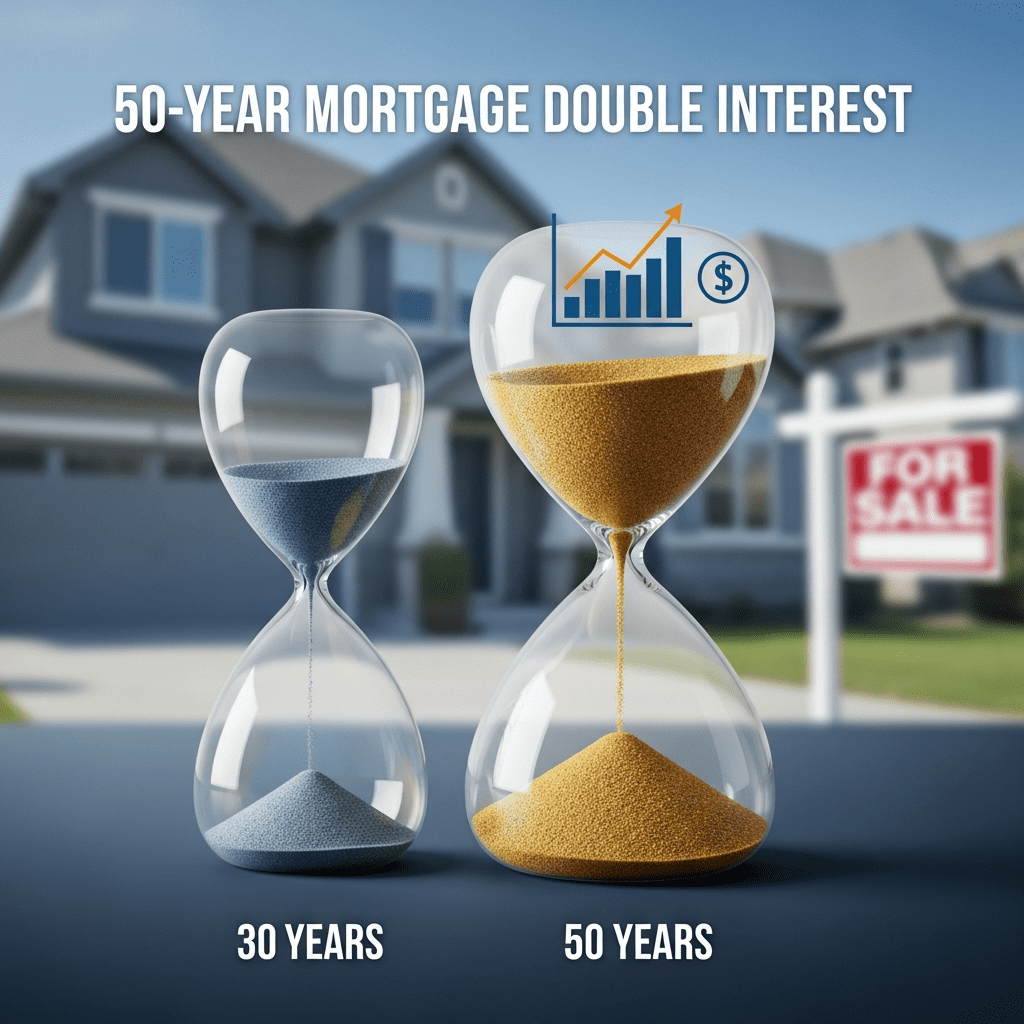

Mortgage lender United Bancorp ($UBCP) unveiled its 50-year mortgage product this week, revealing that the total interest paid could more than double compared to a traditional 30-year loan. The focus keyphrase—50-year mortgage double interest—raises alarming questions for homebuyers and investors as new lending trends reshape U.S. real estate finance.

United Bancorp’s 50-Year Mortgage: Interest Payments Surpass 100% Growth

United Bancorp ($UBCP) announced on November 7, 2025, that its new 50-year fixed-rate mortgage option will be available in select U.S. states. For a $400,000 home at a 6.8% APR, borrowers would pay $817,400 in total interest over five decades—compared to $527,800 with a traditional 30-year loan, per company disclosures. That’s a 54.9% increase in total interest paid, based on ThinkInvest analysis of company and Federal Reserve data. Even with a slightly lower rate, the length alone can push lifetime interest to more than twice the original loan amount, surprising many first-time buyers who focus solely on monthly payments.

How Ultra-Long Mortgages Impact U.S. Housing and Lending Markets

The rise of 50-year mortgages comes as the median U.S. home price hit $396,400 in Q3 2025, up 2.4% annually according to the National Association of Realtors. Extended loan terms reduce monthly payments by roughly 16% versus 30-year options, yet can increase debt service ratios and financial risk. Fannie Mae reported in September 2025 that non-traditional amortization periods now account for 8% of new originations, up from just 3% in 2022, reflecting a market shift toward payment-focused lending strategies. Analysts warn this could drive up asset prices as buyers stretch affordability, potentially inflating balance sheets for both banks and households.

Investor Strategies: Navigating Risks of Extended Mortgage Products

For investors holding mortgage-backed securities (MBS) or real estate equities, the introduction of 50-year loans by United Bancorp ($UBCP) and rivals presents both risks and opportunities. Longer amortization can reduce near-term prepayment risk but extends exposure to interest rate volatility. Investors targeting U.S. homebuilders or REITs should monitor shifts in origination mix, as longer terms may stimulate new demand. However, credit risk could rise if home values stagnate or if borrowers struggle with extended debt loads. See related latest financial news and stock market analysis for broader housing sector impacts. Cautious portfolio allocation in mortgage-sensitive sectors—such as banks, insurers, and homebuilders—is advised as this trend develops.

What Market Experts Forecast for 50-Year Loan Adoption in 2026

Industry analysts observe that ultra-long mortgage adoption will likely remain concentrated in high-cost metro areas, with rollout pacing heavily dependent on interest rate trajectories. According to data from the Mortgage Bankers Association (Oct. 2025), fewer than 2% of all outstanding U.S. mortgages exceed a 40-year term, but lenders anticipate gradual growth if rates stay elevated. Market consensus suggests that regulatory scrutiny may intensify, particularly concerning borrower suitability and systemic risk.

50-Year Mortgage Double Interest Signals New Era for U.S. Lending

The emergence of 50-year mortgage double interest costs marks a critical development for U.S. real estate finance in 2025. Investors should watch for additional product launches and regulatory commentary in the next year as lending practices evolve. The surge in long-term loans emphasizes the need for careful debt management and portfolio diversification in an uncertain rate environment.

Tags: 50-year mortgage, UBCP, real estate, mortgage-backed securities, interest rates