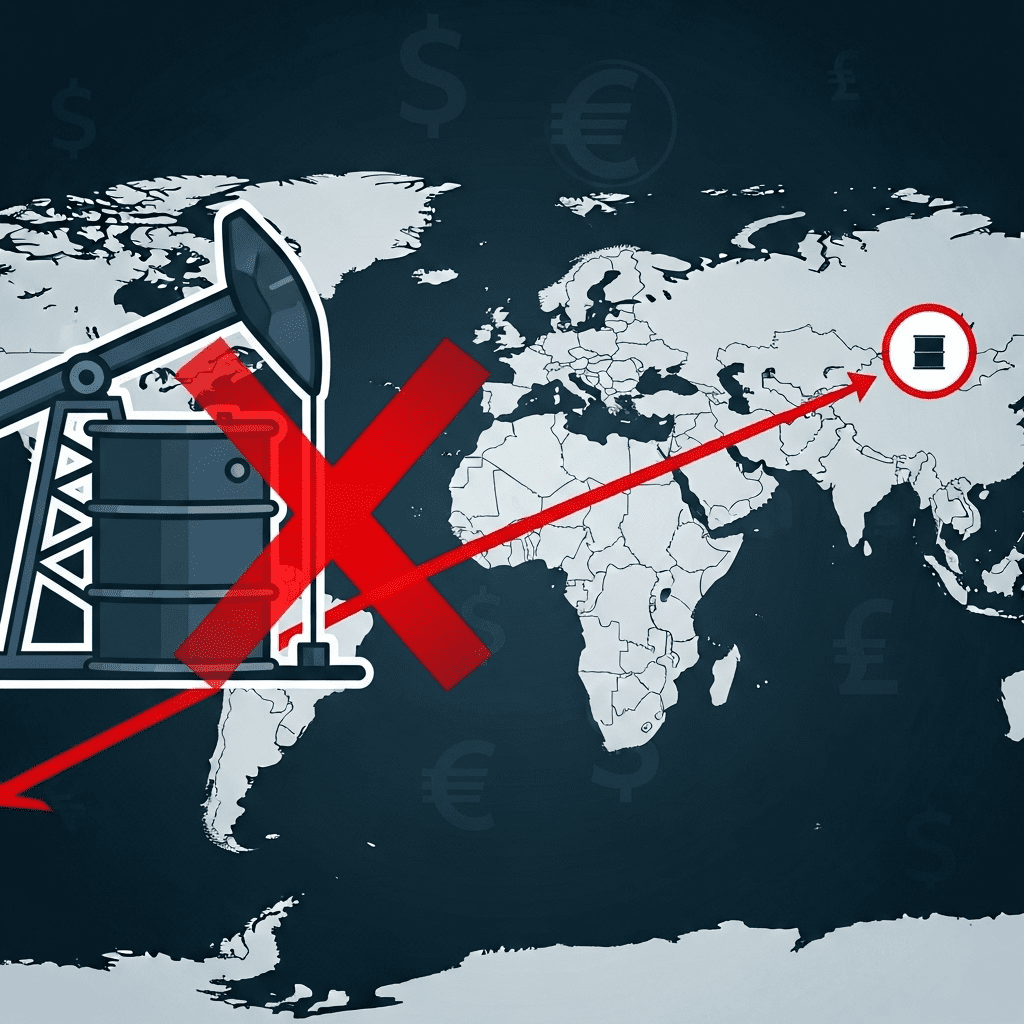

The global economy is feeling the effects after the US puts Russia’s two biggest oil companies under sanctions, a bold move that intensifies international pressure and reshapes the energy sector’s landscape for 2025. As governments and investors assess the fallout, the ramifications for crude markets and international finance are profound.

US puts Russia’s two biggest oil companies under sanctions: Background and Immediate Reactions

On June 12, 2025, the United States announced sweeping sanctions targeting Rosneft and Lukoil, Russia’s largest and most influential oil producers. These sanctions, part of a coordinated Western response to escalating geopolitical tensions and ongoing conflict in Eastern Europe, mark the most significant escalation yet in efforts to limit Russia’s economic capacity.

The action aims to disrupt Russia’s critical energy revenues, which account for a substantial portion of its national budget. US Treasury officials explained that restricting access to American and allied technologies and financial services is intended to curtail oil exports and pressure Moscow to reconsider its foreign policy direction. Already, immediate market ripples were felt, with Brent crude futures spiking nearly 5% during after-hours trading and share prices of major oil multinationals responding to the heightened uncertainty.

How Will These Sanctions Affect Global Oil Supply and Prices?

Analysts warn that with the US puts Russia’s two biggest oil companies under sanctions, a significant realignment in global oil supply chains is underway. Russia is the world’s third-largest oil producer, and together, Rosneft and Lukoil account for over 40% of the country’s output. By restricting their ability to conduct transactions in US dollars, access Western equipment, and utilize international insurance for maritime shipments, the sanctions threaten to reduce Russian exports sharply.

In the weeks following the announcement, OPEC nations have been called upon to boost production, while Asian refiners closely evaluate alternative suppliers. The International Energy Agency (IEA) projects a potential barrel shortfall, especially if secondary sanctions further deter global traders. Oil-importing countries in Europe are especially vulnerable, as winter approaches and energy inventories remain below historical averages.

Strategic and Economic Consequences for Russia and the West

The latest development—US puts Russia’s two biggest oil companies under sanctions—poses significant challenges for Russia’s economy. Loss of Western technology and finance could set back output growth and impede modernization of critical infrastructure, experts say. Additionally, Russia may move to circumvent the sanctions by pivoting further toward Asian markets, exploring non-dollar-denominated trade, and leveraging existing pipelines to China and India.

For the US and Western Europe, the decision underscores the balancing act between pressuring Moscow and managing domestic inflation, particularly as gasoline prices trend higher. The move also signals to investors the growing influence of geopolitical risk in shaping portfolio allocations—a trend explored deeply in our market analysis features.

Global Market Reaction and Investor Sentiment

The sanctions quickly shook global financial markets. Major energy indices saw increased volatility, and safe-haven assets such as gold and government bonds attracted inflows. US and European energy company stocks experienced mixed performance, reflecting both the risk of supply disruptions and the longer-term opportunity for non-Russian firms to gain market share.

Investors are advised to maintain a diversified strategy and closely monitor fiscal policy responses—tools often discussed in our investment insights section. Several major banks have revised their 2025 oil price projections upward, citing protracted instability and uncertain enforcement of the new rules.

Broader Implications: Sanctions, Energy Transition, and Policy Response

By placing unprecedented restrictions, the US puts Russia’s two biggest oil companies under sanctions while accelerating momentum for global energy transition. Policymakers in Brussels, Tokyo, and Washington are under renewed pressure to secure alternative sourcing and fast-track renewable deployments. Meanwhile, corporate executives are reviewing supply chain resilience and regional exposure—topics regularly covered in our latest financial planning resources.

What Comes Next for International Energy Markets?

Looking ahead, much depends on the durability of sanctions compliance and Russia’s counterstrategies. Energy market observers expect continued volatility and a potential race among major consumers to lock in long-term contracts. Meanwhile, the saga adds fuel to the broader debate about energy independence, diversification, and the strategic value of resource security in a fragmented world order.

As events unfold, investors, policymakers, and industry leaders will be watching closely to gauge the next chapter in this evolving crisis—and how the global economy adapts to a new era of supply-side risk and geopolitical competition.