Coinbase wants to bring the entire startup lifecycle onchain, according to CEO Brian Armstrong, signaling a strategic shift with the potential for profound market impact. The move, announced in 2025, positions Coinbase at the center of a growing effort to fuse blockchain infrastructure with global venture creation and fundraising.

What Happened

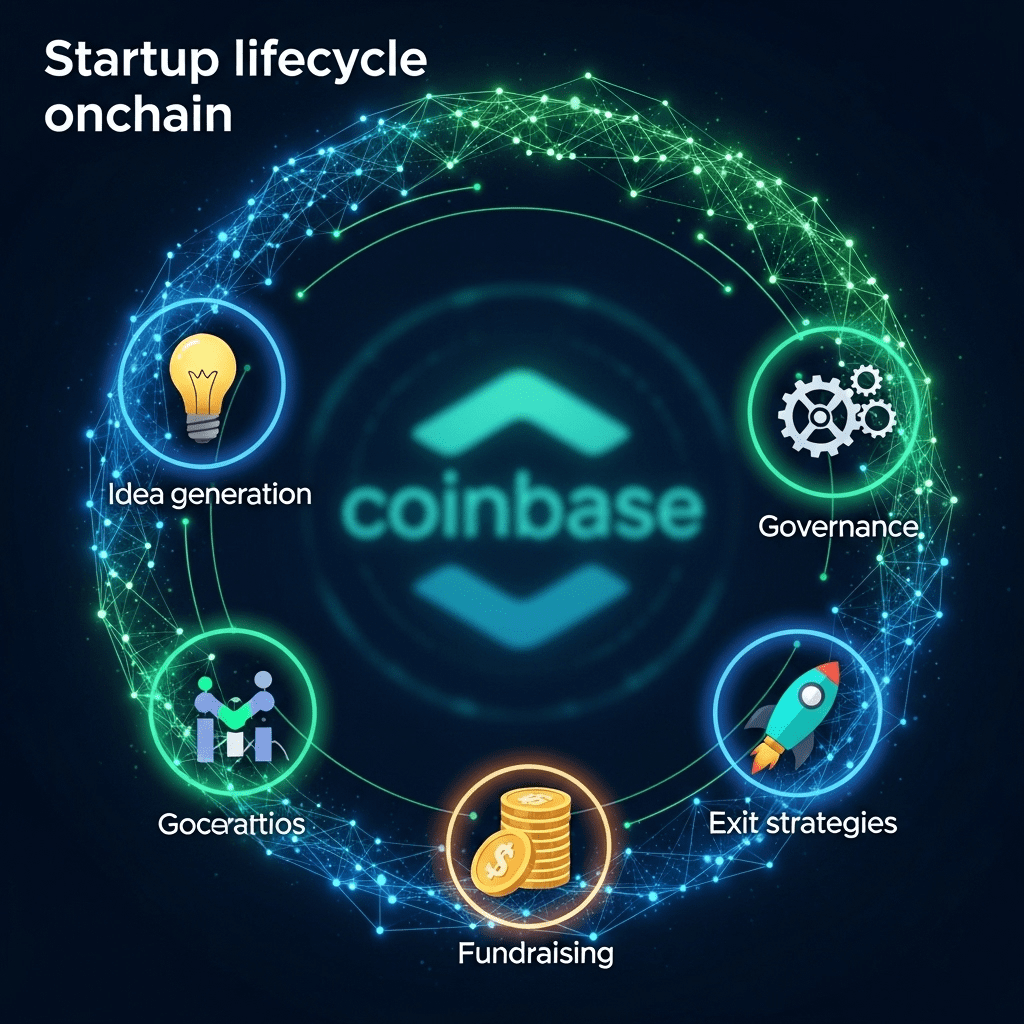

Coinbase wants to bring the entire startup lifecycle onchain, CEO Brian Armstrong told investors and the press at the company’s 2025 Summit. Armstrong described a vision where every phase—from idea generation to fundraising, governance, equity distribution, and even exit strategies—is managed transparently via blockchain-based protocols. “We believe building onchain is the most efficient, transparent, and trustworthy way for startups to operate,” Armstrong said, citing increased security and programmability as key drivers. According to Bloomberg, Coinbase (NASDAQ:COIN) has begun piloting core products for founders using decentralized frameworks, and transaction volumes on its Base network surged nearly 40% year-over-year as of Q1 2025 (source: Bloomberg; Coinbase Q1 2025 Shareholder Letter). With over 110 million verified users reported in its latest SEC filing and a rapidly growing Base ecosystem, Coinbase’s move reflects momentum behind blockchain-native corporate infrastructure.

Why It Matters

This announcement marks a pivotal moment not just for Coinbase, but for the intersection of venture capital, crypto infrastructure, and the wider technology sector. By proposing to onboard the entire startup lifecycle onto blockchain rails, Coinbase is targeting inefficiencies traditionally seen in private fundraising, equity distribution, and compliance. Historically, the VC sector has relied largely on closed networks and jurisdiction-based legal frameworks. In contrast, onchain solutions could open capital markets to global participants and real-time audits. According to Gartner, onchain corporate formation and fundraising are projected to grow by 55% in 2025 as regulatory clarity around tokenized securities improves. Early analyst commentary from Cowen suggests this could accelerate the migration of top-tier startup talent and capital flows toward public blockchains, echoing trends seen in decentralized finance (DeFi) since 2020.

Impact on Investors

The move carries significant implications for investors in Coinbase (COIN), the broader digital asset ecosystem, and even traditional startup backers. For Coinbase shareholders, expanding beyond trading fees into end-to-end startup services could diversify and stabilize future revenue. It may further entrench the company as a gateway not just for crypto trading, but for technology development and capital formation. Investors should consider risks including regulatory changes, execution uncertainty, and heightened competition as players like Binance and Circle also invest in onchain tools. As Mizuho Securities crypto strategist Alex Zhang put it, “If Coinbase’s onchain startup vision achieves scale, it could redefine how equity, governance, and liquidity are handled for a new generation of ventures – making the platform pivotal for Web3 entrepreneurship.” Sectors poised for secondary benefit include legal tech, compliance software, and venture SaaS. For more on sector-level analyses, refer to ThinkInvest’s market analysis and latest investment insights.

Expert Take

Analysts note that integrating the full startup lifecycle onchain could create new revenue streams and reinforce Coinbase’s position as a crypto infrastructure leader. Market strategists suggest that early adoption by founders and VCs will be key to broader market credibility. For related macro perspectives, read ThinkInvest’s crypto outlook reports.

The Bottom Line

Coinbase wants to bring the entire startup lifecycle onchain—a move that could transform venture funding, governance, and ownership models if it scales successfully. While regulatory hurdles and adoption risks remain, the strategic push signals a continued blurring of lines between traditional finance and blockchain technology. Investors should monitor pilot results and ecosystem uptake throughout 2025 as potential precursor indicators.

Tags: Coinbase, startup lifecycle, onchain, crypto news, blockchain innovation.