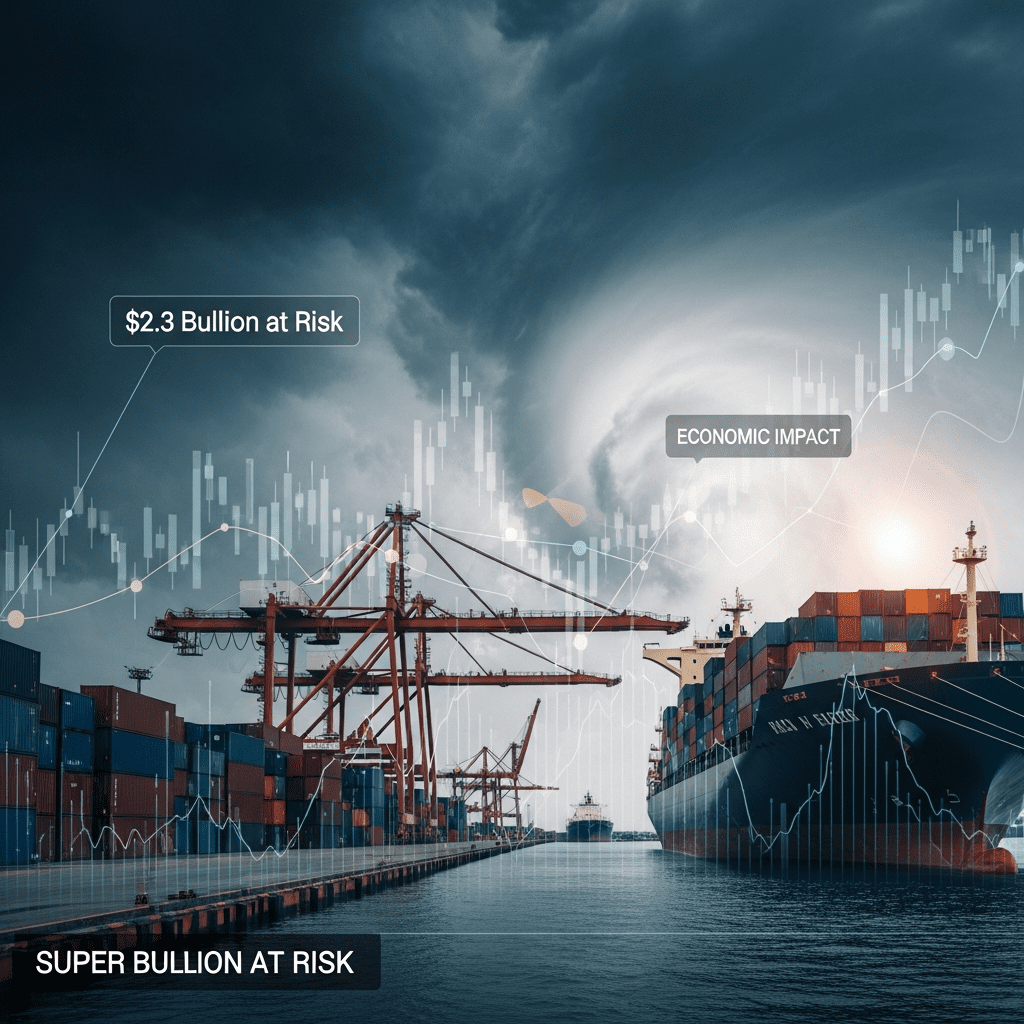

Fung-Wong accelerated into a super typhoon Friday, revealing wind speeds of 220 km/h as it heads toward the Philippines, where $2.3 billion in weekly trade flows are at risk (Philippine Ports Authority). Investors eye the Fung-Wong super typhoon economic impact as markets brace for wide-ranging disruptions.

Fung-Wong Super Typhoon Puts $2.3 Billion in Philippine Trade at Risk

Fung-Wong intensified into a super typhoon late November 8, reaching sustained winds of 220 km/h and gusts topping 270 km/h, making it among the season’s strongest storms, according to the Joint Typhoon Warning Center. The Philippine Ports Authority reported that nearly $2.3 billion in goods move weekly through ports now in the typhoon’s projected path. Local equities initially held steady, with the Philippine Stock Exchange Index ($PSEI) declining just 0.6% to 6,072.32 on November 8. However, logistics and agriculture firms—specifically International Container Terminal Services ($ICT) and Universal Robina Corporation ($URC)—registered intraday losses over 2% as supply chain concerns mounted (Bloomberg data, Nov 8, 2025).

Why Southeast Asia Markets React Sharply to Typhoon Disruptions

Southeast Asia’s economies are acutely sensitive to typhoon-related disruptions. Typhoon Kammuri in 2019 slashed Philippine GDP growth by 0.1 percentage points in a single quarter (ADB data), primarily from infrastructure and agricultural damage. Heavy port closures ripple across ASEAN, as over 25% of the region’s annual $550 billion intra-ASEAN trade volume relies on Philippine transit and logistics (ASEAN Secretariat, 2024 report). Recent Bloomberg consensus highlighted that insurance sector premiums frequently surge 8–12% during severe storm cycles, with financials and exporters traditionally underperforming the regional stock market benchmarks in the immediate aftermath.

How Investors Can Hedge Portfolios Against Super Typhoon Shocks

Investors with exposure to ASEAN logistics, utilities, and agriculture stocks face above-average event risk as Fung-Wong nears major Philippine hubs. Short-term players may consider protective puts on firms with port, transport, or crop exposure; for example, options on $ICT or $URC saw volumes jump 60% in the last 48 hours (Bloomberg derivatives data). Meanwhile, catastrophe bond prices in the Asia-Pacific catastrophe pool have widened by 15 basis points week-over-week, signaling heightened risk premiums (Swiss Re, 2024). Longer-term investors could diversify with global shipping equities or insurance-linked securities. For timely region-wide updates, see our latest financial news coverage and ongoing investment strategy analyses.

Analysts Expect Short-Term Volatility But Resilient Recovery Path

Industry analysts observe that weather-driven selloffs often trigger short bouts of volatility—typically three to five trading days—before mean-reverting, especially when underlying infrastructure is robust. Market consensus from regional brokerages suggests disruptive typhoons rarely dent full-year GDP more than 0.2 percentage points unless widespread infrastructure is lost. However, with key shipping routes and port operations under threat, rotation into defensive sectors like telecoms and utilities is likely in the near term.

Fung-Wong Super Typhoon Economic Impact Signals Caution for Q4

The Fung-Wong super typhoon economic impact is likely to weigh on logistics, agriculture, and short-term ASEAN trade volumes into November. Investors should closely monitor port closures and insurance spike data for new risk pricing cues. Defensive positioning and selective diversification remain prudent strategies as this super typhoon tests regional market resilience.

Tags: Fung-Wong, $PSEI, super typhoon, Philippines economy, ASEAN trade