The Federal Reserve revealed U.S. household debt soared to $17.6 trillion in Q3 2025, as Americans owe more money than ever on auto loans and credit cards. With balances for both reaching new all-time highs, investors are watching for ripple effects. What’s fueling this debt surge, and how might it impact markets ahead?

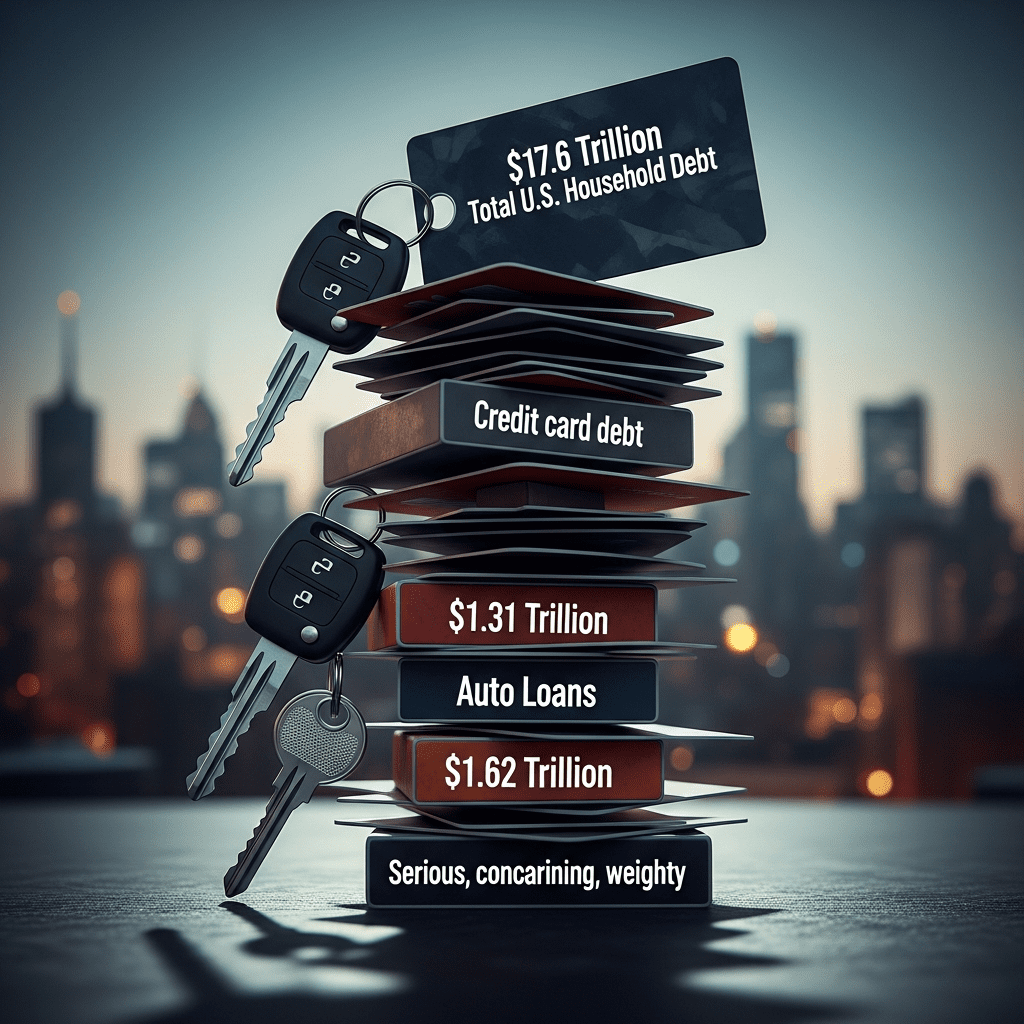

U.S. Household Debt Reaches $17.6 Trillion as Auto, Card Balances Surge

Americans’ total household debt climbed by $630 billion year-over-year to a record $17.6 trillion in the third quarter of 2025, according to the latest Federal Reserve Bank of New York data (published October 2025). The most significant increases appeared in auto loans, which rose $61 billion to $1.62 trillion, and credit card debt, which jumped $97 billion year-over-year to $1.31 trillion—both historic peaks. Credit card delinquency rates also climbed to 5.6%, the highest since 2011. Housing debt, typically the largest category, saw a more modest increase, while student loans remained comparatively stable. Financial news coverage underscores that these two categories now present the fastest-growing risks for U.S. lenders.

Why Rising Consumer Debt Raises Red Flags for the U.S. Economy

The surge in auto and credit card balances signals ongoing pressure on American consumers as living costs remain elevated. According to Bureau of Labor Statistics data, core inflation rates hovered near 4.2% year-over-year as of September 2025, outpacing wage growth for much of the population. Higher interest rates—currently averaging 21% on credit cards and 8.4% on new auto loans (Bankrate, October 2025)—further squeeze household budgets. Economists warn that rising consumer debt often precedes slowdowns in discretionary spending, a key driver of U.S. GDP growth. Comparisons to pre-2008 conditions are premature, but the velocity and concentration of debt growth in these segments has drawn particular scrutiny from both regulators and the banking sector. For more on sector shifts, see stock market analysis at ThinkInvest.

How Investors Can Navigate Record Consumer Debt Pressures

Investors evaluating the impact of Americans owing more money than ever should focus on sectors most sensitive to consumer balance sheets. Major credit issuers such as American Express ($AXP) and Capital One ($COF) have already raised loan loss reserves, signaling expectations of future charge-offs. Automobile financiers including Ally Financial ($ALLY) face potential headwinds as delinquency rates rise. Defensive sectors—such as consumer staples and discount retailers—may prove more resilient. Traders should also monitor quarterly earnings calls for distress signals among big-box chains and regional banks. For those seeking market resilience strategies, ThinkInvest recommends tracking investment strategy updates and following the latest financial news for early warnings.

What Analysts Expect for Consumer Credit Quality Ahead

Market consensus suggests consumer credit quality will remain under pressure through early 2026 if wage gains continue to lag inflation. According to analysts at Moody’s, persistently high borrowing costs will test household capacity to service debt, particularly among lower-income groups. Industry analysts observe that banks with outsized exposure to subprime lending are on watch lists as risk profiles shift. Investors should remain alert to Fed policy changes or unexpected macro shocks that could accelerate delinquencies.

Americans Owing More Money Than Ever Signals Next Credit Cycle

The fact that Americans owe more money than ever—driven by record auto and credit card debt—places consumer credit at the center of market risk radars for 2025-2026. Investors should track macro indicators, earnings forecasts, and consumer sentiment closely as the debt cycle evolves. Proactive portfolio adjustment remains key in navigating potential stress scenarios linked to household leverage.

Tags: consumer debt, credit card balances, auto loans, AXP, U.S. economy