TL;DR: Australia fiddles with fossil gas while the country swelters in record heat, sparking debate over the economic logic and investor risks of current energy policies. Climate scientist Bill Hare argues the government’s stance on gas undermines climate goals and market stability.

What Happened

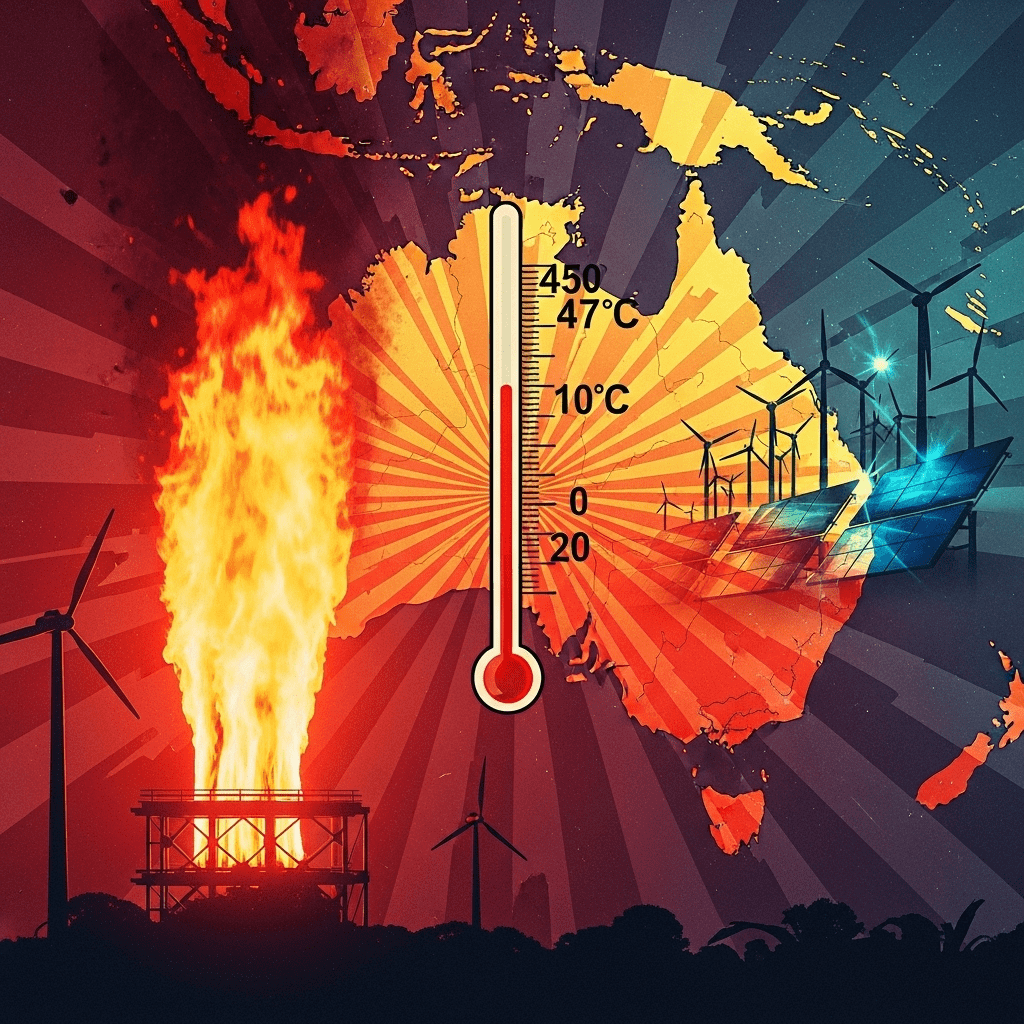

During the 2025 Austral summer, extreme weather gripped major cities like Sydney, Melbourne, and Brisbane, pushing temperatures to record highs—many surpassing 47°C (Bureau of Meteorology, Jan 2025). As the nation faced rolling health warnings and strain on its infrastructure, the Australian government reaffirmed its backing of fossil gas as a critical part of the energy mix. Announcing new exploration permits and subsidies totaling AU$1.2 billion, policymakers emphasized gas as a ‘transition fuel’ to secure grid reliability. Yet, respected climate scientist Bill Hare told ThinkInvest: “Persisting with fossil gas investments ignores both the science and the real economic opportunity of renewables.” The phrase ‘Australia fiddles with fossil gas’ has come to symbolize growing market and public concern.

Why It Matters

The continued prioritization of fossil gas carries significant economic and climate risks. Energy sector data from Bloomberg New Energy Finance (BNEF) show renewable generation costs in Australia fell another 12% in 2024, making wind and solar the nation’s lowest-cost power sources. However, gas infrastructure lock-in could saddle taxpayers and investors with stranded assets—assets that may lose value rapidly as the global clean energy transition accelerates. According to the International Energy Agency (IEA), Australia risks missing its Paris climate targets and faces pressure from trade partners seeking greener supply chains. This divergence between policy and market trends introduces uncertainty for long-term infrastructure planning and capital allocation. Investors are increasingly wary, with the market analysis noting high volatility among domestic energy equities.

Impact on Investors

For global and domestic investors, Australia’s fossil gas pivot presents mixed signals. Listed players like Santos Ltd (ASX: STO) and Woodside Energy Group (ASX: WDS) posted modest Q1 gains but face growing scrutiny from ESG-focused funds. The S&P/ASX 200 Energy Index showed a 3.1% decline since December 2024, underperforming renewable peers tracked by the S&P/ASX Renewable Energy Index, which gained 8.5% in the same period. Transition risk is becoming more material: changes in carbon pricing, export penalties, or regulatory frameworks could rapidly impact asset values. Conversely, green infrastructure, battery storage, and transmission upgrades offer upside as Australia eyes more ambitious climate pathways. For investors seeking clarity, investment insights point to shifting capital streams toward low-carbon assets.

Expert Take

Analysts note that Australia’s insistence on backing fossil gas ‘runs counter to the economic writing on the wall.’ Market strategists suggest sustained government support for gas could introduce structural inefficiencies and hinder investor confidence, especially as institutional capital flows toward a decarbonized grid.

The Bottom Line

Australia fiddles with fossil gas even as extreme heat lays bare the vulnerabilities of fossil-fueled systems and misaligned policy. With mounting evidence that renewables now outcompete gas on cost and grid performance, the window for investors to realign portfolios is narrowing. The convergence of climate, market and policy trends signals both caution and opportunity in Australia’s evolving energy sector.

Tags: Australia energy, fossil gas, climate policy, renewable investments, Bill Hare.