Investors are closely monitoring Salesforce shares this week after a notable rally, underscoring the importance to watch these Salesforce price levels as stock jumps on upbeat sales outlook. The robust performance comes on the heels of the company’s revised sales projections, which paint a more optimistic picture for fiscal 2025 and have reset expectations across the tech sector.

Watch These Salesforce Price Levels as Stock Jumps on Upbeat Sales Outlook

Salesforce (CRM: NYSE) soared more than 8% in extended trading, energized by new sales guidance that exceeded Wall Street expectations. As the market digests the news, technical analysts are highlighting critical price levels that could signal the next leg of the stock’s journey.

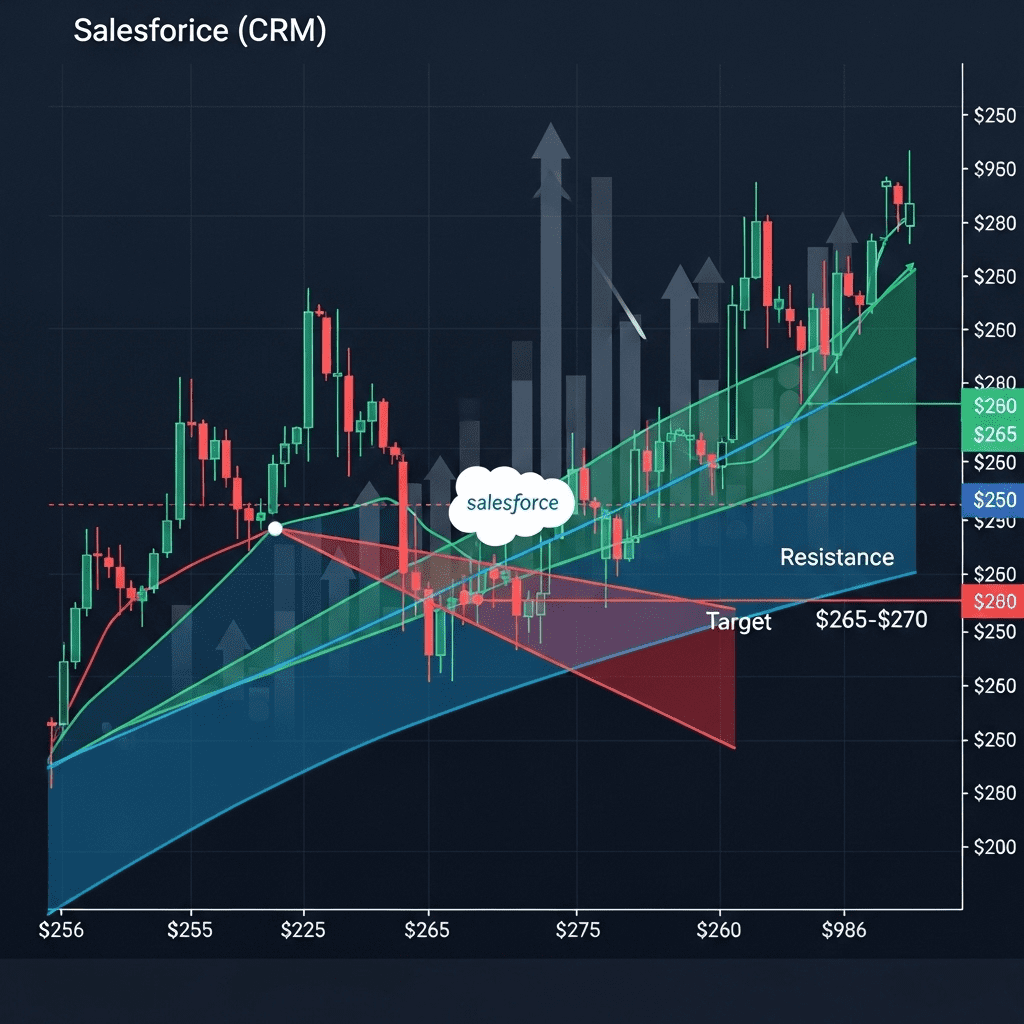

CRM shares broke past several resistance levels, closing near $260. Chart watchers point to the $265–$270 band as the immediate resistance ahead, which lines up with previous highs recorded during previous earnings rallies. If momentum carries the stock above that range on sustained volume, Salesforce could target its all-time high near $286 as the next upside objective.

