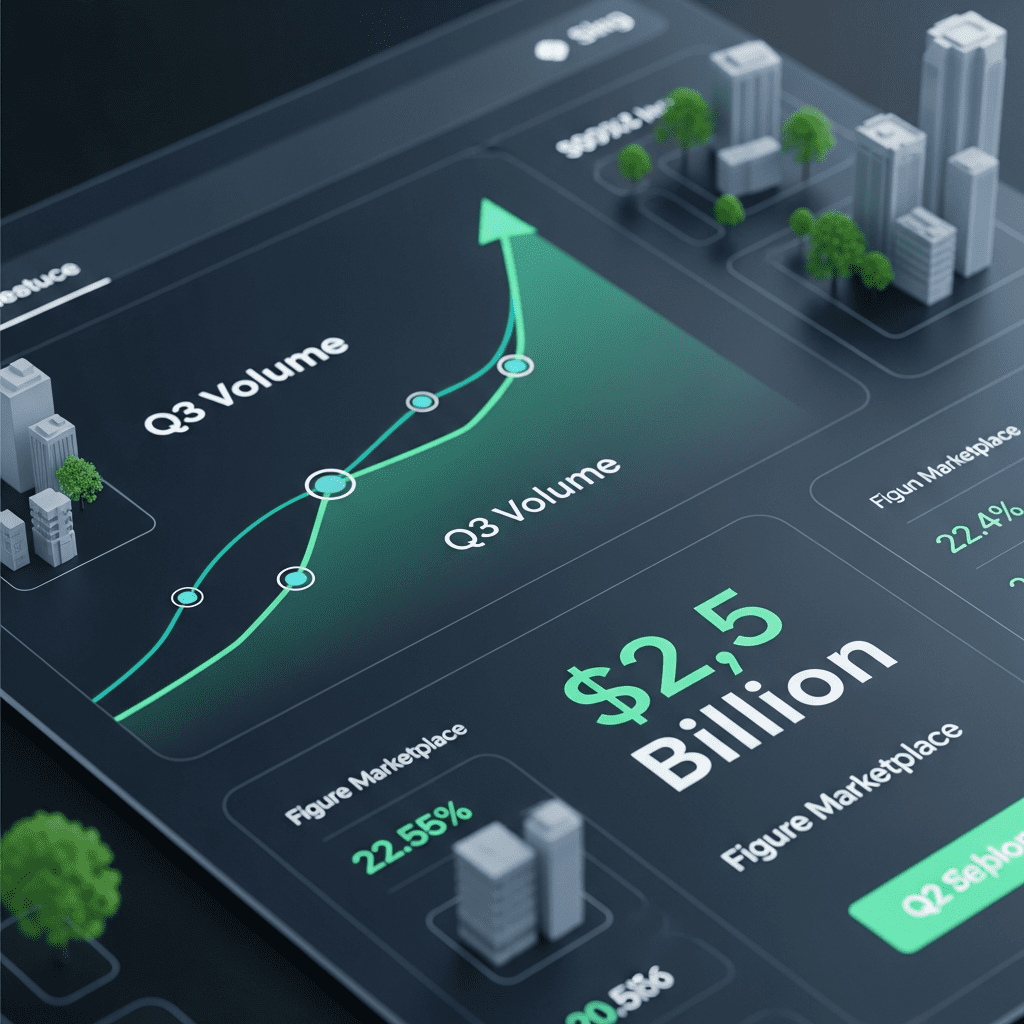

Figure Technologies ($FIGR) revealed its marketplace posted a surprising $2.5 billion in Q3 transaction volume, outpacing forecasts and cementing the platform’s status among digital real estate leaders. With Figure marketplace Q3 volume hitting record levels, investors and analysts are asking what’s fueling this acceleration—and how it reshapes the sector.

Figure’s $2.5B Q3 Marketplace Volume Sets New Industry Benchmark

In its November 2025 disclosure, Figure Technologies ($FIGR) announced a Q3 marketplace volume of $2.5 billion—up 38% from $1.8 billion in Q2 2025 and more than double its year-ago performance. The company attributed this growth to increased institutional adoption, with over 60% of Q3 trades executed by asset managers and REITs, according to company figures published November 15. Average transaction size climbed to $4.2 million, marking a 17% quarter-over-quarter increase. Bloomberg data confirms Figure’s platform now accounts for 9% of all digital real estate settlements in the U.S., compared to just 4% in late 2024.

Why Real Estate Market Liquidity Is Shifting in 2025

The surge in Figure marketplace Q3 volume highlights a broader re-pricing of real estate market liquidity as digital settlement adoption accelerates. According to a September 2025 CBRE report, total U.S. commercial property transactions rose 12% year-over-year, even as traditional brokered deals stagnated. Fractionalization and tokenization—cornerstones of Figure’s platform—are lowering entry barriers, enabling a wave of institutional and non-traditional capital to participate. Simultaneously, persistently high interest rates and tighter credit have motivated sellers to seek marketplaces offering faster clearing times. As more deals migrate to digital rails, market participants expect continued pressure on legacy settlement models.

How Investors Can Capitalize on Digital Real Estate Trading Surge

Investors seeking to benefit from the expansion of Figure Technologies ($FIGR) and similar marketplaces should monitor a mix of liquidity-focused real estate trusts, REIT ETFs, and fintech infrastructure providers. Traders positioned in sector ETFs such as the iShares U.S. Real Estate ETF ($IYR) may find diversification benefits as digital settlements dilute traditional cycles. Asset managers, meanwhile, face new risks from integration bottlenecks and regulatory uncertainty, especially as trading volumes migrate off-exchange. For those following investment strategy shifts across real estate and latest financial news, Figure’s performance points to rapid evolution. As always, thorough due diligence remains key with novel asset issuance and post-trade protocols evolving rapidly.

What Analysts Expect Next for Real Estate Tokenization Leaders

Industry analysts observe that Figure Technologies ($FIGR) is likely to remain a bellwether for digital real estate markets as more platforms enter the space. Many expect further double-digit growth in transaction volumes if institutional adoption momentum continues, with funding rounds and M&A activity tracked closely by sector specialists. Investment strategists note the importance of regulatory developments and interoperability milestones as key differentiators for platform valuations through 2026.

Figure Marketplace Q3 Volume Signals Accelerating Sector Shift

Figure marketplace Q3 volume has set a new digital real estate standard, spotlighting the rapid transformation underway. Investors should watch for additional volume disclosures, changing liquidity patterns, and regulatory responses. As digital settlement platforms like Figure alter competitive dynamics, the shift is poised to intensify—and early movers may have an outsized edge in this evolving market landscape.

Tags: Figure Technologies, FIGR, real estate marketplace, digital assets, Q3 volume