Staying informed of the things to know before the stock market opens is essential for investors who want to navigate daily volatility, capitalize on trends, and manage risk. As global financial markets become increasingly interconnected in 2025, tracking pre-market cues has never been more important for making confident investment decisions.

5 Crucial Things to Know Before the Stock Market Opens

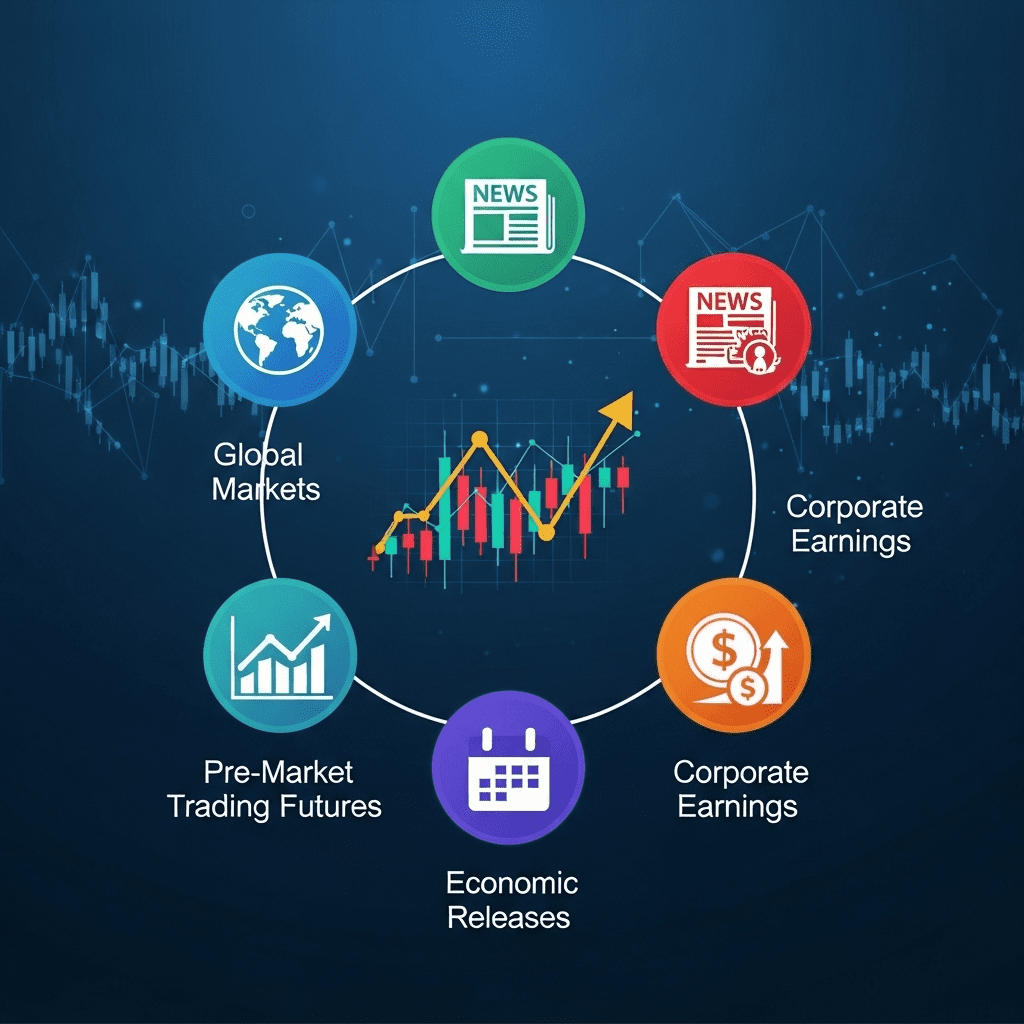

The pre-market session is a vital period that can set the tone for the entire trading day. Here are five essential things every investor should review before the opening bell to stay ahead of the curve.

1. Review Major Overnight Developments

Global events and overnight news headlines can influence stock prices long before domestic markets open. Keep an eye on key developments in international economies, geopolitical activity, or breaking corporate news. For example, regulatory changes in China or economic indicators from Europe often ripple through US equities quickly. Monitoring these updates helps investors anticipate early price movements and align their strategies accordingly. For the latest market news, check trusted financial news sources and economic calendars.

2. Analyze Futures and Pre-Market Trading

Stock index futures—such as the S&P 500, Nasdaq, and Dow—give an early indication of market sentiment. Large moves in futures contracts often precede significant swings at the open. Likewise, actively traded stocks in pre-market hours can signal which sectors or companies are attracting attention. Pay attention to high-volume pre-market movers, as these stocks could see heightened volatility and opportunities when the market opens.

3. Track Key Economic Data Releases

Scheduled economic reports, like nonfarm payrolls, CPI inflation numbers, and consumer sentiment indices, can dramatically impact investor sentiment just before the opening bell. On days with critical economic data releases, expect increased volatility and fast market moves. Staying on top of scheduled announcements—especially those released before the market opens—can provide an edge and help manage risk.

4. Monitor Corporate Earnings and Guidance

Earnings season brings a significant flow of pre-market updates as companies report quarterly results. Strong beats or disappointing earnings can move not just individual stocks but entire sectors. Beyond the reported numbers, keep an eye on management’s forward guidance, as this impacts future valuations. Upgrades, downgrades, and analyst revisions issued before the open may also change the day’s momentum in specific sectors. For detailed earnings analysis, reference reputable financial portals or brokerage platforms.

5. Assess Global Market Performance and Currency Moves

Performance in Asian and European equity markets sets the pace for US trading. Sharp rallies or declines abroad frequently drive opening moves in New York. Additionally, watch for major movements in the US dollar, euro, and other significant currencies, as these shifts can impact exports, sector performance, and even commodity prices. Monitoring global market trends ensures that you are prepared for cross-border influences on your investments.

Why Understanding the Things to Know Before the Stock Market Opens Matters

Having a clear picture of overnight developments, economic news, corporate earnings, and global market action allows investors to react swiftly and make better-informed decisions when the opening bell rings. Incorporating these daily pre-market checks into your routine can help manage risk, identify fresh opportunities, and avoid costly surprises in today’s dynamic environment. For comprehensive investment insights, seasoned investors often rely on a blend of news sources, analytics tools, and expert commentary.

Final Thoughts: Preparing for Market Open in 2025

As algorithmic trading and interconnected markets shape the financial landscape in 2025, paying attention to the things to know before the stock market opens is more valuable than ever. By reviewing key events, tracking global trends, understanding pre-market movements, and anticipating volatility, investors can position themselves for success each trading day.