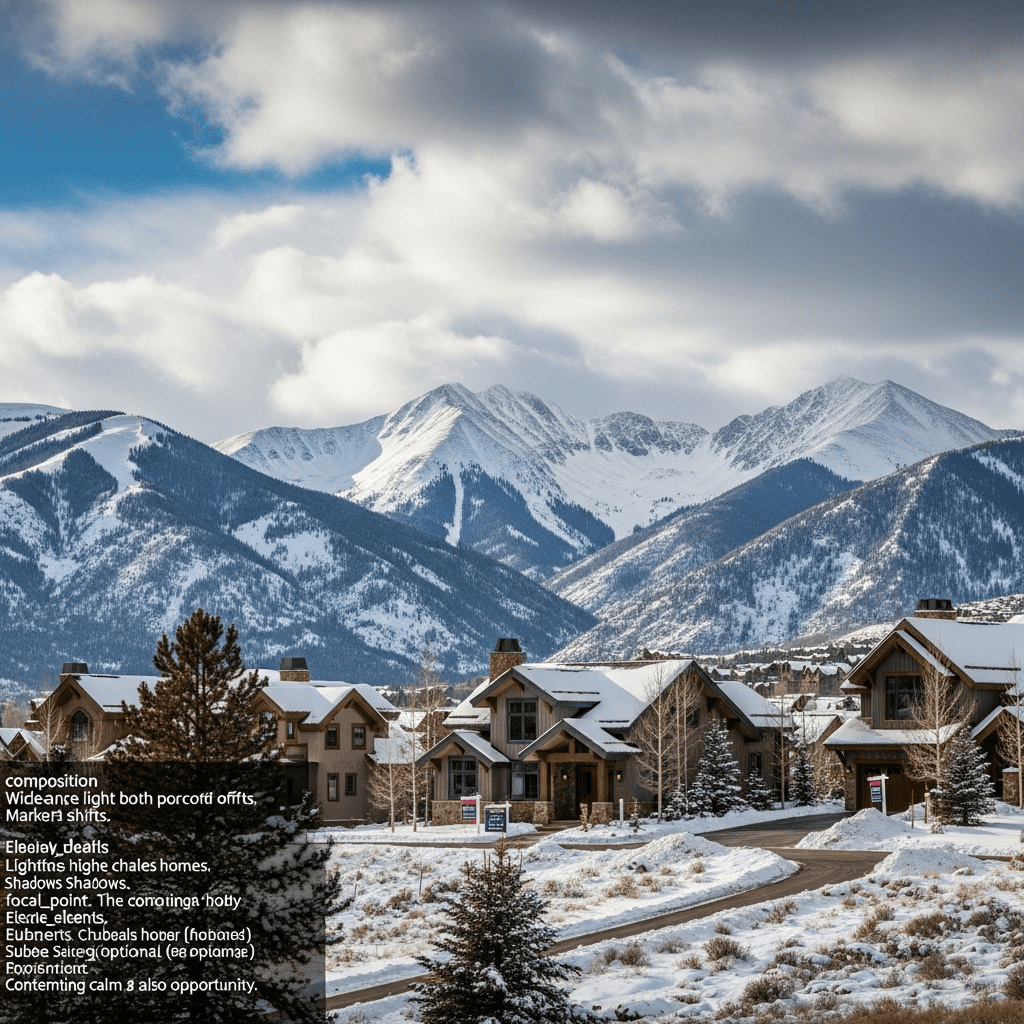

The Colorado housing market sees wider price cuts ahead of ski season, signaling a notable shift in buyer-seller dynamics across key mountain towns and urban corridors. As the fall transitions into winter, real estate professionals and investors are watching closely to determine how these price adjustments will influence the market outlook for 2025.

Colorado housing market sees wider price cuts ahead of ski season: What's driving the trend?

Over the past several years, Colorado’s real estate sector has experienced unprecedented growth fueled by pandemic relocations, high demand for vacation homes, and persistent low inventory. However, the 2025 season brings a cooling effect, with the Colorado housing market seeing wider price cuts ahead of ski season—a trend that is already having implications for buyers, sellers, and investors.

Several factors are converging to prompt these price reductions. Rising mortgage rates in late 2024 have reduced affordability, causing many would-be buyers to pause their home search. Moreover, a surge in new listings—especially in ski towns like Aspen, Vail, and Breckenridge—has led to increased competition among sellers. Homeowners are eager to close deals before winter weather limits showings and before a fresh wave of listings arrives with spring’s demand. As a result, average days on market are lengthening, and sellers are turning to price reductions as a strategic move to attract offers.

Impacts on Key Mountain and Urban Markets

In September and October, MLS data shows price reductions on approximately 25–30% of active listings in Colorado’s mountain resort communities. The impact is significant in towns where luxury inventory once commanded bidding wars; now, second-home buyers exercise greater caution, emboldened by lower negotiating pressure. Even in Denver and Boulder, the market is seeing a similar trajectory—a correction that is returning negotiating power to buyers for the first time in years.

What This Means for Buyers and Sellers

The fact that the Colorado housing market sees wider price cuts ahead of ski season presents unique opportunities, particularly for savvy investors and primary residence buyers. For buyers, increased inventory and more realistic pricing allow for thorough due diligence, more room for negotiation, and the chance to find value in previously overpriced neighborhoods. Timing a purchase close to ski season can offer additional leverage, as sellers must decide whether to accept a lower offer or wait until spring—and potentially face more competition.

Sellers, meanwhile, are advised to adjust their expectations. Instead of chasing peak pandemic-era valuations, today's homeowners should focus on competitively positioning their listings, which may include cosmetic upgrades, pricing to market, and flexible terms. Those who adapt to the new environment are more likely to find success before listings go stale during the winter lull.

Investment Insights: How to Capitalize as Colorado Housing Market Sees Wider Price Cuts Ahead of Ski Season

For investors eyeing the Colorado real estate space, these seasonal price cuts open strategic windows. By monitoring market trends and leveraging investment insights, buyers with strong financing can negotiate significant discounts, particularly on properties that have lingered on the market. Ski rental properties typically rebound come peak season, offering dual advantages of lower entry prices now and robust rental demand later.

Broader Economic and Policy Context

The current trend in which the Colorado housing market sees wider price cuts ahead of ski season also reflects broader national dynamics. Persistent inflation, uncertainty about Federal Reserve policy, and increased property taxes in some counties contribute to an environment of caution for both buyers and sellers. Accessing real-time market intelligence and property market news is more important than ever for stakeholders anticipating future shifts.

Looking Ahead: What to Expect for 2025

Most analysts agree that while the ski season may serve as an inflection point, a sustained buyer’s market depends on interest rates, job growth, and regional population trends. If economic headwinds persist, further price adjustments could continue into spring and summer 2025. Real estate professionals recommend monitoring local trends and staying updated with financial planning strategies to navigate the evolving landscape.

In summary, as the Colorado housing market sees wider price cuts ahead of ski season, the balance of power shifts, and new opportunities—along with risks—emerge on both sides of the transaction. Whether entering the market as a buyer, seller, or investor, informed decision-making will be critical in the months ahead.