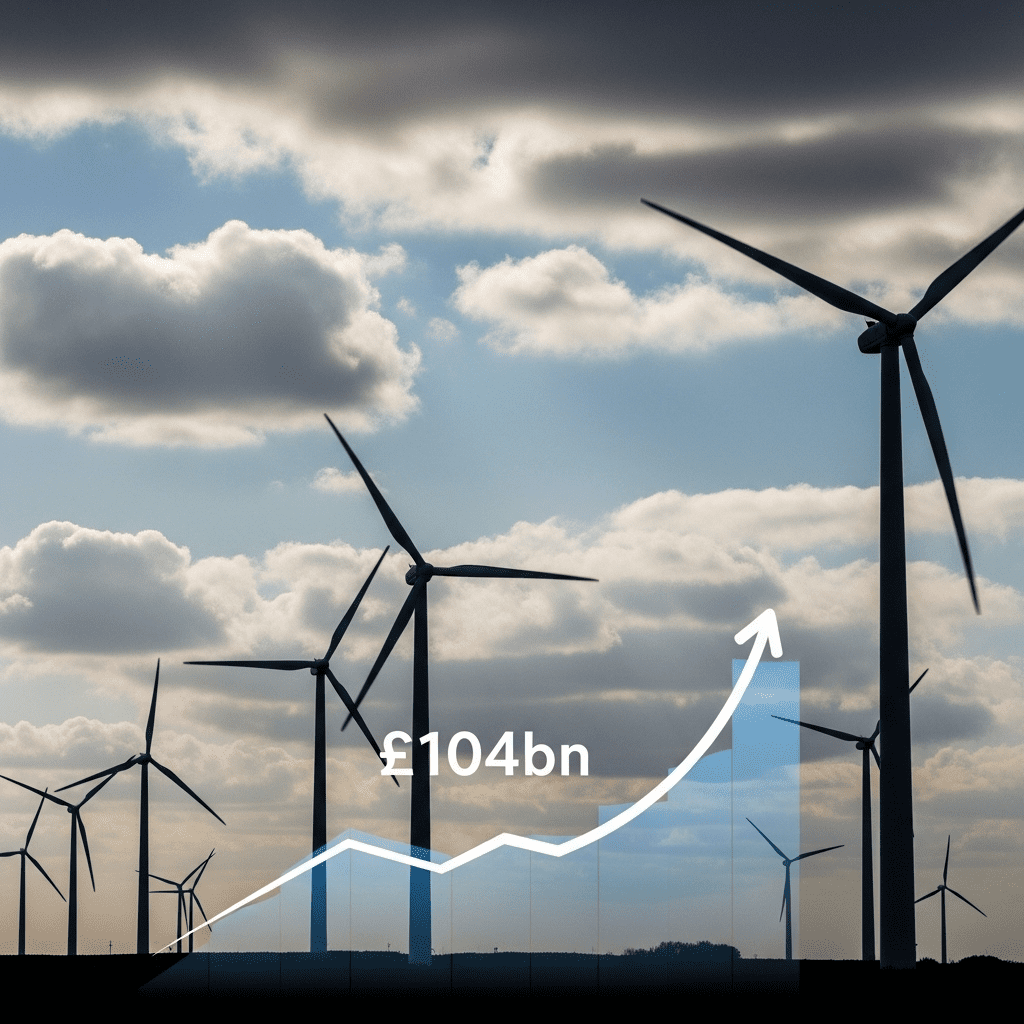

Wind power cuts £104bn from UK energy costs, according to a major new study published in 2025. This substantial cost reduction underscores wind energy’s growing economic influence and points to pivotal opportunities for market participants.

What Happened

Wind power has slashed a remarkable £104bn off UK energy costs since 2010, says a recent analysis by Carbon Brief, whose findings were widely reported by Reuters in June 2025. The study credits the surge in onshore and offshore wind generation—now accounting for over 30% of Britain’s electricity mix—for driving down wholesale power prices and insulating consumers from the full shock of historic gas price spikes. Between 2010 and 2025, the UK multiplied its wind capacity nearly fivefold, from just under 5 GW to more than 24 GW. The report notes, “Without wind, the UK would have faced much higher electricity bills, particularly during recent gas market volatility.”

Why It Matters

This unprecedented £104bn in cumulative savings highlights wind power’s direct benefits for the UK economy and its role in energy market resilience. In the wake of the 2022-23 global energy shock—fueled by geopolitical disruptions and supply bottlenecks—wind generation curbed the UK’s reliance on natural gas purchases, offering a domestic hedge against import price swings. Analysts from BloombergNEF point out that the UK’s approach offers a blueprint for broader European adoption of renewables, with European wind power investment reaching record highs last year. Strong policy support and technological advances suggest the accelerating trend will persist into 2025 and beyond, with renewables exerting more influence over wholesale prices and national energy security.

Impact on Investors

For investors tracking the utilities and renewables sectors, the study’s findings reveal both actionable opportunities and evolving risk profiles. London-listed companies like SSE (LON: SSE) and National Grid (LON: NG) have ramped up their wind portfolios, while global players such as Ørsted (CPH: ORSTED) and Siemens Gamesa (BME: SGRE) remain key suppliers to the UK market. The resulting savings validate accelerated capital flows into wind infrastructure and storage, and support the business case for green power purchase agreements (PPAs). “As wind underpins cost stability, we see growing appetite for long-term infrastructure funds and climate ETFs focused on renewables,” said Olivia Hartley, energy strategist at Tate Capital Partners. However, analysts also caution that grid integration, planning delays, and localized opposition pose ongoing challenges for consistent returns.

Expert Take

Analysts note that the demonstrated £104bn in savings strengthens the investment thesis for renewables, aligning financial performance with the UK’s climate targets. Market strategists suggest that as policy aligns with proven cost benefits, institutional demand for exposure to clean energy assets could see further growth in 2025.

The Bottom Line

Wind power cutting £104bn from UK energy costs since 2010 underscores both its market-transforming role and its resilience against ongoing energy volatility. With further policy backing and scalable technology, investors stand to benefit from wind energy’s integration into the mainstream. Tracking the sector’s trajectory remains crucial for those seeking alpha in a changing European energy landscape.

Tags: wind energy, UK energy market, renewables investment, energy costs, green infrastructure.

For further investment insights on renewable energy trends, explore our latest sector outlook. Readers can find more on shifting energy policy and market analysis or access deep dives into green infrastructure at ThinkInvest.