Fire Erupts at Chevron Refinery in California—an event that has sent shockwaves through the energy industry, rekindling urgent questions about refinery safety, environmental safeguards, and regional energy supply. In this in-depth report, we examine the incident’s immediate effects, explore regulatory and operational ramifications, and assess what this means for California’s energy landscape as the state moves deeper into 2025.

Incident Overview: Fire Erupts at Chevron Refinery in California

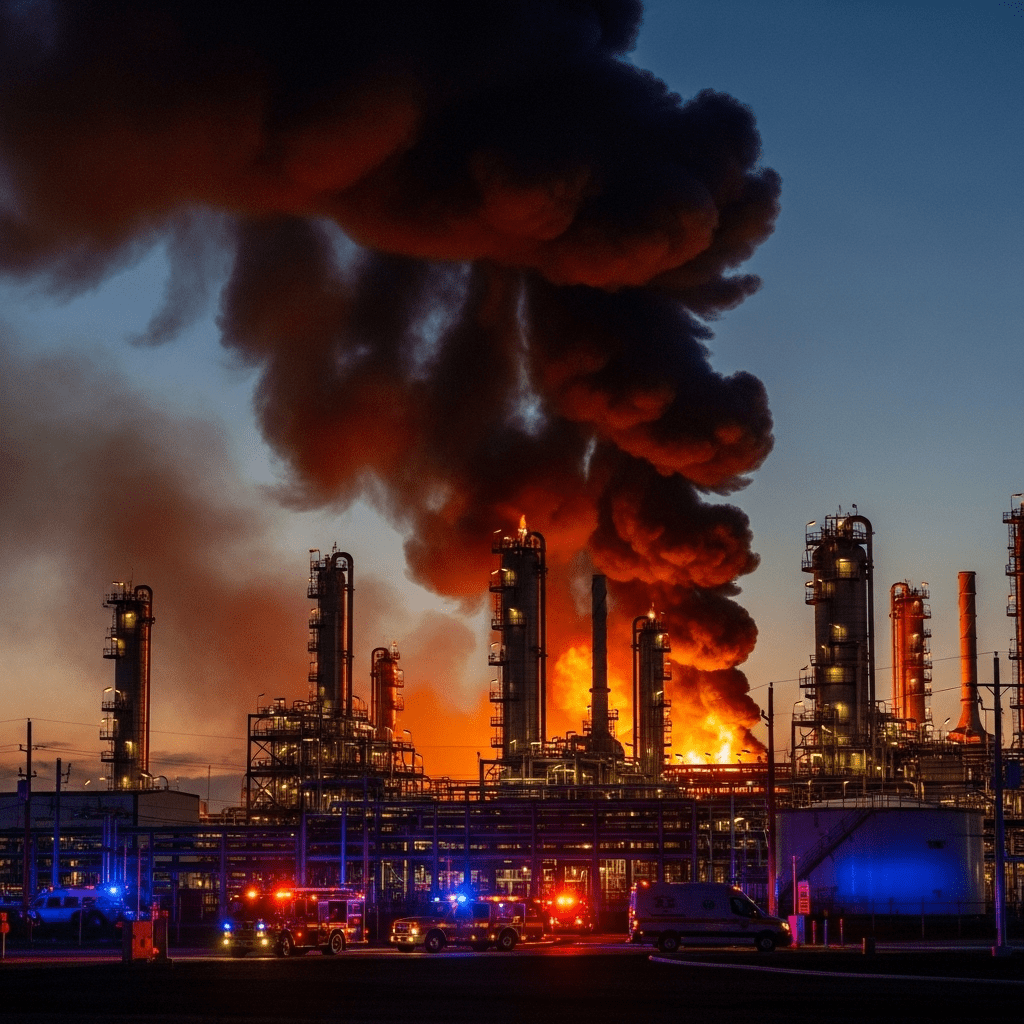

On a brisk morning in early June 2025, emergency alarms blared as a fire erupted at the massive Chevron refinery located in Richmond, California. First responders raced to the scene as thick smoke billowed over the Bay Area. According to preliminary reports, the blaze began in the crude distillation unit, a critical hub of the refinery’s operations. Chevron officials quickly instituted emergency protocols, evacuating personnel and initiating containment measures.

