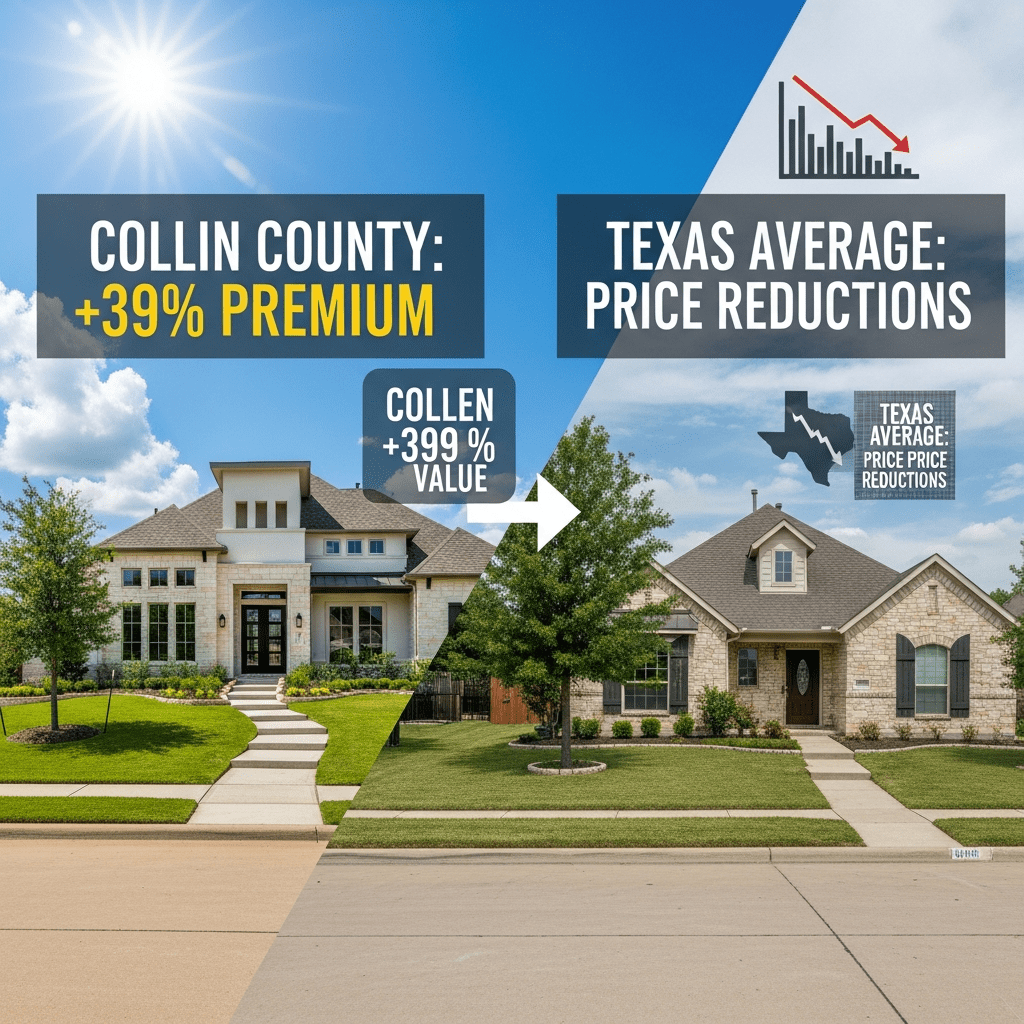

Collin County homes ($CCRE) secured a staggering 39% premium over the Texas state average in October 2025, as the focus keyphrase Collin County home price premium captures headlines—even as a majority of local sellers opt to cut prices. Why are values rising despite widespread price reductions? The data tells a complex story.

Collin County Home Prices Outpace Texas by 39% Despite Cuts

Median home sale prices in Collin County hit $540,000 in October 2025, a 2.3% year-over-year increase and a sharp 39% premium compared to the Texas statewide median of $388,000, according to Redfin data (October 2025 market update). However, 52.8% of active listings in Collin County reduced asking prices before selling—the highest percentage in five years. Transaction volumes slipped by 8% year-over-year, yet homes still moved twice as fast as the Texas average, averaging just 22 days on market compared to the state’s 44 days (Texas Real Estate Research Center, October 2025).

How Collin County’s Housing Premium Impacts Texas Real Estate

The steep Collin County home price premium signals diverging regional dynamics within Texas’ housing market. Strong in-migration, high average household incomes, and robust corporate relocations to the Dallas-Fort Worth metro area underpin continued demand at the upper end. Meanwhile, mid-tier and entry-level homes face greater resistance, leading to a higher percentage of price reductions. Across Texas, existing home sales fell 6% year-over-year in Q3 2025, pushed down by elevated mortgage rates and local affordability challenges (Texas Real Estate Research Center). These shifts suggest Collin County’s premium is sustained by a select segment even as broader state trends cool.

Investor Strategies as Collin County’s Market Diverges from Texas

Investors adapting to the Collin County home price premium should focus on supply-driven micro-markets where demand pressures remain strongest, particularly near major employment hubs and new tech campuses. Risks include potential price corrections if higher reductions signal stalling demand outside luxury segments. Short-term rental operators may benefit as buyers postpone purchases amid affordability concerns. Monitoring stock market analysis for large cap builders active in the region and latest financial news on regional development incentives can help investors spot new catalysts. Rental demand and landlord leverage are both increasing in Collin County, according to local MLS data for Q3 2025.

What Analysts Expect Next for North Texas Housing Premiums

Industry analysts observe that Collin County’s persistent premium over Texas reflects enduring structural advantages—including education, amenities, and corporate migration—but caution that elevated mortgage rates could temper buyer enthusiasm if job growth slows. Data from National Association of Realtors (October 2025) indicates investors remain positive on DFW-area commercial and residential portfolios, though rising price cuts are seen as early signs of cooling rather than a crash.

Collin County Home Price Premium Signals New Era for Investors

The Collin County home price premium is likely to persist into 2026 as population inflows and supply constraints offset market cool-down elsewhere in Texas. Investors tracking Collin County home price premium should monitor signals of demand resilience—including days on market and rental absorption. Expect micro-market strategy and ongoing price segmentation to shape returns next year as Texas housing adjusts.

Tags: Collin County, North Texas real estate, home price premium, Texas housing market, $CCRE