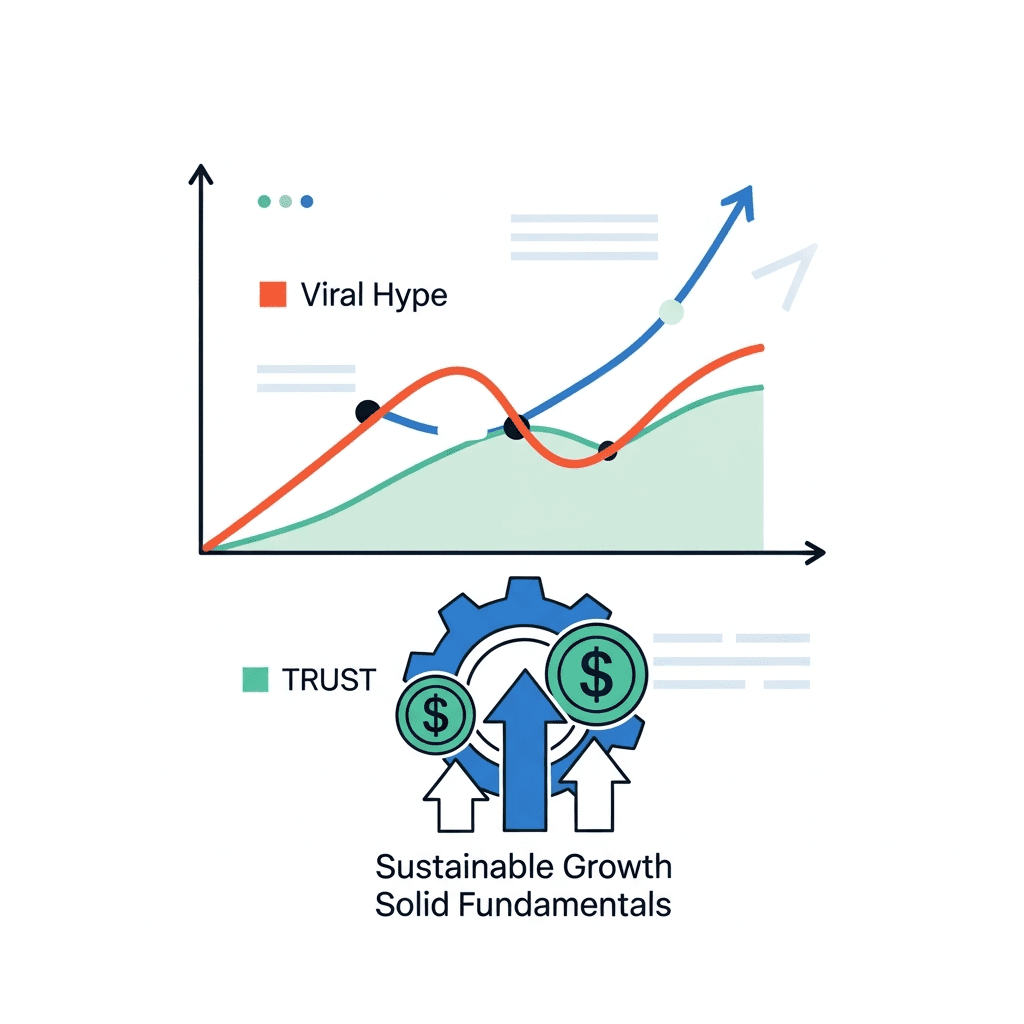

Cluely ($CLLY) CEO Roy Lee revealed that viral hype is not enough to ensure sustainable growth, despite $CLLY’s user base spiking 40% in the past quarter. Lee’s comments spark debate over the longevity of social-driven tech surges, generating uncertainty among investors watching Cluely’s meteoric rise.

Cluely’s Q3 Growth: 40% Surge Raises Viral Hype Questions

Cluely Inc. ($CLLY) reported a 40% quarter-over-quarter increase in its global active user base, climbing from 14 million in Q2 2025 to 19.6 million as of September 30, 2025, according to company filings. Despite shares soaring 28% year-to-date—trading at $74.20 on November 5—CEO Roy Lee emphasized in Tuesday’s earnings call that “viral traction must translate to tangible value” to safeguard long-term shareholder returns. Lee’s statement diverges from recent sector narratives championing social momentum as a stand-alone growth engine. Monthly revenue per user, however, only rose 5% over the same period, pointing toward potential monetization limits (Cluely Q3 Filing, Oct. 30, 2025).

Why Tech Sector Faces Scrutiny as Social-Driven Stocks Surge

The broader technology sector is experiencing high volatility as investors flock to companies with explosive user growth fueled by viral content, echoing fluctuations seen during the 2021-22 meme stock rallies. The NASDAQ Technology Index rose 17% YTD as of October 2025 but is now seeing scattered corrections in platforms whose engagement outpaces revenue gains (Bloomberg, Oct. 2025). According to a recent report by Deloitte (Q3 2025), nearly 60% of tech IPOs in the last 24 months attributed at least half their valuation gains to user growth, not profit metrics. Cluely’s warning may signal a sector-wide reassessment of how much weight viral hype deserves relative to fundamentals.

Investor Strategies as Tech Stocks Like $CLLY Rethink Growth Models

For investors, Cluely ($CLLY)’s pivot highlights a need to scrutinize the sustainability of stocks driven by short-term user influx. Active traders may seek to capitalize on volatility, but long-term investors are wise to evaluate fundamentals such as user monetization and retention rates instead of chasing viral momentum. ETF flows into the U.S. technology sector cooled, with net inflows declining 26% month-over-month in October 2025 (Morningstar data).

Portfolio managers balancing exposure to high-growth tech names are increasingly referencing stock market analysis and latest financial news to assess which companies can deliver post-viral profitability. As sector dynamics shift, understanding the difference between hype-fueled rallies and durable growth is vital for informed allocation—especially for funds overweight on trending tickers like $CLLY.

What Analysts Expect as Cluely Signals Shift from Pure Virality

Industry analysts observe that Cluely ($CLLY)’s messaging may spark a broader shakeout among digital platforms dependent on rapid viral adoption without solid monetization pathways. Several investment strategists at major firms suggest the market is entering a phase where operational metrics—ARPU, churn rates, and gross margins—will override user count as the key performance indicators. Market consensus as of early November 2025 points to increased sector rotation out of pure-play viral growth stocks in favor of companies with proven, recurring revenue streams.

Cluely Roy Lee Viral Hype Comments Signal New Focus for Tech Investors

Roy Lee’s assertion that viral hype is not enough puts new pressure on tech investors to prioritize sustainable business models. Going forward, market participants should watch for upcoming Q4 disclosures of revenue and user engagement data by Cluely ($CLLY) and peers. The focus keyphrase, Cluely Roy Lee viral hype, now frames an essential investor takeaway: watch for companies that convert attention into lasting value—not just fleeting momentum.

Tags: Cluely, CLLY, technology sector, viral hype, Roy Lee