Despite renewed concerns over start-up valuations 2025, this cycle diverges from past peaks in several fundamental ways. High-profile unicorns are achieving record funding amid stronger fundamentals, robust exits, and a shift in investor scrutiny, reshaping risk profiles for both founders and backers.

What Happened

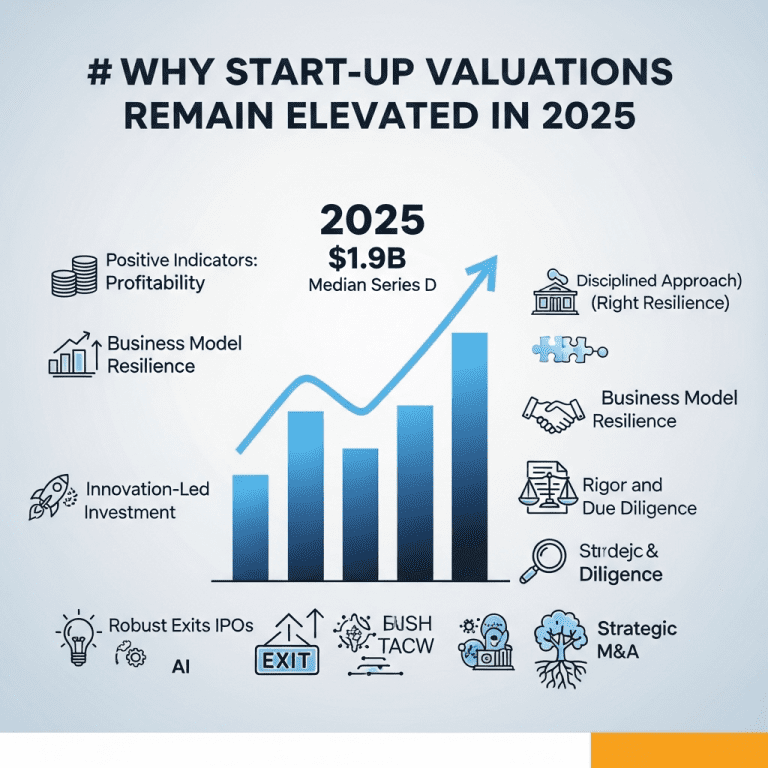

Start-up valuations 2025 have reached historic highs, with global venture funding touching $380 billion in the first half of the year, according to data from PitchBook and Crunchbase. The median Series D valuation for US start-ups rose nearly 24% year-on-year to $1.9 billion, reflecting a new wave of optimism for growth companies. Major exits—such as the $17 billion IPO of fintech leader Kiwi (Reuters, March 2025) and a string of nine-figure M&A deals in AI and biotech—have fueled comparisons to the 2021 peak. Yet, analysts point out that capital deployment, while robust, is being channeled primarily toward companies demonstrating profitability or clear unit economics. “Investors are still willing to pay up, but only for proof, not just promise,” says Dana Wu, partner at Riverstone Capital, in Bloomberg’s Q2 Funding Trends report.

Why It Matters

These record valuations signal deep investor confidence, but also raise questions about overheating—echoing the late 2021 environment, when unicorn creation hit a fever pitch. However, today’s divergence is marked by a more disciplined approach: over 62% of VC deals in Q2 2025 backed startups with positive EBITDA, compared to just 36% at the last peak (Crunchbase, June 2025). Moreover, exits are increasingly skewed toward strategic mergers and public listings on international exchanges, suggesting institutional demand for growth stories remains robust. The surge in AI-driven productivity companies and climate tech pioneers is also reshaping the landscape, driving innovation-led investment insights rather than speculative capital rotations. Industry observers believe this selective exuberance could sustain longer cycles and buffer against sharp reversals.

Impact on Investors

For investors, elevated start-up valuations 2025 present both a challenge and an opportunity. The bullish sentiment means late-stage rounds in sectors like artificial intelligence, digital health, and climate solutions (key tickers: MSFT, NVDA, TSLA) may carry premium pricing, compressing expected returns. However, more rigorous diligence requirements and a focus on cash flow have improved risk-adjusted prospects. “While headline numbers are high, the composition is healthier,” says Priya Mehta, Head of Venture Insights at Alpine Advisors. “Investors need to prioritize business model resilience and market leadership, rather than just chasing the biggest round.” On the public markets front, recent IPOs such as Kiwi (KWI) and Hydreon Bio (HYD) have shown stabilization after listing, unlike the pronounced post-listing declines of 2021, supporting cautious optimism. For broader guidance, see market analysis on exit strategies and next-gen sectors.

Expert Take

Analysts note that the current startup cycle differs from previous peaks due to a pronounced focus on financial resilience and diversified revenue streams. Market strategists suggest that the interplay between institutional capital and targeted sector bets is keeping excesses in check.

The Bottom Line

While start-up valuations 2025 are undeniably high, the combination of more stringent investment criteria, profitable business models, and robust exit markets marks a notable departure from the last cycle’s speculative excess. Investors should recalibrate their approach—embracing innovation, but anchoring decisions on fundamentals to navigate this new landscape. For ongoing trends and actionable research, visit ThinkInvest’s editorial coverage.

Tags: unicorns, venture capital, start-up valuations 2025, funding trends, IPO markets.