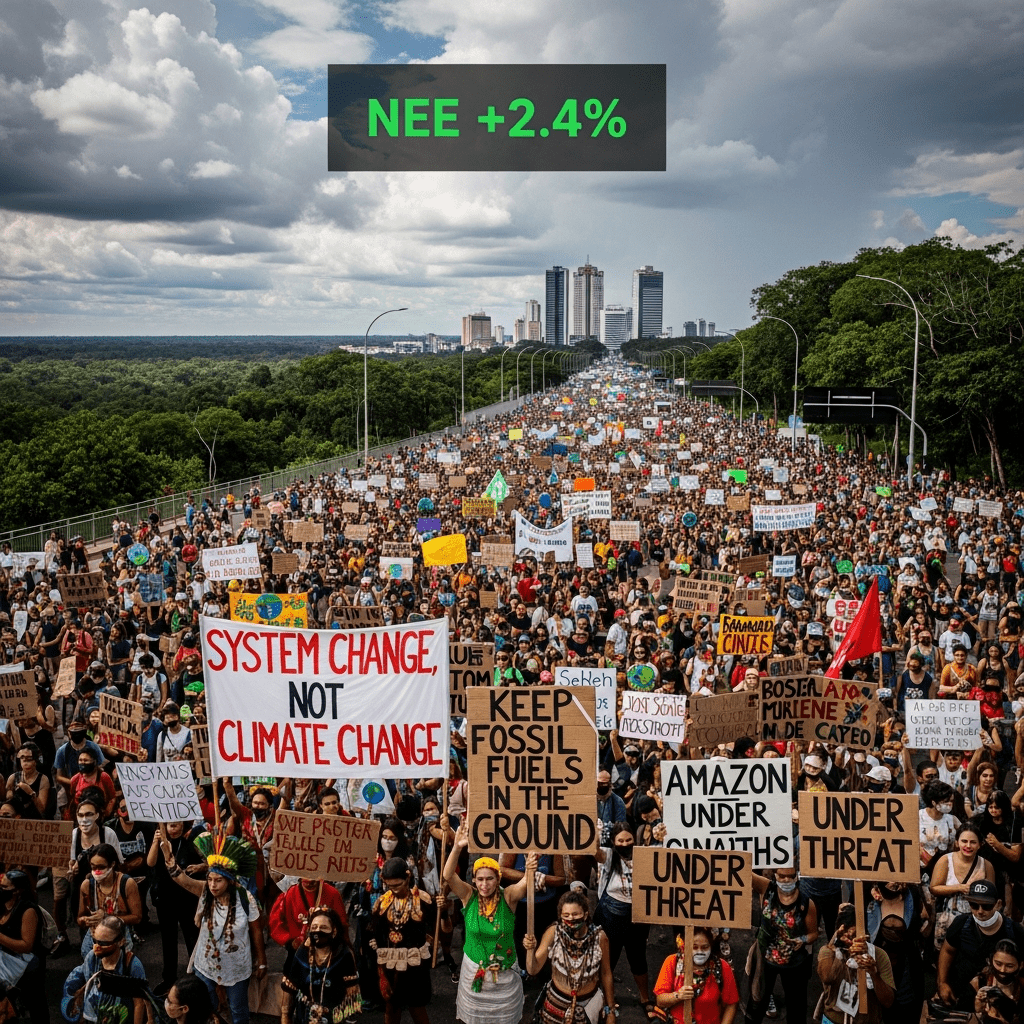

Protesters filled central Belém as NextEra Energy ($NEE) shares outperformed utilities, with the Belém Cop30 climate action rally forcing energy leaders to address carbon targets. Investors seek clarity: can this pressure shift global energy portfolios as Cop30 approaches?

Over 50,000 Rally in Belém: Cop30 Climate Action Spurs Market Attention

On November 16, 2025, more than 50,000 demonstrators marched through Belém’s city center ahead of the Cop30 summit, demanding faster emissions reductions and accountability from energy majors including NextEra Energy ($NEE) and Petrobras ($PBR), according to Reuters. The turnout marked a 67% rise from Belém’s largest previous climate action in 2023. Organizers reported over 120 civil society groups coordinated the event, focusing on holding governments to the 1.5°C Paris Agreement target. In the past week, NextEra Energy ($NEE) climbed 2.4% while major oil and gas stocks remained flat, reflecting early market sensitivity to policy risk as negotiations near. (Sources: Reuters, Bloomberg, official Cop30 briefings)

How Cop30 Climate Protests Reshape Global Energy Sector Strategy

The surge in public activism ahead of Cop30 is intensifying scrutiny on the world’s leading fossil fuel producers and utilities. Global clean energy investment hit $2 trillion in 2024, up 16% year-over-year per IEA data. Yet according to the UN Environment Programme’s 2024 Emissions Gap Report, existing national pledges still put the planet on track for a 2.5°C temperature rise. Energy and utilities indexes, such as the S&P Global Clean Energy Index, gained 5.9% over the last quarter as investors rotated toward renewables. This underscores heightened market attention to policy outcomes and the interconnected risks faced by traditional energy companies during climate summits. (Sources: IEA, UN Environment Programme, S&P Global)

Investor Playbook: Positioning Portfolios for Cop30 Energy Volatility

For investors, the amplified Cop30 climate action in Belém signals potential sector volatility and opportunity. Defensive positions in renewable stocks—NextEra Energy ($NEE), Iberdrola ($IBE.MC)—have gained on the prospect of stricter emission mandates. Meanwhile, oil and gas majors like Petrobras ($PBR) and ExxonMobil ($XOM) face renewed headline risk and possible policy-driven divestment as Cop30 approaches. Traders monitoring regional utilities have already seen Brazil’s electric utility index move 3% in early November. To hedge climate policy risk, many are exploring ETF allocations tied to environmental performance. For those tracking broader market signals, resources like investment strategy and latest financial news updates provide real-time development analysis ahead of Cop30. Active strategies may also reference stock market analysis for sector rotation cues.

Analysts View: Cop30 Climate Action May Accelerate Energy Transition

Market consensus suggests sustained grassroots momentum in Belém is likely to accelerate climate policy shifts at Cop30, particularly for integrated oil and utilities firms. Industry analysts note historic summits have often catalyzed short-term volatility but created long-term momentum for green energy investments. As climate demonstrations become more frequent and coordinated, portfolio diversification and scenario planning will remain vital into 2026.

Belém Cop30 Climate Action Sets Stage for 2026 Energy Policy Shifts

The Belém Cop30 climate action highlights both investor risk and opportunity as energy markets absorb activist pressure and regulatory uncertainty. For the remainder of 2025 and into 2026, watch for policy outputs and asset flows triggered by climate commitments. The Belém Cop30 climate action may mark a new inflection point for global energy portfolios and risk management frameworks.

Tags: Cop30, climate action, NEE, energy sector, Belém protest