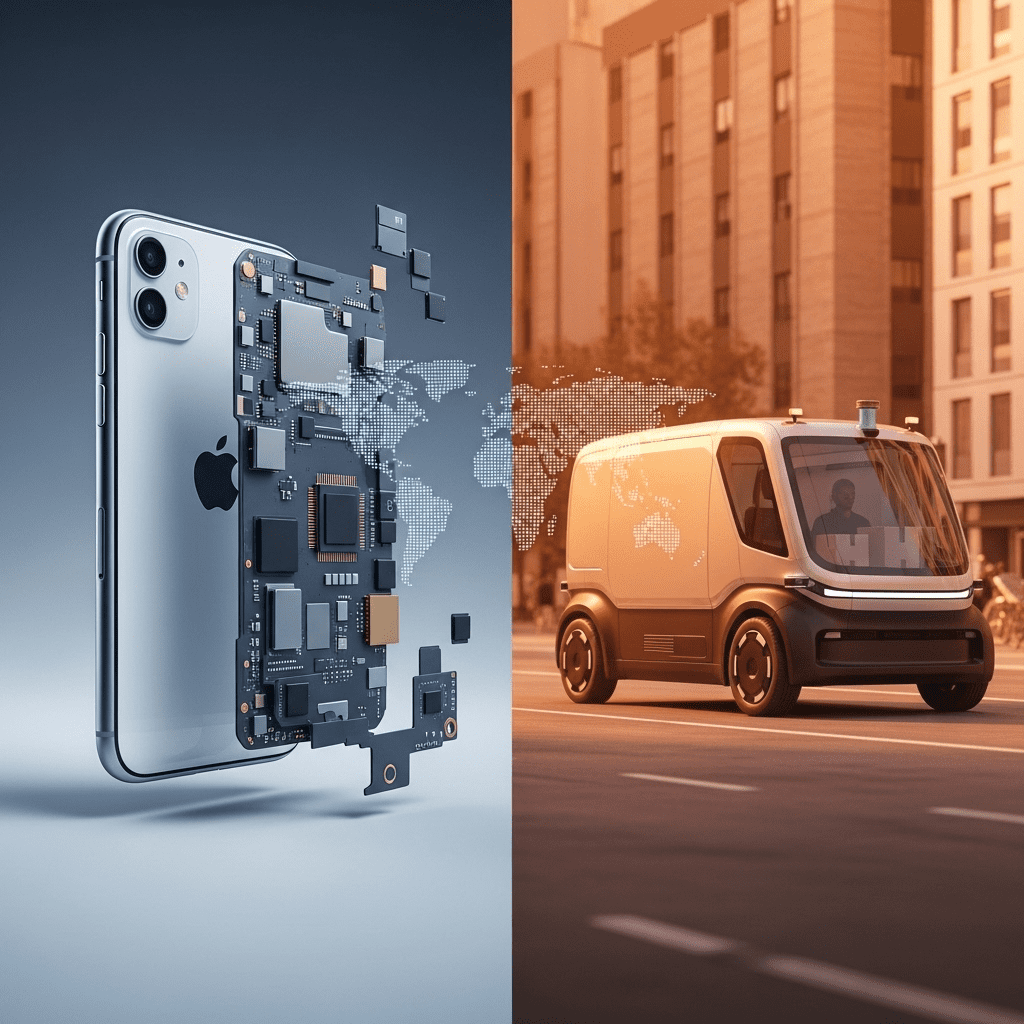

Apple’s iPhone Air cuts and China robovan rollout are headline developments shaping global economic trends in 2025. As two of the world’s most influential tech players implement pivotal shifts, investors and analysts are focused on understanding the broader market implications and the opportunities and challenges ahead.

How Apple’s iPhone Air Cuts and China Robovan Rollout Affect the Global Economy

Apple’s decision to scale back its iPhone Air production signals a shift in both company strategy and consumer demand. At the same time, China’s aggressive expansion of autonomous robovans in urban logistics is revolutionizing supply chains. Both moves reverberate through tech stocks, supply chains, and investor sentiment, underscoring the interplay between American innovation cutbacks and Chinese technological advancement.

Apple’s iPhone Air Cuts: A Demand and Supply Chain Snapshot

In early 2025, Apple announced a notable reduction in its iPhone Air production targets, citing softer global demand and challenging economic headwinds. Analysts link these iPhone Air cuts to inflationary pressures, lengthening upgrade cycles, and competition from emerging Asian smartphone makers. According to market research firm IDC, quarterly shipments for higher-end devices like the iPhone Air are projected to decrease by up to 12% year-over-year in key mature markets.

This strategic downsizing directly impacts Apple’s extensive supply network, particularly Asian semiconductor and component manufacturers. Potential implications for tech sector earnings have led investors to reassess both short-term revenue forecasts and long-term growth strategies for firms dependent on Apple contracts. Meanwhile, some analysts see Apple redirecting resources toward software and services, as recurring revenue streams become increasingly attractive amid hardware uncertainty.

China’s Robovan Rollout: Driving Urban Logistics Forward

As Apple tightens its hardware pipeline, China is accelerating its rollout of robovans—autonomous delivery vehicles spearheaded by major logistics and e-commerce giants. Industry leaders like JD.com and Alibaba began mass-deploying robovans across urban districts in late 2024, aiming to fulfill last-mile deliveries at lower costs and with higher efficiency.

The economic ripple effects of China’s robovan expansion are significant. According to McKinsey, autonomous vehicles in logistics could add $70 billion in productivity gains to China’s economy by 2028. Job displacement in traditional delivery segments is paired with new opportunities in AI engineering, sensor technology, and data analytics. For global investors, the robovan rollout is seen as a bellwether for China’s commitment to smart infrastructure and as a hedge against Western tech volatility.

Investment Outlook Amid Apple’s iPhone Air Cuts and China Robovan Rollout

The concurrent developments of Apple’s iPhone Air cuts and China robovan rollout present both risks and rewards for portfolio managers. Tech sector ETFs have adjusted weightings, temporarily favoring automation and logistics firms over traditional consumer electronics brands. Meanwhile, US-China trade relations remain a wildcard as supply chain interdependence raises questions about future regulatory and competitive landscapes―a frequent topic among investment insights readers and analysts alike.

What Should Investors Watch Next?

Financial experts recommend tracking Apple’s future quarterly reports for guidance on hardware-to-services transition strategies, which could stabilize the company’s valuation amid production cuts. Meanwhile, monitoring real-world performance and adoption rates for Chinese robovans will be key to assessing scalability and international expansion prospects in automation.

Broader Market Implications

The dual narrative of Apple’s strategic contraction and China’s automation boom highlights the volatility and dynamism of today’s global economy. Institutional investors are urged to diversify across both established tech giants and rising automation sectors, capitalizing on the transformation of traditional and digital business models. For those keeping pace with market evolution, leveraging economic analysis tools can help identify long-term value amid short-term uncertainty.

Conclusion: The Road Ahead for Tech-Led Economic Change

In summary, Apple’s iPhone Air cuts and China robovan rollout symbolize contrasting but equally powerful forces shaping the technology landscape and broader economy in 2025. Whether recalibrating supply chains or driving automation forward, the actions of these market leaders will continue to set the agenda for investors and policymakers navigating an increasingly complex global marketplace.