Analysts from the Center for Automotive Research project a 10–15% increase in truck imports, potentially supporting more manufacturing jobs and regional economic growth. For investors, these developments suggest possible opportunities in automotive, logistics, and infrastructure equities.

Implications for Consumers

US consumers may soon see lower prices for imported trucks, which have risen in recent years. Since trucking is vital to small business operations, greater vehicle affordability could encourage more small business financing and expansion across transportation-dependent sectors.

North American Trade Relations and Strategic Competitiveness

Industry leaders view this tariff relief as proof of North America’s “made together” approach. By embracing interconnected supply chains rather than isolated production, the US acknowledges Canada and Mexico as key partners in maintaining global competitiveness. This collaboration is particularly important as Asian and European automakers increase market pressure.

Geopolitical and Labor Considerations

Stronger trade ties across North America help prevent offshoring to regions with lower labor standards. They also reaffirm a shared commitment to fair wages and sustainable manufacturing. The policy may create thousands of new jobs in border states, reinforcing the region’s economic integration and resilience.

What Comes Next: Tracking the Policy’s Impact

As the US offers tariff relief for trucks imported from Mexico and Canada, market analysts will closely monitor truck import volumes, auto sector stock performance, and consumer pricing trends. Experts also advise watching for potential updates to content rules under USMCA or any retaliatory trade measures.

In the long run, this initiative could become a model for additional trade facilitation policies in other industries. Strengthening supply chain resilience remains a top priority as governments and investors adapt to evolving global market conditions.

Financial advisors recommend staying informed about regulatory changes and analyzing how automaker earnings, logistics stocks, and regional economies respond to this development. For deeper insights on North American trade and investment opportunities, visit ThinkInvest.org and explore their global market reports.