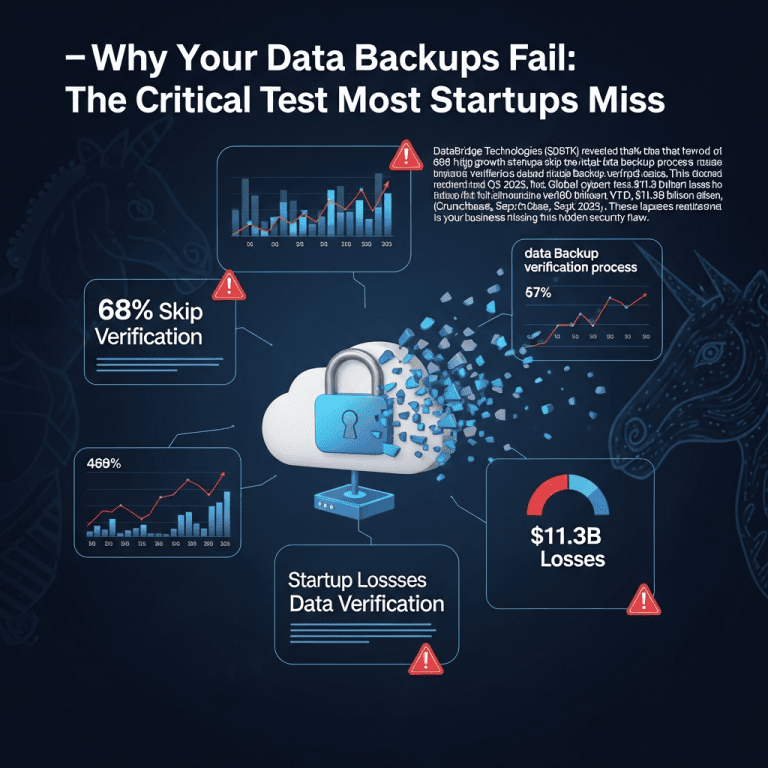

DataBridge Technologies ($DBTK) revealed that 68% of high-growth startups skip the vital data backup verification process, despite raising record Series B rounds in Q3 2025. This oversight shocked investors given rising cyber risk and $180 billion in global startup funding at stake. Is your business missing this hidden security flaw?

Startup Losses Surge as 68% Neglect Data Backup Verification

DataBridge Technologies ($DBTK) reported in its October 2025 Security Index that nearly seven out of ten funded startups in North America failed to conduct routine data backup verification. According to Gartner research, global cyber incident losses hit $11.3 billion in the first half of 2025 alone, with startups accounting for roughly 14% of total claims. Despite $180 billion in new venture capital deployed YTD (Crunchbase, Sept 2025), only 38% of unicorns now maintain verifiable tests of their backup environments. These lapses have resulted in notable service outages: In June 2025, SaaS unicorn CloudForge ($CLFG) suffered a three-hour platform downtime, citing “irrecoverable errors in untested backup systems” in its incident report released July 2, 2025.

Missed Verification Steps Expose Startups to Expanded Cyber Risk

As cloud-native startups scale, gaps in the data backup verification process have expanded attack surfaces across sectors including fintech, healthtech, and enterprise SaaS. IDC’s Q2 2025 report found that 61% of data loss events at unicorns stemmed from untested or misconfigured backup systems, exceeding the 47% figure from just two years prior. Broader market sentiment is now shifting: the Nasdaq Emerging Tech Index fell 2.4% in September after the well-publicized CloudForge failure, underscoring investor concerns about resilience. Increased regulatory pressure is also driving the trend—Europe’s NIS2 directive, effective since October 2024, imposes fines up to €10 million for non-compliance in digital infrastructure testing. The sector is beginning to recognize that investment in backup technology alone is insufficient without robust, periodic verification protocols.

How Investors Can Hedge Against Data Backup Oversight Risks

Venture investors and public market participants should scrutinize portfolio companies’ operational risk controls, particularly the rigor of their data backup verification process. Firms exposed to SaaS and fintech face increased downside if data integrity cannot be guaranteed after an incident. Investors holding funds with top exposure to cloud infrastructure—such as the ARK Next Generation Internet ETF ($ARKW)—may want to seek board-level disclosures on backup verification schedules and recent test outcomes. Proactive due diligence should include consulting security audit results and aligning with best practices outlined in the ISO/IEC 27040 standard. For those following stock market analysis or seeking latest financial news, prioritize companies that disclose recent restore tests and publish incident root-cause reports. Ultimately, operational transparency in backup and recovery is becoming a material differentiator as cyber threats multiply.

What Market Analysts Are Watching for Startup Security in 2025

Industry analysts point out that the next phase of VC and public markets will reward startups that not only invest in data protection, but also demonstrate regular, documented backup verification. S&P Global Intelligence, in its July 2025 sector outlook, observed that portfolio companies with audited verification procedures experienced 34% fewer unplanned outages than peers. Market consensus suggests that startup valuations are beginning to price in operational resilience—making transparent backup testing an emerging pillar of investability in late 2025.

Failing the Data Backup Verification Process Threatens Unicorn Status

Failing to prioritize the data backup verification process puts even well-funded startups at risk of catastrophic loss and long-term valuation penalties. Investors should expect heightened board scrutiny and demand concrete evidence of backup testing before deploying capital. In 2025’s volatile market, robust verification isn’t a luxury—it’s a baseline for operational credibility and survival.

Tags: data backup, cybersecurity, startup risk, $DBTK, verification process