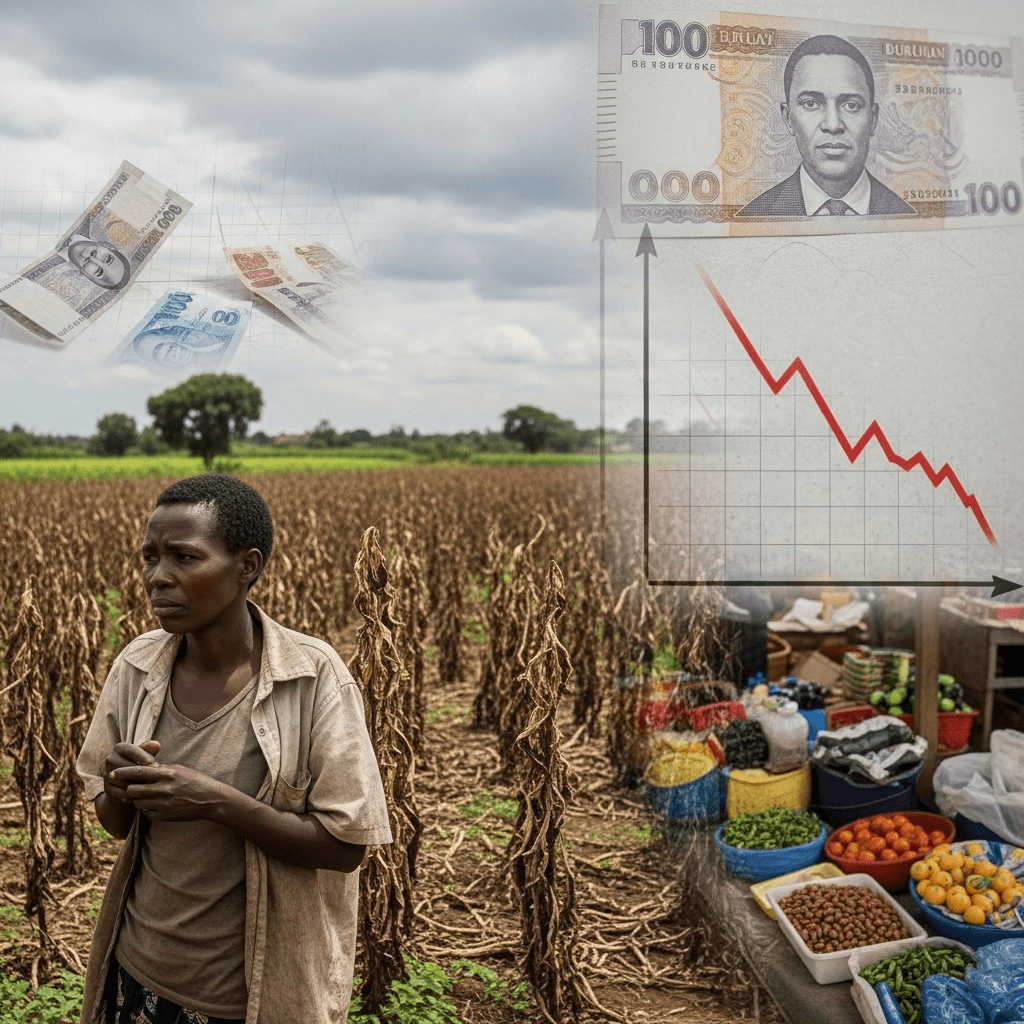

As Burundi endures ‘worst economic crisis in a country not at war’, global attention is turning to the deepening hardship in this East African nation. Despite the absence of active armed conflict, millions of Burundians are experiencing unemployment, food insecurity, and currency collapse that threaten the country’s fabric and regional stability.

