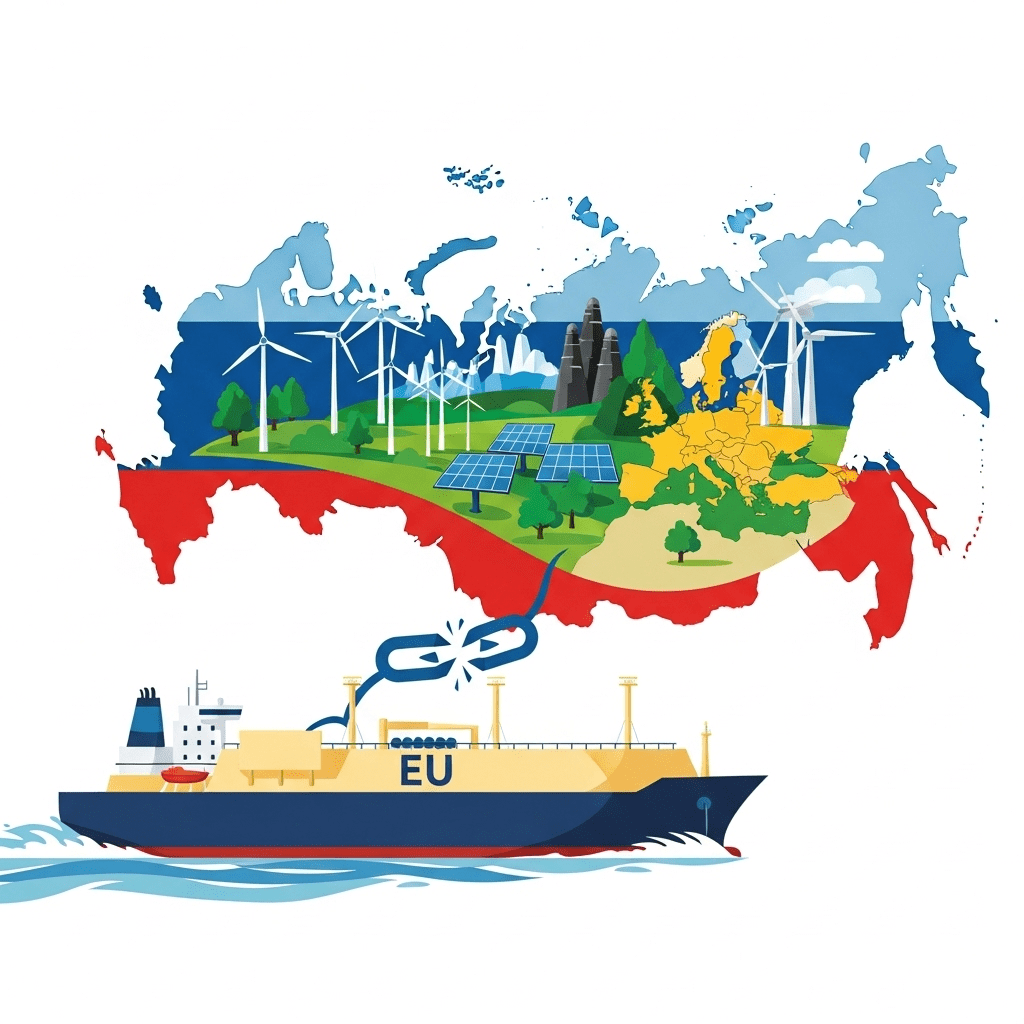

The announcement that the EU includes Russian LNG import ban in 19th sanctions package marks a significant escalation in Europe’s ongoing response to geopolitical tensions with Russia. As liquid natural gas (LNG) has become an increasingly vital segment of international energy trade, this latest round of sanctions targets a critical revenue stream for Russia while forcing European energy markets to adapt and diversify. The implications of these measures are broad, affecting investors, energy companies, and global supply chains as the region navigates an evolving landscape in 2025.

EU Includes Russian LNG Import Ban in 19th Sanctions Package: What Does It Mean for Energy Markets?

