What Happened

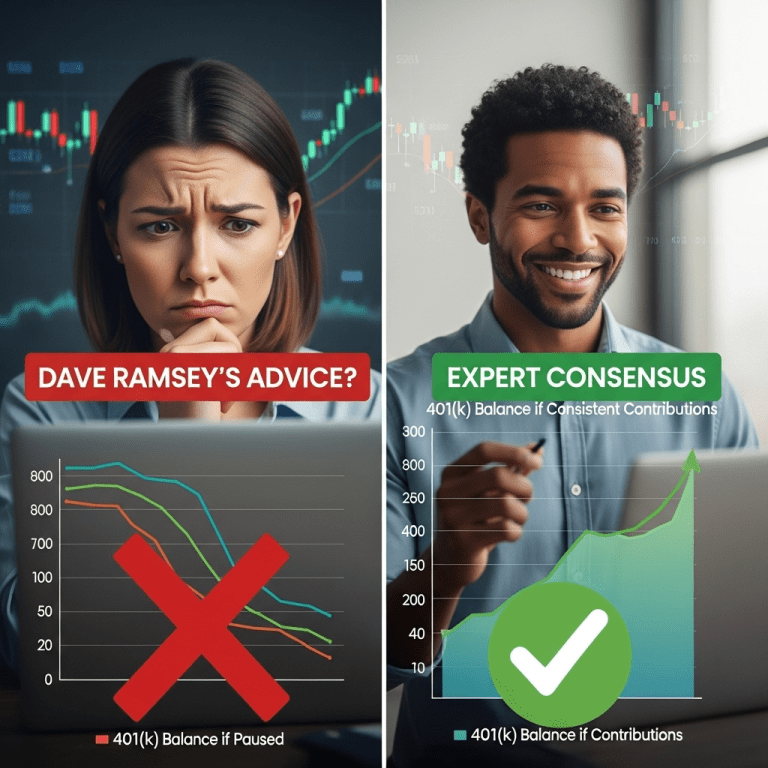

Personal finance expert Dave Ramsey has reiterated his controversial stance recommending Americans “pause 401(k) contributions” during periods of debt payoff or cash flow constraints. The statement, widely circulated in early 2025 through his radio show and syndicated columns, sparked debate across financial circles. According to Bloomberg, approximately 70% of U.S. workers have access to employer-sponsored retirement plans, with 401(k) participation rates holding strong above 60% despite market volatility (Bloomberg, Jan 2025). Ramsey’s advice contrasts with most fiduciary guidance, which strongly encourages consistent, uninterrupted retirement saving—especially when employers offer contribution matches, potentially leaving “free money” on the table.

Why It Matters

Suspending 401(k) contributions, even temporarily, can have profound long-term implications due to the power of compounding growth. Historical data from Fidelity (Q4 2024 Retirement Analysis) shows that missing even three years of contributions can reduce final balances by over 15% for the average saver. With rising inflation and persistent market uncertainty, many Americans already face a burgeoning retirement gap. According to the Employee Benefit Research Institute, the median U.S. retirement account balance is $113,000—far below the estimated need for a secure retirement. Analysts warn that guidance like Ramsey’s promotes short-term relief at the expense of long-term financial resilience.

Impact on Investors

For investors, the critical tradeoff is short-term liquidity versus the exponential benefit of consistent 401(k) investing—especially when employer matches (often 3–6%) are at stake. Avoiding contributions means missing out on both market recoveries and tax advantages. U.S. equity markets, as reflected by the S&P 500 (SPX), have historically rebounded after downturns, benefiting disciplined savers. “The opportunity cost of pausing 401(k) contributions is underestimated by many,” says Lauren Ellis, CFP at Meridian Wealth Advisors. “Over decades, even brief lapses can create thousands in lost growth, which can’t be easily made up later.” For those reassessing their financial strategies, reviewing long-term wealth-building ideas and drawing on trusted investment insights remains crucial. Key retirement sectors—like diversified asset management (VOO, BLK) and fixed income—may see shifting allocations from individual investors who heed short-term advice.

Expert Take

Market strategists suggest that maintaining even minimal 401(k) contributions during downturns or personal setbacks is preferable to a full pause. Analysts note that a withdrawal from employer-matched contributions is “a permanent forfeiture of return.” As highlighted in recent market analysis, compounding and dollar cost averaging are too critical to sacrifice for temporary reprieve.

The Bottom Line

Diluting retirement savings by pausing 401(k) contributions—notably when employer matches are available—could severely undermine long-term wealth building, despite short-term financial pressures. As debates over personal finance best practices persist, investors should weigh advice and data carefully, recognizing that Dave Ramsey is wrong about pausing 401(k) contributions when viewed through a market and compounding lens. In 2025, financial resilience will depend on consistently leveraging every available avenue for tax-advantaged retirement saving.

Tags: 401k strategy, Dave Ramsey, retirement planning, personal finance, S&P 500.