To the downside, analysts are emphasizing the need to hold the $250–$255 support zone. A decisive break beneath these markers could expose CRM to further profit-taking, potentially retesting the technical 50-day moving average, currently hovering around $243.

What’s Fueling the Salesforce Rally?

The upbeat outlook stems from Salesforce’s latest earnings release, where management provided a revised sales forecast for the remainder of the fiscal year. CEO Marc Benioff cited robust demand for customer relationship management solutions and recent wins in enterprise AI integrations, which have boosted both market optimism and analyst price targets.

The company reported a 12% jump in year-over-year revenue, accompanied by improved operating margins and strong recurring contract growth. According to independent analysts, Salesforce’s revenue mix—shifting toward high-margin cloud software and AI-driven solutions—positions the business for continued outperformance relative to its peers.

Analyst Outlook and Market Commentary

Leading brokerages are recalibrating their price targets following Salesforce’s guidance update. Morgan Stanley reiterated an overweight rating, signaling confidence in Salesforce’s competitive moat and cross-sell potential across its expansive cloud portfolio. Meanwhile, Jefferies upgraded CRM from hold to buy, projecting that accelerating digital transformation trends and resilient enterprise spending will fuel above-average returns through 2025.

For investors seeking actionable investment insights, it’s important to monitor both company fundamentals and macroeconomic headwinds. With the Federal Reserve’s evolving interest rate policies, tech sector valuations could remain volatile; however, Salesforce’s steady cash flow and expanding total addressable market bolster its long-term case.

Key Factors for Salesforce Stock Performance

- AI Integration: Salesforce’s new Einstein AI suite is drawing praise for driving higher customer engagement and new enterprise deals.

- Recurring Revenue: Subscription models now make up more than 90% of total sales, enhancing earnings visibility for investors.

- Cloud Adoption: Ongoing migration to cloud services, especially among global 2000 corporations, continues to drive CRM platform expansion.

Volatility remains a hallmark of growth tech stocks, so prudent investors should track critical support and resistance zones, factoring in wider market trends. For comprehensive market outlooks, check ThinkInvest.org’s latest stock market analysis for evolving narratives across the enterprise tech space.

Risk Considerations and Technical Guidance

While Salesforce’s fundamentals are encouraging, it is essential for investors to manage risk and avoid chasing price spikes after strong earnings events. Technical indicators—such as relative strength index (RSI) and moving averages—suggest the stock could enter overbought territory in the near term.

Options traders are already pricing in elevated volatility, with implied volatility readings spiking post-earnings. For those planning longer-term allocations or swing trades, daily and weekly closes above the $270 level may confirm continued bullish momentum. On the flip side, failure to sustain support at $250 may trigger short-term corrections, offering potential entry points for value-oriented investors.

Informed market watchers leverage both technical and fundamental signals when navigating big earnings moves. Stay updated with ongoing financial news and expert commentary to ensure decisions align with your broader portfolio objectives.

Conclusion: Navigating Salesforce Price Action in 2025

The imperative to watch these Salesforce price levels as stock jumps on upbeat sales outlook cannot be overstated for active traders and institutional investors. With CRM’s sales prospects brightening and shares at pivotal chart levels, the coming weeks could define the next phase of growth—whether to new all-time highs or a consolidation phase as the broader market recalibrates.

Whether you’re trading short-term swings or evaluating Salesforce as a core holding, careful analysis of these technical thresholds, alongside ongoing earnings surprises, will be key to refining your 2025 tech allocation strategy.