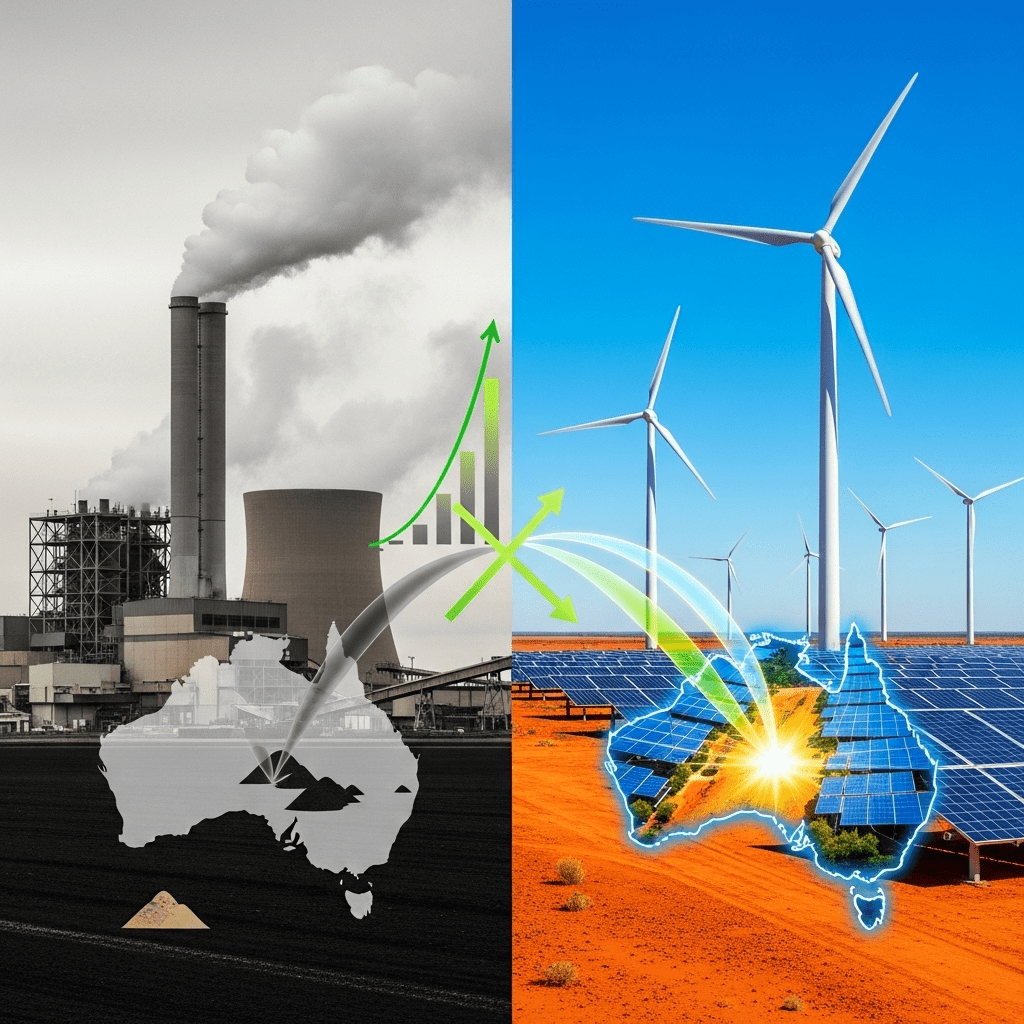

In a landmark development for sustainable energy, electricity from renewables overtakes coal in Australia for the first time, signaling a paradigm shift in the country’s power sector and opening new avenues for investors and policy-makers alike.

Electricity from Renewables Overtakes Coal in Australia: The Turning Point

The 2024-2025 financial year marks a significant milestone: for the first time ever, renewable energy sources—including solar, wind, and hydro—have generated more electricity than coal-fired plants across Australia. According to recent data published by the Australian Energy Market Operator (AEMO), renewables supplied 36.7% of the country’s electricity, surpassing coal’s 32.5%. This change is not only a testament to Australia’s rapid clean energy transition but also a crucial indicator for institutional investors seeking diversification strategies in the evolving energy market.

Drivers of the Renewable Surge

Several factors have contributed to this record-breaking shift. Utility-scale solar and wind projects expanded at an unprecedented rate throughout 2024, boosted by strong policy incentives and private capital inflows. Rooftop solar has also taken off; over three million Australian homes now feature photovoltaic panels, making Australia one of the world’s leaders in solar adoption per capita.

Simultaneously, aging coal-fired power stations have struggled with frequent outages and economic viability due to rising maintenance costs and increasing carbon pricing. The closure of major coal plants, such as Liddell and Callide, further accelerated the trend, cementing renewables as the grid’s backbone.

Investment Implications as Electricity from Renewables Overtakes Coal in Australia

The ascendance of renewables has far-reaching implications for investors. The clean energy transition is creating opportunities in ancillary sectors, such as energy storage, grid infrastructure, and green hydrogen. The Australian government’s $20 billion Rewiring the Nation plan, for example, aims to modernize transmission networks, opening the door to new infrastructure partnerships and long-term growth opportunities.

Impact on Energy Prices and Market Volatility

Historically, Australia’s reliance on coal made its power sector vulnerable to global commodity price swings. The increased share of renewables, with negligible marginal generation costs, has helped stabilize wholesale electricity prices, benefiting both businesses and consumers. However, the variability of wind and solar output presents new challenges for grid operators, necessitating robust storage solutions and advanced forecasting powered by artificial intelligence.

Policy and Regulatory Support Underpins the Shift

The federal and state governments have played a central role in supporting renewable uptake. Ambitious Renewable Energy Targets (RETs), tax incentives for green projects, and investment in storage technologies have created a fertile ground for innovation and financial backing. Major superannuation funds and global investors are now targeting large-scale solar and wind assets as part of their sustainable portfolio allocations.

Australia’s Position in the Global Renewable Landscape

Australia’s breakthrough comes as global competition for clean energy investment intensifies. The country’s abundant sunshine, wind corridors, and advanced regulatory environment position it as a leader in renewable energy exports, particularly green hydrogen and critical minerals used in battery manufacturing. As electricity from renewables overtakes coal in Australia, international analysts are watching closely, with the nation serving as a model for others seeking to reduce emissions while maintaining grid reliability.

The Road Ahead: Challenges and Opportunities

Despite the positive trajectory, several challenges remain. Integrating high levels of intermittent renewables requires accelerating grid upgrades, deploying utility-scale batteries, and fostering demand-side management. Nevertheless, the current trend is expected to continue: industry experts predict renewables could supply over 50% of electricity by 2030, reducing reliance on imported fossil fuels and ensuring more resilient energy systems.

For financial professionals and energy analysts, the message is clear: as electricity from renewables overtakes coal in Australia, long-term value lies in digital infrastructure, innovative storage solutions, and ESG-aligned assets. Sound due diligence and proactive engagement with policymakers will be essential for capitalizing on this unprecedented energy transformation.