Capital One Financial Corp. ($COF) maintained its savings account yield at 4.35% APY as of November 2025, as confirmed in its latest customer update. With deposit rates diverging across the sector, Capital One savings account rates remain competitive but face rising challenges from fintech rivals and online banks. Could your cash deliver more return elsewhere?

Capital One Yields 4.35% as Savings Account Rates Face Stiff Competition

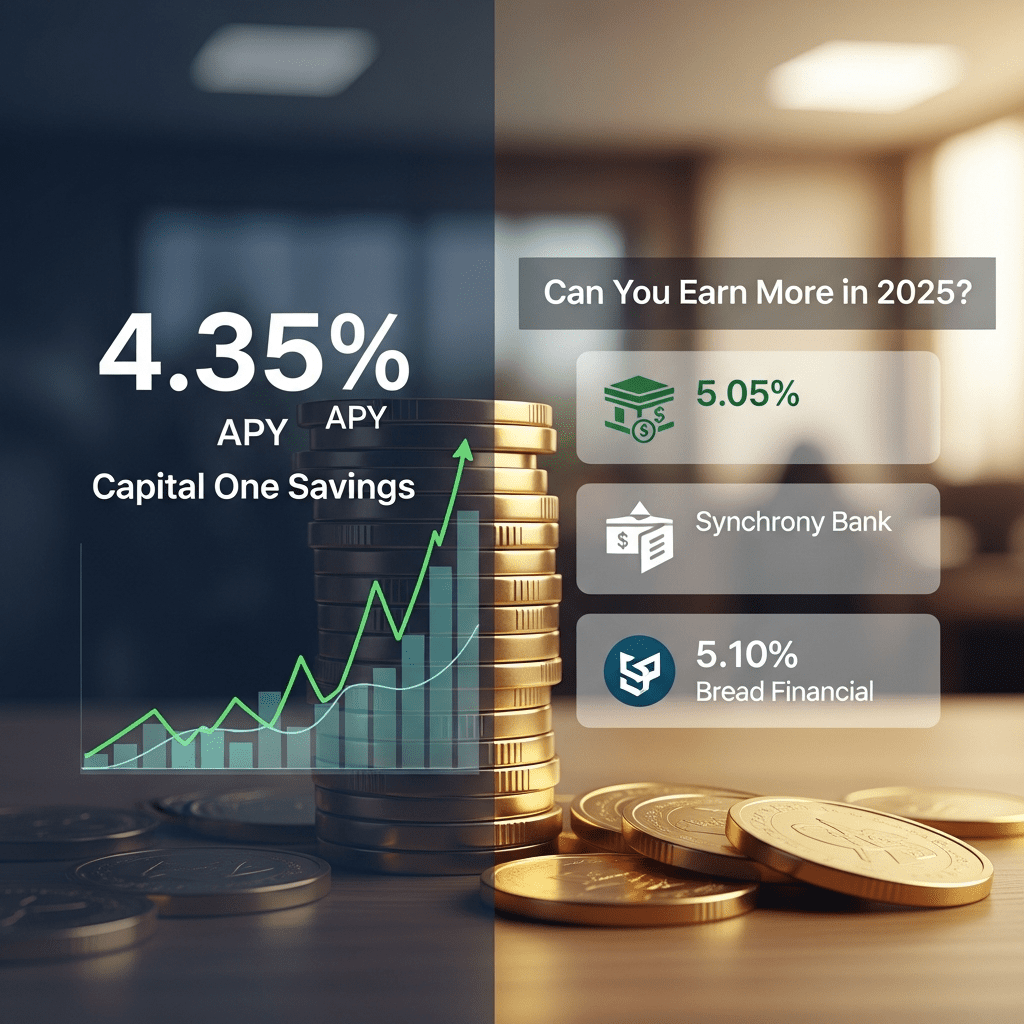

Capital One ($COF) currently offers a 4.35% annual percentage yield (APY) on its high-yield savings account, unchanged since the July 2025 Federal Reserve rate pause, according to company disclosures and FDIC data. As of November 1, 2025, the account features zero monthly maintenance fees and no minimum opening deposit. Despite this, several online banks now list savings APYs above 5%, with Bread Financial reporting a 5.10% rate and Synchrony Bank offering up to 5.05% APY (source: Bloomberg, November 2025). The gap between traditional banks and digital-first competitors has widened since the beginning of the year, when average U.S. savings account rates hovered near 0.45% (FDIC data, January 2025).

Why Higher-Yield Savings Accounts Are Upending Retail Banking

The rapid ascent of high-yield savings accounts has unsettled legacy banks, pushing competition for deposits to levels unseen since 2007. Data from the Federal Reserve shows U.S. savings account balances reached $11.3 trillion in October 2025, while average deposit rates climbed in tandem with the Fed’s overnight rate—currently 5.25% after five consecutive hikes since 2023 (latest financial news). Online institutions, which face lower overheads, continue passing on higher yields to customers. This shift has forced traditional banks like Capital One ($COF) and JPMorgan Chase ($JPM) to reevaluate product offerings or risk losing deposits to fintech disruptors and neobanks. The spread between the lowest and highest APYs now exceeds 4 percentage points, intensifying pressure on incumbents to innovate.

How Savers Can Capitalize: Comparing Rates and Avoiding Hidden Fees

For savers seeking optimal returns, regularly comparing available APYs is essential. While Capital One’s 4.35% remains attractive versus the national average, alternatives such as Marcus by Goldman Sachs (4.90% APY) and Ally Bank (4.80% APY) may offer higher yields with similar FDIC protection (per company and Reuters data, October 2025). Investors should also review account terms for withdrawal limits or maintenance charges, which can erode earnings. Portfolio managers increasingly recommend a laddered approach—allocating cash between a primary high-yield account and short-term Treasury bills or money market funds, many now yielding 5% or higher. For those with significant liquid assets, seeking promotional rates from fintechs may be advantageous, though these offers can fluctuate. For a comprehensive view of current rates and risk factors, consult latest financial news and stay updated with ongoing investment strategy best practices.

Analysts Expect Deposit Rate Competition to Persist Into 2026

Industry analysts observe that the scramble for retail deposits will likely persist as long as the Federal Reserve maintains a restrictive policy stance. According to market consensus (Bloomberg, October 2025), banks with robust digital platforms stand to benefit from customer migration, while brick-and-mortar institutions may lag without meaningful rate hikes or added features. Investment strategists note that the ongoing shift to higher-yield products is unlikely to reverse until Fed cuts materialize, keeping the deposit-rate gap wide into mid-2026.

What Capital One Savings Account Rates Signal for Savers in 2025

Capital One savings account rates remain solidly above average, but evidence suggests disciplined savers could earn more by shopping around. With rates at multiyear highs, expect further innovation and competition across the sector. Investors searching for yield in 2025 should monitor potential Fed moves and regularly review Capital One savings account rates against emerging fintech options to make the most of liquid cash assets.

Tags: Capital One, COF, savings account rates, fintech, high-yield savings