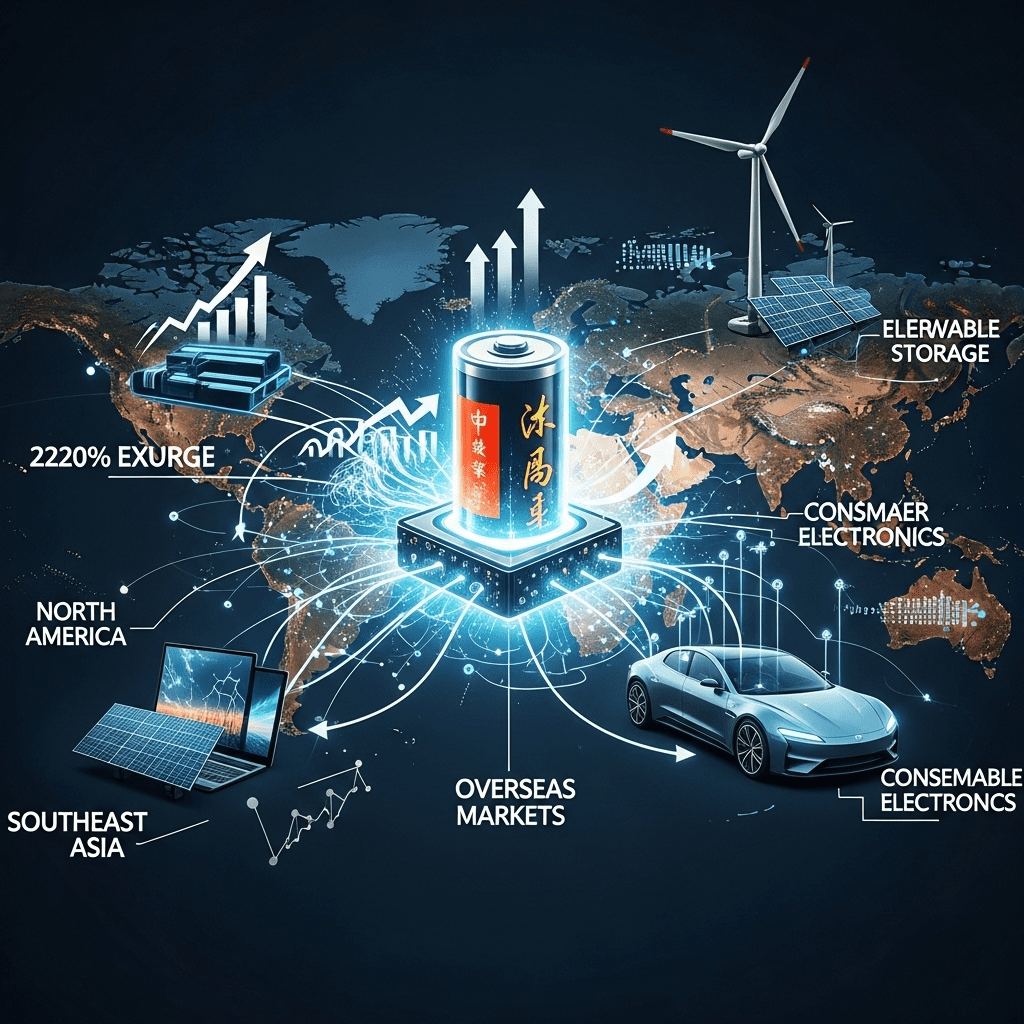

The global energy landscape is undergoing a seismic shift as China’s battery giants flood overseas markets. In 2025, Chinese battery exports surged an astounding 220%, triggering profound changes across the electric vehicle (EV), renewable energy storage, and consumer electronics sectors worldwide. This unprecedented expansion is cementing China’s leadership in battery technology, raising both lucrative investment opportunities and new strategic risks for global markets.

China’s Battery Giants Flood Overseas Markets: Causes of Explosive Export Growth

Chinese companies like CATL, BYD, and EVE Energy have leveraged advanced lithium-ion technology and massive production capacity to dominate battery manufacturing. The latest customs data indicates that battery exports from China reached nearly $80 billion in the first half of 2025, a record-breaking figure propelled by soaring overseas demand. This surge has been attributed to several key factors:

- Global EV Adoption: Electric vehicle sales expanded rapidly in Europe, Southeast Asia, and the Americas, driving a sharp increase in battery imports from China.

- Cost Leadership: Economies of scale and aggressive investments have allowed Chinese manufacturers to undercut international competitors, offering high-performing batteries at competitive prices.

- Supply Chain Security: Battery buyers worldwide have sought to diversify their supply sources, with Chinese suppliers providing consistent, large-scale output during periods of geopolitical upheaval.

The Competitive Edge: Technology and Scale

China’s battery industry benefits from sustained government support, deep local supply chains, and relentless innovation. Companies ramped up research and development spending by 18% year-over-year in 2025, focusing on next-generation chemistries such as lithium iron phosphate (LFP) and solid-state batteries. This R&D emphasis has delivered higher energy density, longer lifecycles, and greater manufacturing efficiencies—features increasingly demanded by EV makers and grid operators.

With factories churning out gigawatt-hours of capacity, Chinese giants are uniquely positioned to supply both global automakers and emerging energy storage projects, further cementing their market dominance. These developments open up attractive avenues for global portfolio diversification as investors seek exposure to the evolving energy value chain.

Global Repercussions as Chinese Battery Exports Surge 220%

The outsized role of China’s battery giants in international trade poses both opportunities and concerns. On one hand, access to affordable, high-performance batteries accelerates the worldwide transition to clean energy and sustainable transportation. For nations pursuing aggressive net-zero goals, imports from China offer a fast track to electrification and energy independence.

On the other hand, the rapid ascent of Chinese manufacturers creates new dynamics in trade policy and energy security. Western regulators increasingly scrutinize supply chain dependencies, leading to discussions around tariffs, local content requirements, and the reshoring of critical industries. These tensions could influence long-term market trends as governments and corporations strategize to balance cost savings with resilience and autonomy.

Impact on Investment and Industry Landscape

The 220% export boom is redrawing the competitive map for battery production worldwide. Markets such as the European Union, India, and North America are accelerating investments in domestic gigafactories to mitigate reliance on Chinese imports. Yet, for now, China retains a substantial technological and cost advantage that may persist for years, affecting stock valuations, supply contracts, and innovation pathways across the sector.

Investors are eyeing both potential winners and emerging risks in this landscape—from Chinese market leaders’ robust quarterly earnings to volatility in battery raw material prices. Technology transfer, joint ventures, and regulatory frameworks will likely define the next phase of cross-border competition and cooperation.

Outlook: What’s Next as China’s Battery Giants Expand Further?

The trajectory shows no signs of slowing. China’s battery giants flood overseas markets not only with physical products but also with technical know-how, joint manufacturing deals, and advanced R&D partnerships. Industry forecasts suggest global battery demand will double again by 2028, putting even greater focus on supply security and cost optimization.

For strategic investors, understanding China’s pivotal role in the battery value chain remains crucial. Monitoring policy developments, trade negotiations, and technology breakthroughs will be vital as the world’s energy transition accelerates. To stay informed of these shifts and their implications, access timely investment insights and market analysis across the energy sector.

Conclusion

China’s battery giants flooding overseas markets amid a 220% export surge has transformed global supply chains, sparked policy debates, and changed how the world powers transportation and storage. The coming years will test the resilience of this dominance and shape the future direction of the clean energy economy. Investors, policymakers, and industry leaders alike must navigate this watershed moment with a keen understanding of the evolving risks and unprecedented opportunities at stake.