Florida Realtors ($FLREALTORS) announced a new bilateral agreement with the Japan-America Real Estate Coalition, unveiling $1.2 billion in cross-border property transactions this quarter. The Florida Realtors Japan real estate ties stunned analysts with the rapid surge, hinting at deeper international investment streams in 2025.

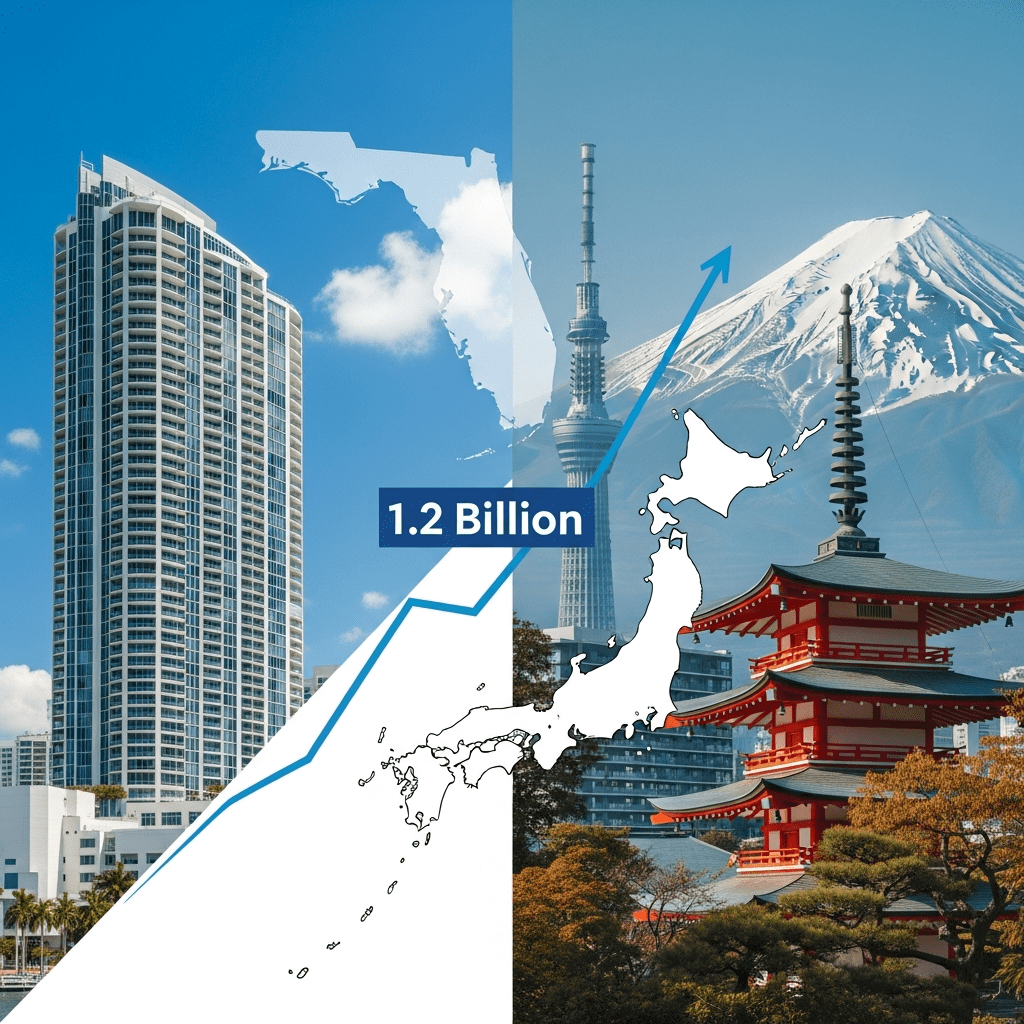

Florida-Japan Property Alliance Drives $1.2B in Q3 Deals

In October 2025, Florida Realtors ($FLREALTORS) and the Japan-America Real Estate Coalition formalized an agreement directed at expanding investment flows and knowledge exchange between markets. Initial disclosures reveal $1.2 billion in new cross-border transactions in Q3 2025 alone, according to data from JAREC. The volume represents a 38% year-over-year increase compared to Q3 2024, when international transactions totaled $870 million. According to Florida Realtors’ official statement, commercial assets made up over 60% of deal value, with Miami and Orlando ranking as prime destinations for Japanese institutional buyers.

International Investment to Florida Real Estate Surges in 2025

This alliance signals a broader expansion in international inflows to Florida’s real estate sector. Data from the National Association of Realtors (NAR) shows that foreign buyers accounted for 10.2% of Florida’s $142.7 billion in residential sales in the 12 months through August 2025. Japanese buyers moved up to the fourth-largest foreign investor group, more than doubling their transaction volume since 2022. Factors such as the strong dollar-yen differential and favorable U.S. commercial property yields—averaging 6.2% in core Florida submarkets per CBRE—are driving this shift.

Investor Strategy: Risk, Rewards, and New Portfolio Positioning

For investors watching the Florida-Japan real estate corridor, the expansion creates new portfolio diversification avenues. Long-term investors may seek exposure to prime retail and multifamily assets, where Japanese demand is outpacing supply—Colliers data reports a 22% rise in Japanese-backed acquisition offers in Florida since January. However, risks remain: currency fluctuation and U.S. interest rate trends could alter cap rate spreads rapidly. Active traders and institutional allocators tracking these developments may find actionable updates in latest financial news and broader stock market analysis on international capital trends. Understanding seasonal transaction cycles—typically peaking in Q1 and Q3—could further optimize entry timing.

Analysts See Sustainable Cross-Border Property Demand Growth

Industry analysts observe that the Florida-Japan coalition formalizes what has been a growing trend in Asian outbound real estate capital. According to a CBRE MarketWatch report published September 2025, rising Japanese pension fund allocations to U.S. commercial property remain resilient despite global rate volatility. Market consensus suggests that sustained policy support and continued yield premium in Florida versus other Sun Belt states will keep international demand elevated in the near term.

Florida Realtors Japan Real Estate Ties Signal Global Capital Shift

The expansion of Florida Realtors Japan real estate ties highlights a continued tilt of global capital toward U.S. Sun Belt markets. Investors should monitor Q4 deal data for signs of increased portfolio flows and track potential regulatory or currency factors that could alter return profiles. Cross-border collaboration is set to remain a defining trend for 2025’s real estate market landscape, offering both risks and unique growth opportunities for diversified investors.

Tags: Florida Realtors, JAREC, cross-border real estate, international investment, property markets