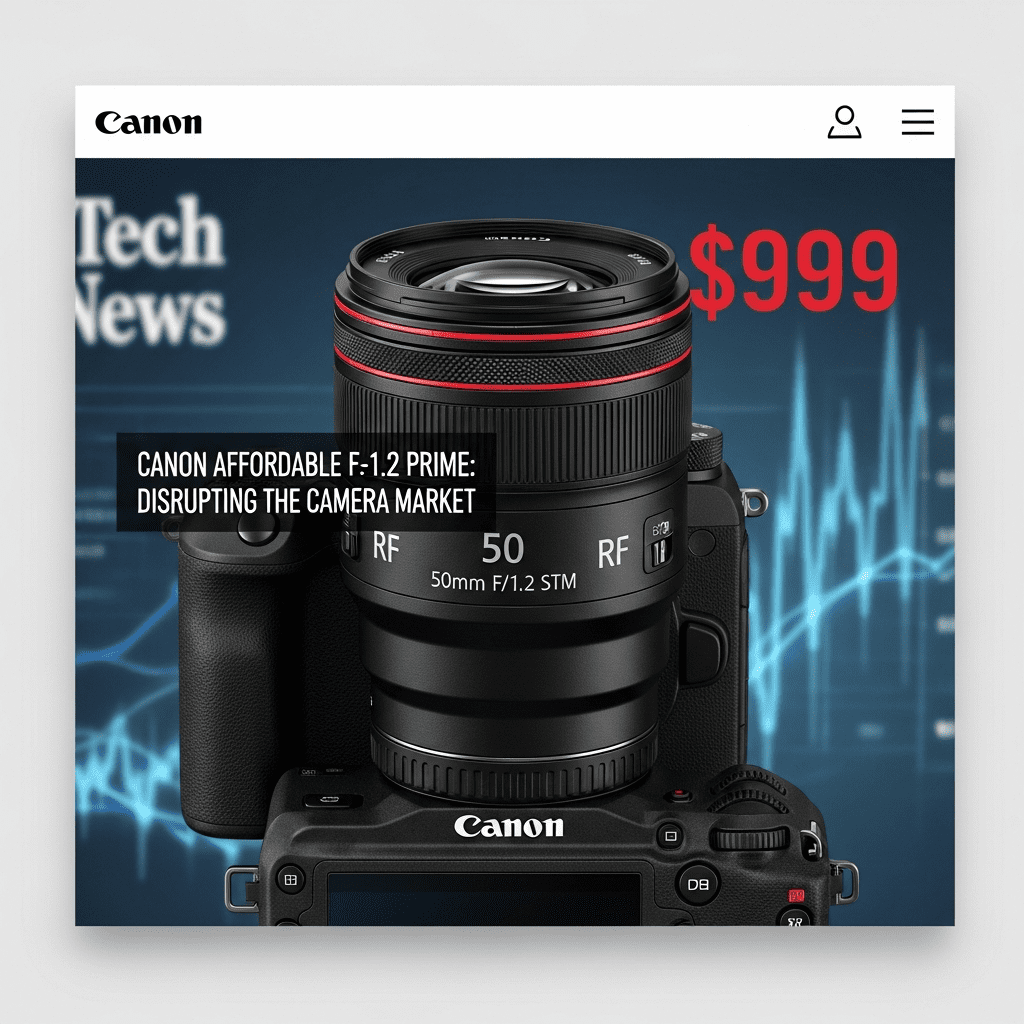

Canon Inc. ($7751.T) revealed its new RF 50mm f/1.2 lens for just $999 on November 6, sending shockwaves through the camera market. This Canon affordable f/1.2 prime rivals budget Chinese counterparts while maintaining brand prestige—and investors are watching closely. Why did Canon choose this moment to strike?

Canon Debuts Sub-$1,000 RF 50mm f/1.2 Prime in Surprise Launch

Canon Inc. ($7751.T) announced its long-anticipated RF 50mm f/1.2 STM, priced at $999 and available immediately through global retailers. The move undercuts third-party lens makers such as Yongnuo and Viltrox, whose 50mm f/1.2 alternatives sell in the $600–$850 range (source: B&H Photo, October 2025). Canon shares on the Tokyo exchange rose 2.4% to JPY 3,320 following the announcement (Bloomberg data). Canon reported global interchangeable lens sales of 9.7 million units for the year ended September 2025—a 6% gain year-over-year (company IR release, Oct. 2025). The RF 50mm f/1.2 incorporates weather sealing and dual nano-USM motors, previously only seen in Canon lenses above the $1,800 mark (Canon press release, Nov. 2025).

Why Camera Sector Pricing Pressures Intensify After Canon’s Move

Canon’s disruptive pricing places additional pressure on Chinese lens manufacturers that have capitalized on the sub-$1,000 market. Pre-pandemic, over 31% of mirrorless system lens sales priced under $1,200 were from independent brands (CIPA statistics, 2022). However, Canon’s aggressive pivot could reverse the trend by leveraging both brand loyalty and broader distribution. Industry analysts note that the move may prompt Sigma, Tamron, and Sony ($6758.T) to fast-track affordable wide-aperture primes, intensifying price-based competition in an $18.2 billion global camera accessory sector (Statista, 2025). The sector’s gross margin compression, with averages slipping from 42.1% in 2022 to 39.6% by late 2024, is likely to accelerate (stock market analysis).

How Investors Should Position Amid Changing Lens Market Dynamics

Long-term investors holding shares in Canon or rival lens makers should expect near-term sales volume growth but longer-term margin pressure. Canon’s value-focused pivot may force competitors such as Fujifilm Holdings ($4901.T) and Sony to revise pricing on their own f/1.2 primes ahead of the 2025 holiday period. Meanwhile, distribution partners and specialty retailers may benefit from higher volumes but risk inventory imbalances if the race to the bottom intensifies (Reuters, October 2025). Active traders may seek opportunities in camera supply chain plays, given heightened component demand. For more details on current sector performance, see our recent latest financial news coverage and investment strategy insights for technology hardware sectors.

What Analysts Expect After Canon’s Disruptive Lens Launch

Industry analysts at Daiwa Capital and Jefferies suggest Canon’s launch is likely to yield short-term share gains but at the risk of cannibalizing higher-priced RF lens models. Investment strategists note that while premium margins are threatened, Canon’s decision signals a calculated bid for dominant volume as overall camera system demand stabilizes. Market consensus suggests other Japanese camera majors will likely emulate this pricing strategy within six months, intensifying competitive headwinds.

Canon Affordable f/1.2 Prime Signals New Era in Camera Sector

This Canon affordable f/1.2 prime debut is more than a pricing story—it signals a tactical resetting of expectations for both investors and competitors. Investors should watch for further responses from rivals and monitor global lens sales volume, as margin compression and rapid innovation shape the coming year. Strategic positioning in camera sector equities requires vigilance as cost and value become inseparable in driving growth.

Tags: canon, 7751.T, lens market, technology, camera sector