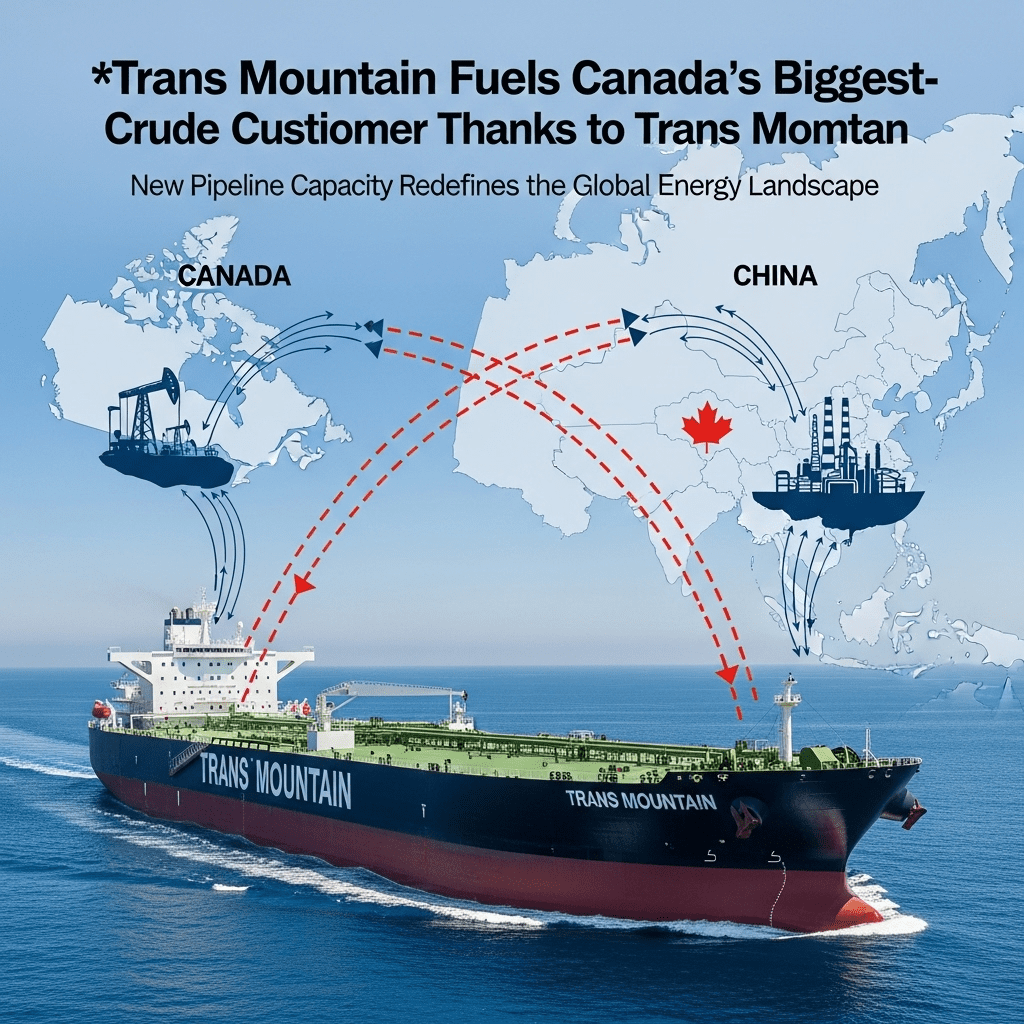

The global energy landscape is undergoing a significant transformation as China becomes Canada’s biggest crude customer thanks to Trans Mountain. With the recent expansion of the Trans Mountain pipeline, Canada’s oil sands are gaining unprecedented access to Asia’s largest economy, setting new records for crude exports and redefining Canada’s position in the global oil market.