The decision by the European Union to ban imports of Russian LNG in its 19th sanctions package sends a strong message about the bloc’s commitment to tightening economic restrictions. Until now, while oil had been under strict sanctions, Russian LNG continued to flow to Europe, serving as a critical buffer during winters and supporting grid stability.

With this new measure, European importers are now barred from signing new Russian LNG contracts, and existing agreements are under intense scrutiny. These sanctions are expected to affect not just immediate energy supplies but also influence long-term investment strategies and infrastructure planning across the continent.

The Rationale Behind Targeting Russian LNG

Russian LNG exports to Europe accounted for roughly 15% of Europe’s total LNG imports in 2024, according to data from the International Energy Agency (IEA). The EU’s calculus in targeting LNG is grounded in both geopolitical strategy and energy security. Officials view LNG as a key financial inflow for Russia’s economy, while at the same time recognizing the vulnerability of European energy supplies to disruptions.

While earlier sanction rounds left LNG largely untouched for practical reasons, the EU now judges renewable capacity and alternative gas sources as sufficiently developed to withstand potential shocks. This aligns with wider European objectives of reducing dependence on Russian energy and fostering closer ties with suppliers from the United States, Qatar, and Norway.

Impact on Global Gas Prices, Energy Security, and Investments

The move that the EU includes Russian LNG import ban in 19th sanctions package is poised to generate immediate volatility in European gas markets. Forward contracts for LNG delivery have already shown price fluctuations as traders digest the sanctions’ likely impact. Industry analysts suggest that the ban may drive spot prices upward in the short term, especially if unforeseen supply hiccups occur during peak demand seasons.

For energy security, the shift puts additional pressure on European governments to ramp up investments in renewables, storage, and LNG regasification terminals adapted for non-Russian supplies. Investors are closely monitoring developments to assess risk exposure in European utilities and exporters facing the loss of Russian contracts. Additionally, global LNG suppliers may see new opportunities to enter the European market and secure long-term offtake agreements, potentially spurring further energy infrastructure upgrades.

Russia’s Response and Broader Geopolitical Repercussions

The Kremlin has condemned the EU’s latest sanctions, warning that further economic pressure could prompt countermeasures, including halting pipeline gas flows. Russian energy firms are likely to redirect more LNG loads to Asian markets, solidifying trade links with China and India while potentially accepting less favorable terms. Geopolitical experts warn that energy trade realignments will have ripple effects on global shipping, insurance costs, and the broader stability of energy markets.

Meanwhile, European authorities are working to reassure consumers that energy supplies will remain stable. Emergency stockpiling and new interconnection projects are being reviewed to cushion the impact of reduced Russian imports. The policy is intended not only to weaken Russia financially but also to accelerate Europe’s shift to net-zero emissions and bolster resilience against future supply disruptions.

Strategic Considerations for Investors Amid Sanctions and Market Volatility

For financial professionals and institutional investors, the fact that the EU includes Russian LNG import ban in 19th sanctions package presents both risks and strategic openings. Volatility in European gas prices may create opportunities for funds specialized in energy trading or alternative infrastructure. Companies positioned in renewable generation, energy storage, and North American or Middle Eastern LNG exports stand to benefit from shifting demand dynamics.

Portfolio managers will need to monitor how utilities and industrial buyers renegotiate long-term supply deals and manage exposure to spot market fluctuations. Additionally, regulatory developments in the EU energy sector—including incentives for green hydrogen and electrification—are expected to accelerate, presenting further avenues for sustainable finance and clean energy investments.

Looking Ahead: EU Energy Independence and Changing Trade Patterns

As the 19th sanctions package takes effect, the EU’s stance sets a new precedent for energy independence and global alignment. The ability of European markets to absorb these shocks—and attract investment into cleaner, diversified energy infrastructure—will prove critical for long-term stability. Meanwhile, the world will watch closely how Russian exports adapt to new realities and how energy geopolitics shifts in the years to come.

In sum, the EU’s latest move—by including Russian LNG in its growing list of sanctioned commodities—underscores the intertwining of energy security, international finance, and geopolitical strategy in today’s complex global economy.