In the rapidly evolving landscape of modern energy storage, one fact remains clear: lithium-ion batteries still dominate the tech world. Despite emerging alternatives and persistent supply chain challenges, lithium-ion technology continues to be the backbone of devices ranging from smartphones to electric vehicles (EVs), underscoring its enduring relevance for investors and technology leaders.

Why Lithium-ion Batteries Still Dominate the Tech World

The unparalleled success of lithium-ion batteries stems from their unique combination of high energy density, long cycle life, and declining production costs. These batteries offer efficient storage solutions critical for devices that demand significant power in compact, lightweight forms. As industries expand their reliance on renewable energy and EVs, the fundamental properties of lithium-ion cells ensure their primacy in global markets—a trend that is particularly evident in 2025’s investment strategies and sector forecasts.

Energy Density and Performance: A Continuous Edge

One of the primary reasons lithium-ion batteries maintain their lead is their superior energy density compared to legacy technologies such as nickel-cadmium and lead-acid batteries. This high density means devices can be lighter, thinner, and run longer, which remains essential for consumer electronics and portable devices. Even as research continues into next-generation solutions like solid-state and sodium-ion batteries, lithium-ion cells consistently offer a compelling balance of performance metrics and cost efficiency.

Manufacturing Scale and Cost Dynamics

A mature and highly developed global supply chain has further entrenched the dominance of lithium-ion batteries. Gigafactories across Asia, Europe, and North America have dramatically driven down per-kilowatt-hour costs over the last decade. According to BloombergNEF, the average price of lithium-ion battery packs fell from over $1,200 in 2010 to just $139 in 2024, making mass-market adoption feasible for electric vehicles and stationary storage alike. These cost advantages continually attract venture capital and corporate investment, with energy storage trends remaining a top research focus for investors.