How China Becomes Canada’s Biggest Crude Customer Thanks to Trans Mountain

Historically, Canadian crude exports were heavily reliant on the United States due to limited infrastructure options for reaching broader export markets. However, the completion and expansion of the Trans Mountain pipeline have been pivotal. The project, which now triples the original capacity to nearly 890,000 barrels per day, provides direct access from Alberta’s oil sands to the Pacific coast. This strategic gateway has enabled Canadian producers to target Asia-Pacific customers, with Chinese refiners leading the surge in demand for Canadian heavy crude.

According to 2025 export data, China now accounts for more than 30% of all Canadian overseas crude shipments, a sharp increase from pre-expansion figures. This new dynamic is changing price benchmarks and boosting Canadian producers’ revenues by offering access to global pricing rather than being constrained by regional U.S. markets and discounts. For energy investors, this shift creates a broader market context for Canada’s oil sector and encourages more robust capital inflows for both upstream development and infrastructure projects.

The Trans Mountain Expansion: A Game Changer for Canadian Oil

The Trans Mountain expansion was completed at a critical juncture, as global oil demand underwent recalibration in the wake of supply chain disruptions and geopolitical tensions. The $30 billion megaproject not only increases pipeline capacity but also provides essential redundancy and flexibility to Canadian exporters. The Port of Vancouver now serves as a major crude oil export hub, with frequent VLCC (Very Large Crude Carrier) loadings destined for China’s coastal refineries.

Chinese buyers are attracted to Canada’s heavy crude, known as Western Canadian Select (WCS), due to its price competitiveness and suitability for China’s complex refining sector. Amid shifting OPEC+ strategies, Canadian barrels are often priced below similar grades from the Middle East and Latin America, making them attractive for Asian importers seeking to diversify supply and optimize refining margins. This trend is expected to accelerate as China’s energy mix gradually transitions but remains heavily reliant on imported crude through the mid-2020s.

Implications for Canada’s Oil Industry and Global Energy Markets

China becomes Canada’s biggest crude customer thanks to Trans Mountain at a time when diversification is vital for Canadian oil exporters. The ability to tap into lucrative Asian markets has reduced the sector’s vulnerability to volatility in U.S. demand and pipeline bottlenecks. In addition, greater exposure to global crude benchmarks, such as Brent, supports stronger netbacks for Canadian producers and contributes to government revenues through higher royalties and taxes.

For the global energy market, this shift underscores Canada’s emerging role as a key exporter to non-U.S. destinations. By 2025, more than 40% of incremental Canadian export growth is projected to be absorbed by Asian buyers, primarily China. This has strategic implications for global supply chains, pricing, and the geopolitics of energy. While OPEC producers may feel increased competitive pressure, the move also presents opportunities for portfolio diversification and risk management across global energy investments.

ESG Concerns and Policy Considerations

The rising volume of Canadian crude heading to China also brings environmental, social, and governance (ESG) issues to the forefront. Investors and policymakers face renewed scrutiny over the carbon intensity of oil sands production and the environmental impacts of expanded tanker traffic along British Columbia’s coastline. While Canadian producers are advancing emissions reduction technologies and carbon capture initiatives, ongoing transparency and collaboration will be key to sustaining social license and long-term energy transition strategies.

Investment Outlook as China Becomes Canada’s Biggest Crude Customer Thanks to Trans Mountain

Energy sector analysts expect that China’s growing role as Canada’s largest crude customer will drive further capital expenditures in midstream and downstream assets, as well as upstream production. For investors seeking exposure to Canadian oil, opportunities span pipeline operators, integrated producers, and energy infrastructure funds. Monitoring trade data, policy shifts, and global energy demand cycles will be essential for crafting resilient investment strategies in light of this changing market landscape.

For those joining the sector, understanding how macroeconomic, regulatory, and ESG factors interplay in this unique Canada-China trade relationship could unlock substantial value. As always, staying informed with authoritative investment insights and ongoing market analysis remains crucial for navigating the complexities of the modern energy market.