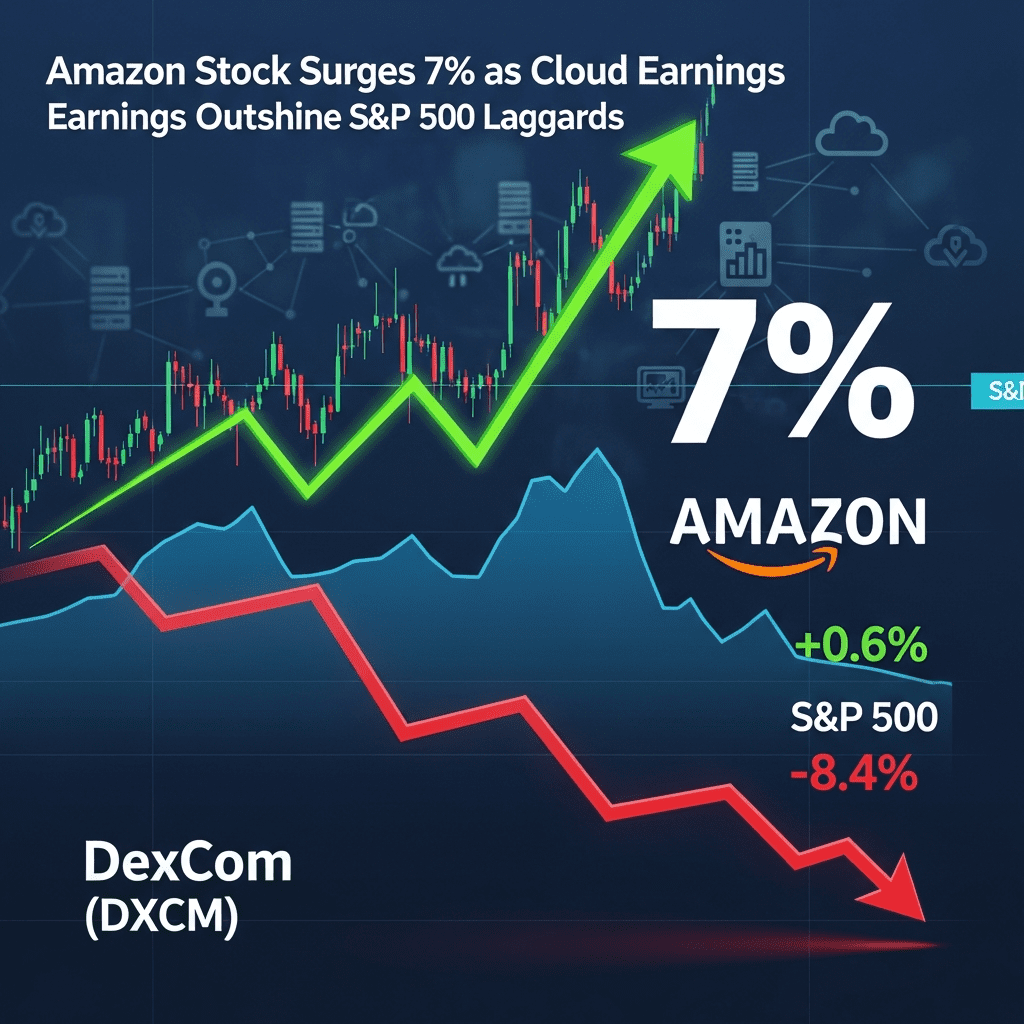

Amazon ($AMZN) secured a striking 7% surge today, outpacing the S&P 500 gains and losses as cloud revenue shattered Wall Street expectations. Meanwhile, DexCom ($DXCM) revealed a sharp drop, catching investors off guard amid shifting sector sentiment. What’s driving these divergent moves—and what should investors watch next?

Amazon Rallies 7% As AWS Revenue Drives S&P 500 Gains

Amazon.com Inc. ($AMZN) shares soared 7.1% to $207.83 in Friday’s pre-market session after the company reported third-quarter revenue of $178.2 billion, up 13% year-over-year. Notably, Amazon Web Services (AWS) posted an 18% jump in sales to $29.1 billion, beating consensus forecasts by $800 million, according to Bloomberg data (October 31, 2025). Trading volume spiked above 90 million shares by noon ET—nearly twice its 30-day average—reflecting bullish market momentum as Amazon’s cloud unit delivered its strongest growth since early 2022. In contrast, the S&P 500 Index gained just 0.6% to 4,485.32, highlighting Amazon’s outsized contribution to today’s market upside. (Source: Bloomberg, Nasdaq data)

How Amazon’s Cloud Surge and DexCom’s Slide Impact the Broader S&P 500

Amazon’s robust cloud growth had ripple effects across the technology and consumer discretionary sectors, boosting peers such as Microsoft ($MSFT) and Alphabet ($GOOGL), which both posted 2-3% intraday gains. However, DexCom ($DXCM), a leading diabetes device firm, tumbled 8.4% to $88.17 after issuing weaker-than-expected guidance, dragging down the healthcare segment. Collectively, health care shares fell 1.1% in early trading, while the tech-heavy Nasdaq 100 advanced 1.2%, according to Reuters market summaries. Overall, the day’s S&P 500 gains and losses reflect persistent sector rotation as investors pivot toward companies with resilient top-line growth amid mixed macroeconomic indicators. (Sources: Reuters, S&P Dow Jones Indices)

Portfolio Strategies: Navigating S&P 500 Earnings Volatility Now

Investors holding large-cap technology stocks may see ongoing tailwinds, especially as firms like Amazon ($AMZN) and Microsoft ($MSFT) demonstrate strong cloud-based earnings power. Defensive sectors—including health care and consumer staples—remain under pressure as names such as DexCom ($DXCM) face demand uncertainty. Traders employing momentum strategies could benefit from sector leadership trends evident in today’s stock market analysis. Long-term investors might also consider rotating into select growth names while closely monitoring forward guidance signals. For further context on how market leadership shifts can affect asset allocation, review the latest financial news and explore comprehensive investment strategy frameworks for volatile earnings cycles.

Expert Analysis: Why Tech Outperformance May Persist Into Year-End

Industry analysts observe that robust cloud adoption and accelerating enterprise IT spending continue to favor mega-cap technology leaders like Amazon ($AMZN) and Microsoft ($MSFT). Market consensus suggests technology will remain a relative outperformer as inflation moderates and Federal Reserve policy stabilizes. However, strategists at Goldman Sachs caution that high valuations could heighten volatility around future earnings releases, especially if consumer demand weakens or regulatory scrutiny intensifies. (Source: Institutional investor commentary, September–October 2025)

S&P 500 Gains and Losses Today Signal Shifting Leadership Ahead

The pronounced S&P 500 gains and losses today underscore a transition in market leadership, amplified by Amazon’s cloud-driven rally and DexCom’s pullback in health care. Looking forward, investors should watch for further earnings surprises and monitor shifting sector rotation patterns as economic data and rate expectations evolve. Staying alert to emerging catalysts will be vital for navigating ongoing market volatility in the weeks ahead.

Tags: S&P500, AMZN, DXCM, stock-market, earnings