The ongoing issue of the US politicising South Africa trade talks has taken centre stage in discussions about global economic stability and emerging market relations. South Africa’s foreign minister recently criticized Washington for leveraging political concerns in bilateral trade negotiations, raising questions over the future of investment flows and trade agreements between the two nations.

Economic Impact of US Politicising South Africa Trade Talks

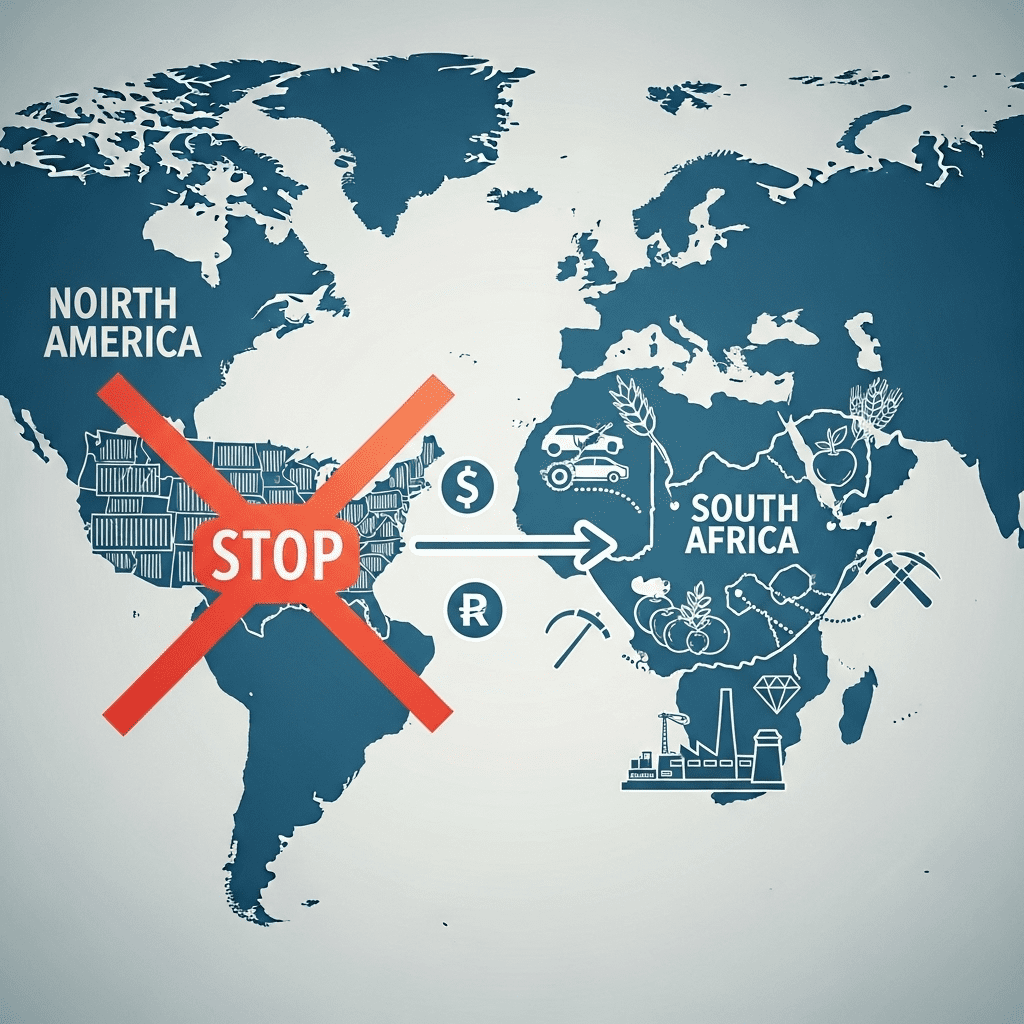

With the US politicising South Africa trade talks, the economic landscape for both countries stands at a crossroads in 2025. South Africa, a pivotal member of the African Continental Free Trade Area (AfCFTA) and a longtime beneficiary of US trading frameworks such as the African Growth and Opportunity Act (AGOA), finds its export sectors—especially automotive, agricultural, and minerals—under scrutiny. The political backdrop is particularly concerning for international investors assessing risk and opportunity in the region.

Foreign Minister Naledi Pandor stated that recent pressures from Washington have centered on issues extending beyond trade, such as South Africa’s diplomatic alignment and global policy positions. This development risks undermining the credibility and trust essential for robust economic relations. Should key programs like AGOA be affected, thousands of jobs in South Africa could be at stake, and trade volumes may shrink, shaking investor confidence.

Political Leverage and its Consequences for Trade Policy

Historically, the US has wielded significant influence in shaping the trade agendas of developing partners. However, as the US politicising South Africa trade talks comes into sharper focus, it reveals a growing tension between political objectives and economic cooperation. South African officials argue that using trade pacts to enforce non-trade-related demands undermines the spirit of multilateralism and fair competition.

Industry analysts warn that uncertainty could push South Africa closer to alternative partners, including China and the European Union, who may offer more predictable terms. Investors monitoring this climate increasingly consult emerging market analysis resources to manage exposure to geopolitical risks.

Broader Implications for Global Trade Relations

The US politicising South Africa trade talks does not only affect bilateral transactions; it may also ripple through global supply chains and set a precedent for future trade relations with other African nations. This could alter regional supply and demand, shift logistics hubs, and change the terms of raw material and finished goods exports. Financial experts suggest that these moves may influence how global investors allocate capital across Africa.

Experts from global trade trends coverage note that South Africa’s reaction could spur policy shifts elsewhere, encouraging peer nations to diversify partnerships or renegotiate trade terms to mitigate similar risks. For investors monitoring 2025 markets, transparent policy, stable legal frameworks, and consistent trade standards remain crucial. The politicisation of negotiations could disrupt these fundamentals and drive capital to less contentious environments.

Investor Outlook: Mitigating Risks Amid Uncertainty

For portfolio managers and multinational firms with South African exposure, diversification and diligence are key strategies in response to the US politicising South Africa trade talks. While diplomatic tensions rise, opportunities may emerge in new sectors like technology, renewable energy, and regional logistics, should South Africa pivot toward new alliances. Staying ahead requires up-to-date intelligence from sources like investment insights and careful scenario planning.

Moreover, South Africa’s robust legal institutions and diversified economy may cushion some short-term shocks. Nonetheless, 2025 will be a pivotal year; negotiations and foreign policy choices will influence everything from currency stability to cross-border investment flows. Economists recommend that both governments prioritize stability and transparency to retain investor trust.

Conclusion: The Path Forward for US-South Africa Economic Relations

The US politicising South Africa trade talks sets a critical tone for trans-Atlantic economic interactions in 2025. As both sides weigh economic gains against political pressures, the outcome will have far-reaching consequences—not just for bilateral trade, but for the global investment climate. For investors and policymakers, navigating this complex landscape demands vigilance, credible analysis, and ongoing dialogue. The coming months are likely to shape Africa’s economic position on the world stage.