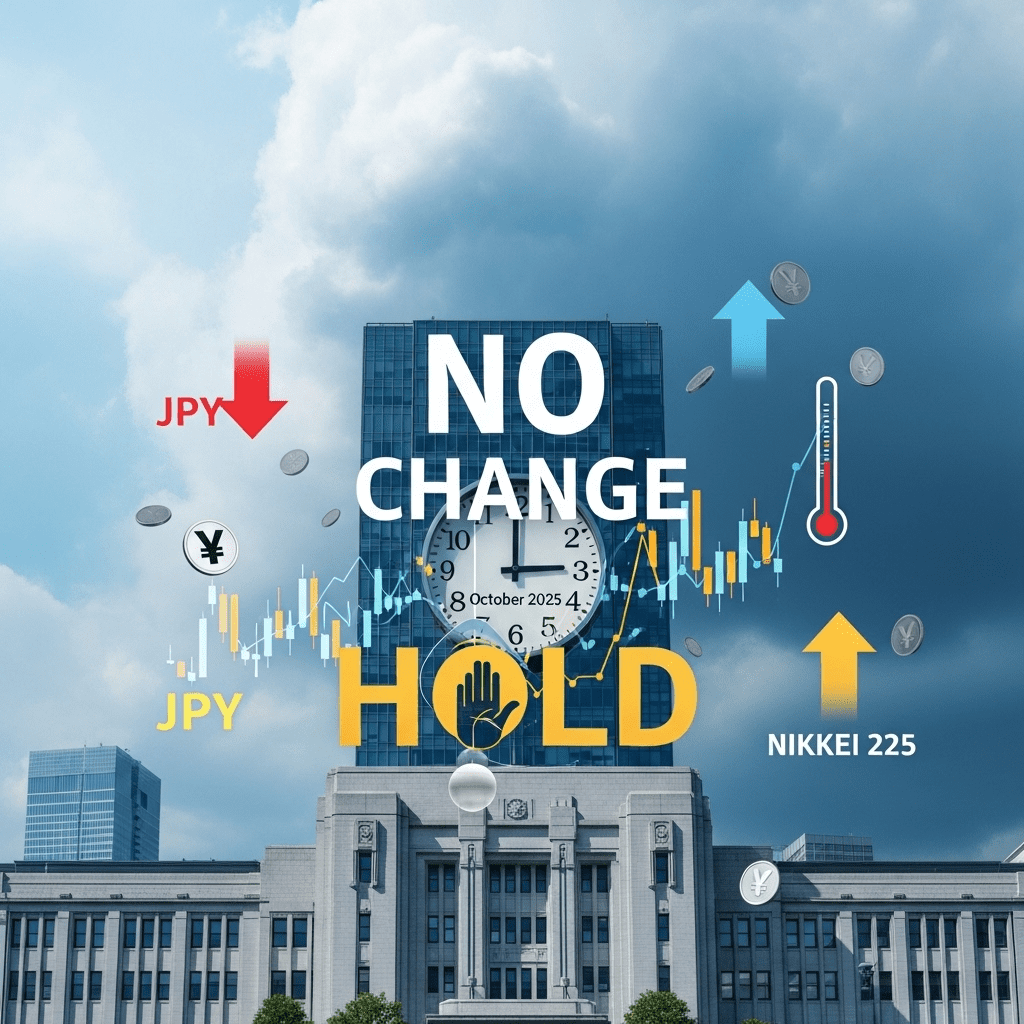

The Bank of Japan ($BOJ) revealed a surprise policy hold on October 30, keeping rates unchanged despite rising inflation and yen volatility. The BOJ policy hold October 2025 announcement, led by new governor Sanae Takaichi, left traders questioning the ultra-cautious stance just as market expectations tilted toward gradual tightening.

BOJ Keeps Rates at -0.10% Despite Inflation Spike in October 2025

The Bank of Japan ($BOJ) held its short-term rate steady at -0.10% and maintained the 10-year JGB yield target around 0%, surprising investors who expected at least a minor shift. October CPI rose 3.5% year-on-year, exceeding the BOJ’s 2% objective for a 16th consecutive month, according to Japan’s Ministry of Internal Affairs. Yen ($JPYUSD) fell as much as 0.9% to 153.40 per dollar immediately after the decision, while the Nikkei 225 gained 0.7% in afternoon trading on the Tokyo Stock Exchange. Although senior officials have signaled growing concern over imported inflation and wage pressures, Takaichi reiterated the need for “patience” in official remarks cited by Reuters on October 30.

How BOJ Policy Caution Impacts Yen, Bonds, and Asian Markets

The unexpected BOJ policy hold reverberated across Asian markets, exacerbating yen weakness and lifting Japanese government bond yields. The yield on the benchmark 10-year JGB hit 0.91%, its highest since 2012, per Bloomberg market data. Regional currencies such as the South Korean won and Malaysian ringgit also retreated amid rising dollar strength. Historically, the BOJ has been the last major central bank to exit negative rates; this persistence continues to fuel capital flows out of Japanese assets in pursuit of higher global yields. With year-to-date inflows into Japanese equities declining to $26.2 billion as of October 27, analysts note that investor appetite is moderating (Japan Exchange Group data).

Investor Strategies: Navigating BOJ Caution in Volatile Yen Markets

Active traders reacted to the BOJ’s inaction by boosting short positions on the yen and reallocating to export-heavy Japanese stocks poised to gain from currency weakness. Long-term investors may consider monitoring sectors such as manufacturing and technology, as these benefit from lower input costs and competitive export prices. However, ongoing negative rates raise risks for Japan’s banking sector, with profit margins compressed further. Portfolio managers with exposure to Japanese bonds must contend with potential volatility, as rates may remain lower for longer than expected. For broader context and strategies, see forex trading insights and the latest updates in financial news.

What Analysts Expect Next for BOJ Policy and the Japanese Market

Industry analysts observe that the BOJ remains caught between global tightening and domestic fragility. Strategists at Mitsubishi UFJ Morgan Stanley note that, barring a sudden wage surge or external shock, the BOJ is likely to hold steady into early 2026. Market consensus suggests the risk of policy error has grown, as a delayed exit from ultra-loose policy could further strain the yen and stoke imported inflation, while an abrupt shift risks destabilizing debt markets. Japanese corporates and global investors are closely monitoring labor data and upcoming wage negotiations for clues on timing.

BOJ Policy Hold October 2025 Signals New Era of Market Uncertainty

The BOJ policy hold October 2025 signals a pivotal moment for currency, bond, and equity markets in Asia. Investors should track inflation, wage growth, and yen volatility, with Takaichi’s cautious approach likely to drive uncertainty in the quarters ahead. For those with significant Japan exposure, tactical flexibility and ongoing monitoring of policy statements remain crucial as the Bank of Japan plots its next move.

Tags: BOJ, yen, Japanese bonds, monetary policy, Takaichi