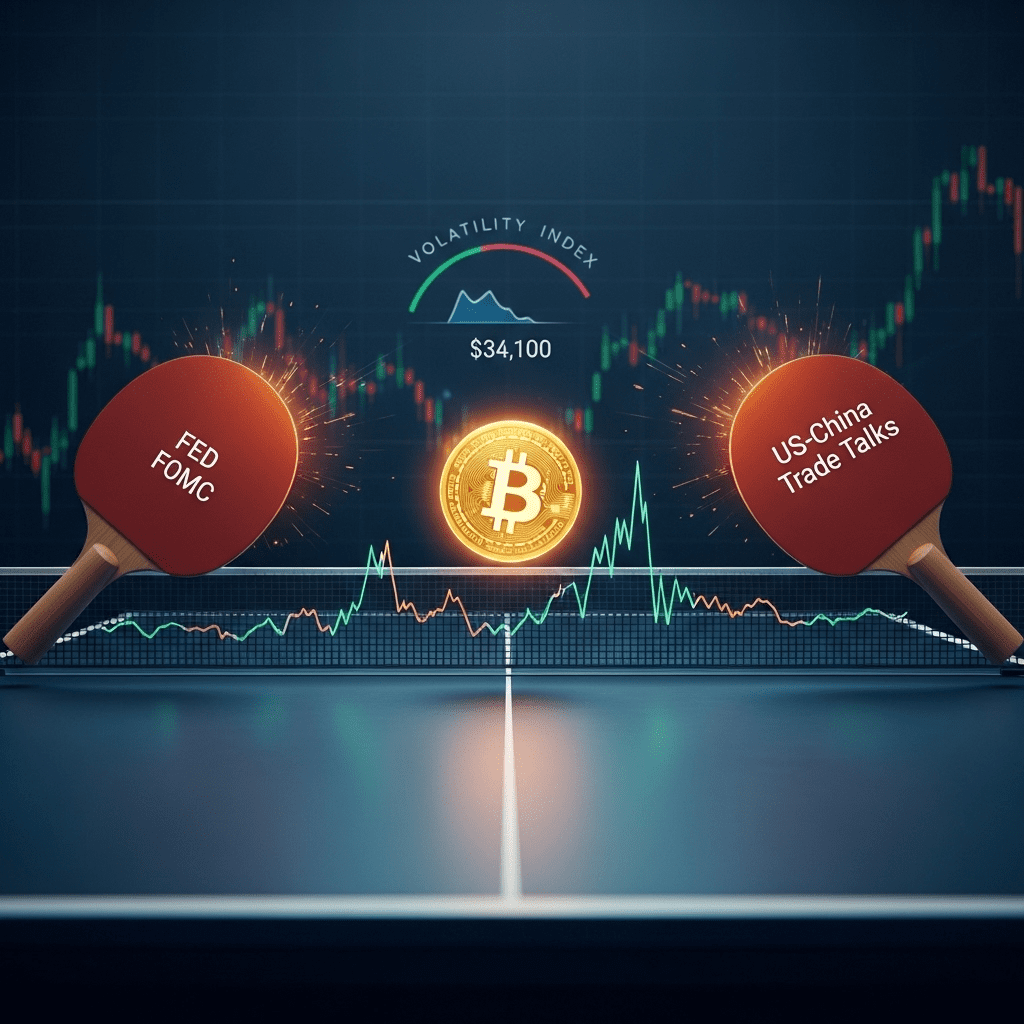

Bitcoin ($BTC) stalled near $34,100 this week as the cryptocurrency’s ‘ping-pong’ price action defies breakout expectations. The Bitcoin ping pong price action puzzles investors, with low volatility persisting even as the Fed FOMC and US-China trade talks approach high-stakes conclusions.

Bitcoin Trades Tight: Price Range Holds Below $34,500 as Volumes Slide

Bitcoin ($BTC) remains locked in a narrow trading band between $33,800 and $34,500 since October 22, amid historically low volatility. Spot trading volume on Binance slumped to $9.2 billion on October 27, down 37% from two weeks ago, according to CoinMarketCap. The flagship cryptocurrency’s 7-day volatility index fell below 1.8%, its lowest reading since May 2023. Bloomberg data shows BTC’s price failed for the fourth consecutive session to close above the $34,500 resistance, signaling continued trader indecision ahead of major macro events.

Why Crypto Market Volatility Hinges on Fed FOMC and US-China Talks

The broader cryptocurrency market mirrors Bitcoin’s stalled momentum, with the total digital asset market cap hovering at $1.29 trillion as of October 28 (CoinGecko). Traders attribute this sideways action to mounting anticipation around the US Federal Reserve’s FOMC statement on October 30 and the pending announcement on renewed trade tariffs between the US and China. In past years, such macro catalysts have triggered sharp moves: in June 2023, Bitcoin surged 12% after unexpected dovish Fed comments. Currently, the Chicago Board Options Exchange’s Bitcoin Volatility Index (BVIN) is down to 34.8, near its 18-month lows, reinforcing market-wide caution. Industry reports from The Block note that stablecoin flows and options open interest remain muted, showing risk aversion across the crypto sector.

How Crypto Investors Can Position Amid Bitcoin Ping Pong Price Action

Active traders are deploying neutral-to-rangebound strategies, such as selling strangles and iron condors in BTC options, to profit from low movement. Long-term holders, meanwhile, are largely sitting tight, as glassnode data shows over 68% of circulating Bitcoin has not moved in the past six months. Altcoin investors should note that major tokens like Ethereum ($ETH) and Solana ($SOL) mirror Bitcoin’s stagnation, both flatlining within 2% over the past week. For diversified exposure, investors may monitor cryptocurrency market trends or consider investment strategy shifts if volatility returns post-FOMC. Those trading on leverage face heightened liquidation risk if an event-driven breakout occurs, a trend observed during previous Fed decision weeks, per Kaiko Research.

What Analysts Expect for Bitcoin After Key Macro Catalysts

Market strategists at Galaxy Digital and Bernstein forecast that Bitcoin could break its current range if the Fed signals a prolonged pause or if US-China trade negotiations spark new risk appetite. However, industry analysts caution that persistent uncertainty or hawkish Fed language could extend the current stagnation. As of October 28, most institutional desk commentaries point to a “wait-and-see” stance ahead of Wednesday’s FOMC outcome, citing the recent collapse in realized volatility and positioning data from CME Group.

Bitcoin Ping Pong Price Action Sets Up for Post-Fed Volatility Shift

The Bitcoin ping pong price action is a clear sign that investors await policy clarity from the Fed and a decisive US-China deal update. With volatility at multi-year lows and key events on the immediate horizon, traders should prepare for rapid shifts once catalysts hit. This consolidation phase may offer opportunities for range trading now, but vigilance is crucial for potential breakouts in the coming days.

Tags: Bitcoin,BTC,cryptocurrency,Fed FOMC,market volatility