Tech World Applications: From Smartphones to Grid Storage

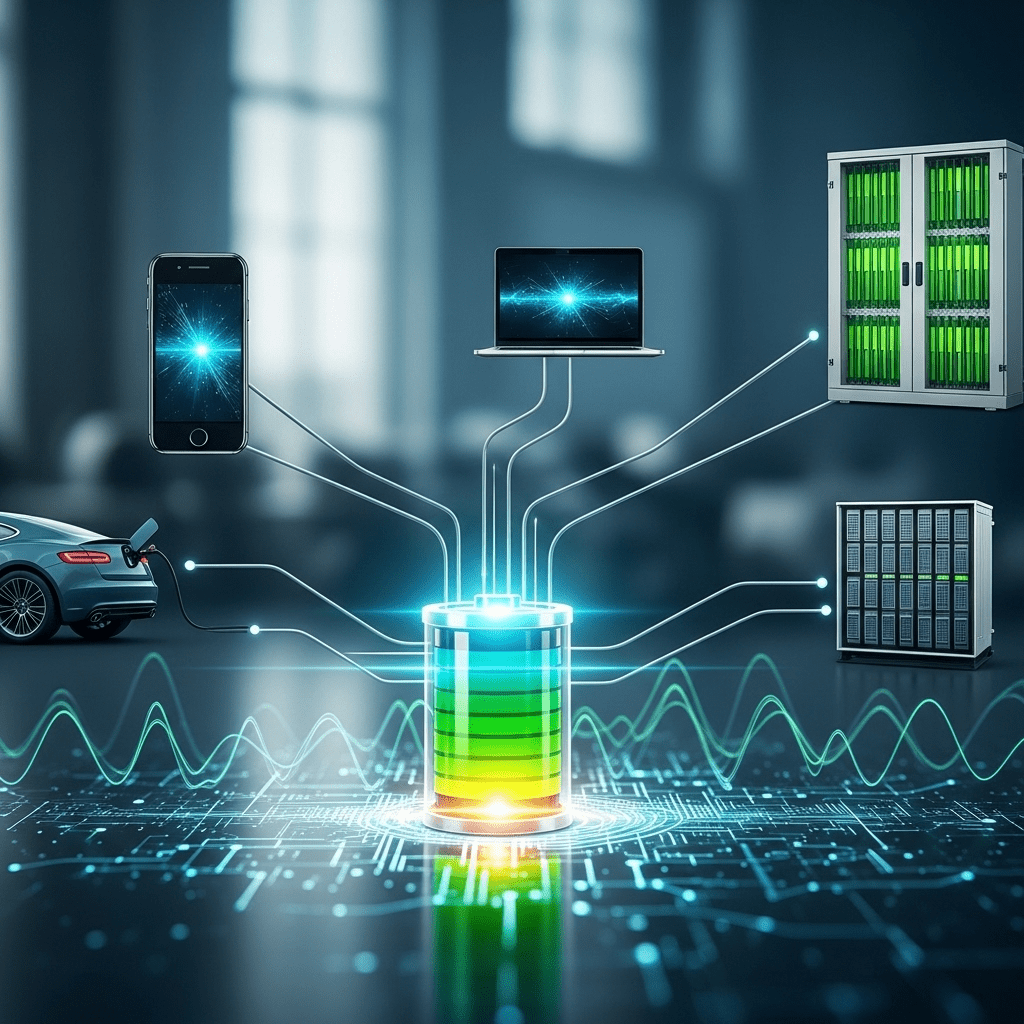

It is nearly impossible to picture the tech ecosystem without lithium-ion technology. Virtually all major smartphones, laptops, and wearable devices rely on this chemistry for power solutions. The EV revolution—with giants such as Tesla, BYD, and Volkswagen investing billions in battery R&D—remains heavily predicated on lithium-ion innovations. Additionally, utility-scale battery projects, essential for integrating renewable energy into grids, rely overwhelmingly on lithium systems due to their proven reliability and rapidly improving economics.

EV Market Acceleration

The electric vehicle sector is perhaps the clearest example of how lithium-ion batteries still dominate the tech world. With global EV sales forecast to exceed 16 million units in 2025, the continued refinement of lithium-ion technology is vital to reducing range anxiety, charging times, and overall vehicle costs. Automakers are fiercely competing to increase energy density, cut charging intervals, and minimize critical mineral dependencies, all while leveraging the scale and existing knowledge base of lithium manufacturing.

Research, Safety, and Ongoing Innovations

While alternative chemistries—such as solid-state, sodium-ion, and lithium-sulfur—are advancing, they have yet to surpass the commercial readiness or cost-effectiveness of lithium-ion in most practical deployments. Industry leaders are mitigating traditional concerns about degradation, thermal runaway, and raw material sourcing through research into new electrolytes, advanced cell designs, and battery recycling. As a result, sustainable technology investments continue to prioritize lithium-ion supply chain optimization and circular economy solutions.

Investment Implications: The Enduring Value Proposition of Lithium-ion

For investors seeking exposure to the global transition toward electrification, lithium-ion battery technology offers both stability and growth potential. Conglomerates focusing on batteries, mining companies with critical lithium reserves, and firms innovating within the recycling space have all seen significant interest from global capital markets. This dominance also presents a hedge against volatility, as new contenders like sodium-ion or hydrogen face multi-year timelines before achieving similar uptake or profitability. Investment insights consistently highlight lithium-ion as a pivotal theme in 2025’s clean energy portfolios.

Conclusion: Lithium-ion’s Secure Spot in Tech’s Future

As global demand for electrification, renewable energy storage, and portable devices grows, lithium-ion batteries are poised to remain at the heart of the tech world. Evolving research, robust infrastructure, and ongoing investment ensure that any future shifts in battery chemistry will build squarely on the foundation established by decades of lithium-ion development. For the foreseeable future, the answer to why lithium-ion batteries still dominate the tech world is grounded in a blend of science, economics, and strategic foresight.