The cause of the fire is currently under investigation, with early speculation centering on mechanical failure within processing equipment. The incident compelled local authorities to issue shelter-in-place advisories to surrounding communities, reflecting the seriousness of the situation. Thankfully, early statements from Chevron indicate that injuries were minimal, thanks in large part to the facility’s rigorous emergency preparedness procedures. For ongoing updates and perspectives on the energy sector, visit ThinkInvest.

Operational and Market Impacts for California’s Energy Sector

The Chevron refinery in California is among the state’s most significant petroleum processing hubs, supplying both Northern and Southern California with gasoline, diesel, and jet fuel. The fire’s immediate aftermath saw refinery operations curtailed, and several processing units taken offline for evaluation and repairs.

This supply disruption created volatility in the regional fuel market. Spot gasoline prices surged by as much as 7%, with supply chain analysts forecasting continued price pressures in the days ahead. Distributors and retail fuel providers scrambled to secure alternate supplies from neighboring states and the Gulf Coast. Meanwhile, the California Energy Commission reiterated the importance of energy resilience and diversification in response to such emergencies.

Impact on Regional Infrastructure

With the Chevron refinery temporarily offline, California’s intricate energy infrastructure faces new strain. The incident exposes vulnerabilities in the state’s heavy reliance on a handful of major refineries for daily fuel consumption. Power providers and transit authorities closely monitored fuel reserves, wary of disruptions to public transportation and emergency response fleets. For those tracking market trends, detailed analysis is available at ThinkInvest.

Environmental Considerations and Community Response

Whenever a fire erupts at a Chevron refinery in California, environmental advocates and local residents raise concerns about air quality, water contamination, and long-term ecological effects. Monitoring stations recorded heightened levels of particulate matter and volatile organic compounds in the immediate vicinity of the blaze.

Chevron swiftly launched environmental mitigation efforts, deploying air filtration units and working in tandem with state and federal agencies to contain runoff and minimize atmospheric impacts. Community leaders called for more rigorous oversight and proactive investment in sustainable refinery technology to prevent future incidents.

Lessons in Risk Management and Public Safety

This latest fire reignites scrutiny over refinery safety protocols across the Golden State. Despite advances in digital monitoring, predictive maintenance, and automation, complex facilities like Chevron’s Richmond site remain susceptible to rare but significant accidents. Industry experts argue that robust compliance regimes, comprehensive worker safety training, and transparent communications are indispensable in minimizing both human and environmental risks.

Regulatory Oversight and Industry Adaptation

In response to the fire, California regulators have pledged thorough investigations and potential revisions to existing safety regulations. Agencies such as Cal/OSHA and the California Environmental Protection Agency have dispatched inspection teams to assess both the proximate causes of the incident and Chevron’s ongoing response. Discussions around stricter emission standards, enhanced worker protections, and modernization of refinery infrastructure have gained momentum in the state legislature.

This event may accelerate existing efforts to transition California’s energy mix away from traditional petroleum products. Policymakers, investors, and community organizations are watching closely, advocating for greater investment in renewable energy and resilient supply chains. Insightful commentary on these evolving policy trends can be found through ThinkInvest.

Looking Ahead: California’s Path to Energy Resilience

While the “fire erupts at Chevron refinery in California” headline underscores the inherent risks in the state’s fossil fuel infrastructure, it also shines a light on the adaptability and resilience of local communities and the broader energy sector. In the coming months, refinery safety audits and recovery efforts will play out against a backdrop of rising consumer dependence on alternative fuels and electricity.

As California continues to chart its forward trajectory toward sustainability, ongoing vigilance, regulatory innovation, and transparent public dialogue will be essential. The Chevron incident serves as a crucial learning opportunity—for industry leaders, policymakers, and everyday citizens—reminding all stakeholders of the importance of balancing operational imperatives with social and environmental responsibility.