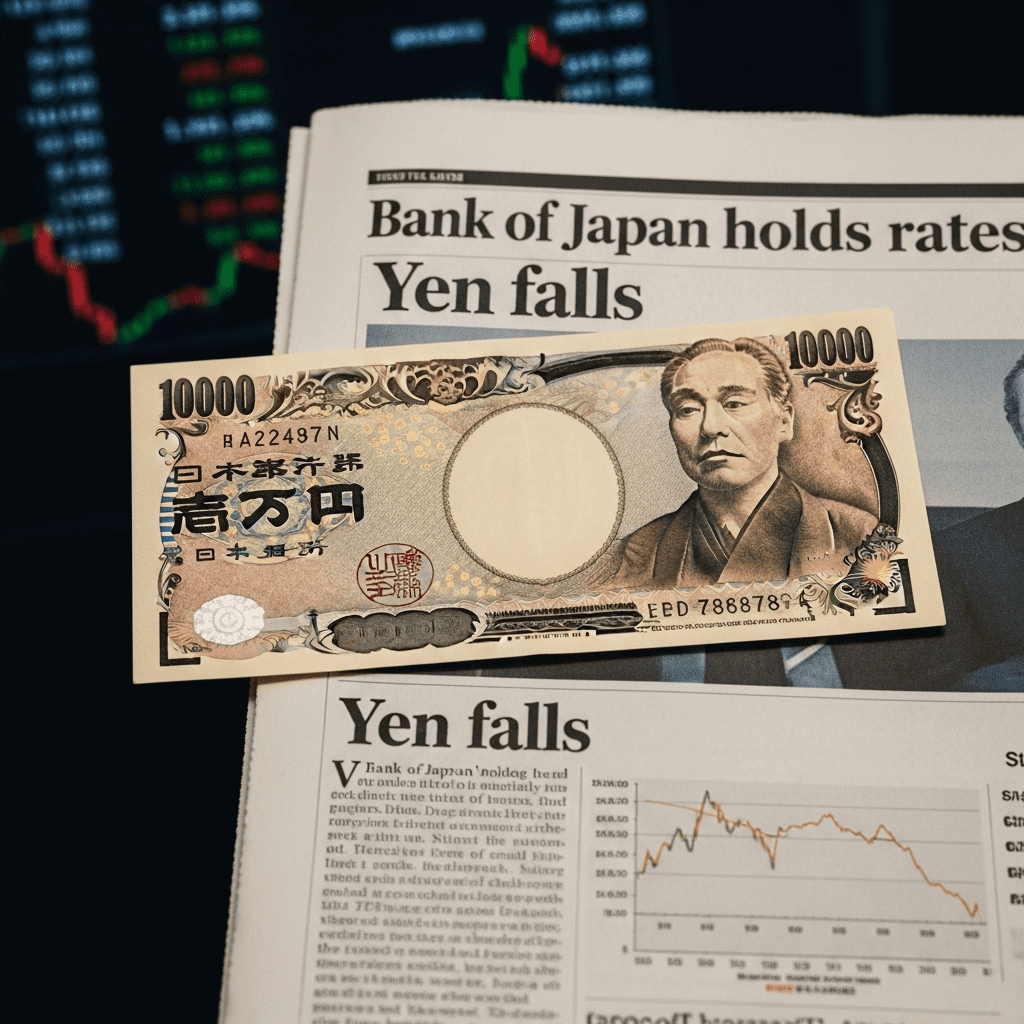

The Bank of Japan ($8301.T) sits tight on rates at its October meeting, defying some expectations for a move as two board members dissent. Bank of Japan sits tight on rates while the yen falls to 151.20 per dollar, raising fresh questions for investors.

Bank of Japan Holds Key Rate at 0.1% Despite Split Vote

Bank of Japan ($8301.T) announces it is maintaining its benchmark interest rate at 0.1% on October 30, keeping its ultra-loose policy unchanged. Notably, two of nine policy board members dissented, advocating for a modest hike—a rare public split. The yen slipped 0.8% to 151.20 against the U.S. dollar immediately after the announcement, its weakest since November 2022, according to Bloomberg data. Meanwhile, Nikkei 225 futures edged down 0.6% in pre-market trading as traders digest the decision and its ramifications for Japanese assets.

Why Japan’s Rates Decision Ripples Through Global Currency Markets

The Bank of Japan’s status quo policy is increasingly at odds with tightening by other major central banks. The decision sustains a record divergence in global policy rates, prompting speculators to push for further yen depreciation. Year-to-date, the yen has weakened more than 13% against the U.S. dollar, amplifying concerns around imported inflation and destabilizing capital outflows, per Reuters. Japanese government bond yields remain suppressed near 0.95% for 10-year JGBs—well below U.S. Treasury yields hovering above 4.6% as of October 29, 2025. This dynamic sees traders revisiting carry trades, borrowing cheaply in yen to invest in higher-yielding assets abroad, increasing pressure on the Japanese currency and on emerging markets sensitive to capital flows.

Portfolio Moves: How Investors Can Navigate BoJ’s Rate Hold

Investors holding Japanese equities face renewed currency risk as the yen declines, while exporters may benefit from improved global competitiveness. Those exposed to the Japanese bond market are likely to see muted yield moves barring any emergency intervention. Currency traders may find opportunity in the persistent yen weakness but should be wary of potential Ministry of Finance action to stem volatility. Within this environment, some analysts recommend a diversified approach, balancing Japanese equities, hedged ETFs, and select emerging markets. For further sector-specific analysis, refer to stock market analysis and for macro policy trends, see the latest financial news. FX participants should monitor forex trading insights as policy divergence remains a key driver.

What Analysts Expect If Pressure Mounts on the Yen

Market consensus suggests the Bank of Japan will maintain its patient stance unless yen depreciation triggers inflation spikes or capital flight. Industry analysts observe that continued dissent on the policy board signals rising pressure for a shift, especially if the yen tests multi-decade lows. Investors are watching for incremental language changes in BoJ guidance as potential precursors to future tightening.

Bank of Japan Sits Tight on Rates: What’s Next for Global Markets

The Bank of Japan sits tight on rates even as global central banks tighten, reinforcing Japan’s divergence and volatility in currency markets. Investors should closely track yen levels and policy commentary for signs of intervention or policy recalibration. A prudent approach is to hedge currency exposure and watch for signs of coordinated action as the rate gap persists into 2025.

Tags: Bank of Japan, $8301.T, yen, monetary policy, forex