The Complex Roots: Why Burundi Endures ‘Worst Economic Crisis in a Country Not at War’

The dire situation in Burundi can be traced to a multitude of economic, political, and structural factors. Historically, Burundi has faced development challenges, but the events over the past two years have exacerbated its fragile economy. The nation’s overreliance on subsistence agriculture, limited foreign investment, and pervasive political uncertainty have converged into a perfect storm, crippling growth and livelihoods.

Collapse of the Burundian Franc and Rising Inflation

One of the most immediate and tangible effects of the crisis is the collapse of the Burundian franc. Since early 2023, the currency has lost more than 60% of its value against the US dollar. This sharp devaluation has triggered unprecedented inflation, pushing prices of essentials like maize, cooking oil, and medicine far beyond the reach of ordinary citizens. According to regional economic observers, this inflation rate is among the highest outside active war zones, threatening household survival and further destabilizing the economy.

Impact on Daily Life and Social Infrastructure

For millions of Burundians, shortages and soaring prices are upending daily routines. Food insecurity is climbing relentlessly, with the World Food Programme estimating that more than 60% of households now struggle to meet daily caloric needs. Teachers, healthcare workers, and civil servants report unpaid or delayed salaries, hollowing out public services and pushing professionals to seek opportunities elsewhere.

Education and Healthcare in Crisis

With state revenues shrinking, critical public sectors have suffered acute budget cuts. Schools face chronic shortages of supplies, and teacher absenteeism is becoming commonplace. Similarly, health facilities endure frequent stockouts of essential medicines. Chronic malnutrition is rising, and preventative care efforts have faltered, raising alarms among international aid groups and development partners.

Drivers of the Economic Meltdown

Several underlying drivers fuel the ongoing economic crisis in Burundi:

- Political Instability: Prolonged uncertainty around governance and unresolved political tensions continue to undermine investor confidence.

- Dependency on Agriculture: Nearly 90% of Burundians depend on a rain-fed agricultural system, making the nation extremely vulnerable to climate shocks and crop failures.

- Foreign Exchange Shortages: With shrinking exports and falling remittances, the government faces a chronic shortage of foreign currency, compounding import bottlenecks and pushing the black market for dollars to record levels.

International organizations, such as the World Bank and African Development Bank, have cited these vulnerabilities in recent assessments. However, tangible progress remains elusive, as fiscal constraints limit the government’s policy responses.

Regional Reverberations

The ramifications of Burundi’s crisis extend beyond its borders. Neighboring nations like Rwanda and Tanzania face increased migration pressures as Burundians seek refuge. The instability threatens cross-border trade, regional food supplies, and even security in the Great Lakes region.

Burundi’s Prospects: Pathways Out of the Crisis

Amid these daunting challenges, economic strategists and humanitarian organizations are urging a multipronged approach. Policy recommendations include targeted cash transfers to the vulnerable, reforms to attract investment, and regional cooperation on food security. Long-term, Burundi’s leaders must address deep-rooted governance issues and diversify the economy to reduce dependence on subsistence agriculture.

International Support and Investment Opportunities

While prospects for rapid recovery remain slim, targeted international support could ease the burden for Burundi’s poorest households. Analysts suggest that microfinance initiatives, infrastructural investment, and responsible private sector engagement could lay the groundwork for sustainable growth. Diaspora remittances and enhanced regional trade networks may also help stabilize the currency and provide new sources of employment.

Monitoring the Future: Staying Informed on Burundi’s Economy

As Burundi endures ‘worst economic crisis in a country not at war’, global and regional actors must remain vigilant. Multinational organizations, governments, and private investors seeking to understand the risks and opportunities in Burundi’s economy would benefit from regular updates and in-depth analysis. For ongoing insights into African and global economic trends, visit the latest research on emerging markets at leading economic intelligence platforms.

Conclusion

The plight of Burundi is a sobering reminder that nations can suffer extreme economic hardship even outside armed conflict. Solutions will require both immediate humanitarian support and courageous, long-term structural reforms. Ensuring a more stable, prosperous future for Burundians depends on the concerted action of domestic leaders, international allies, and a global community committed to inclusive economic recovery.