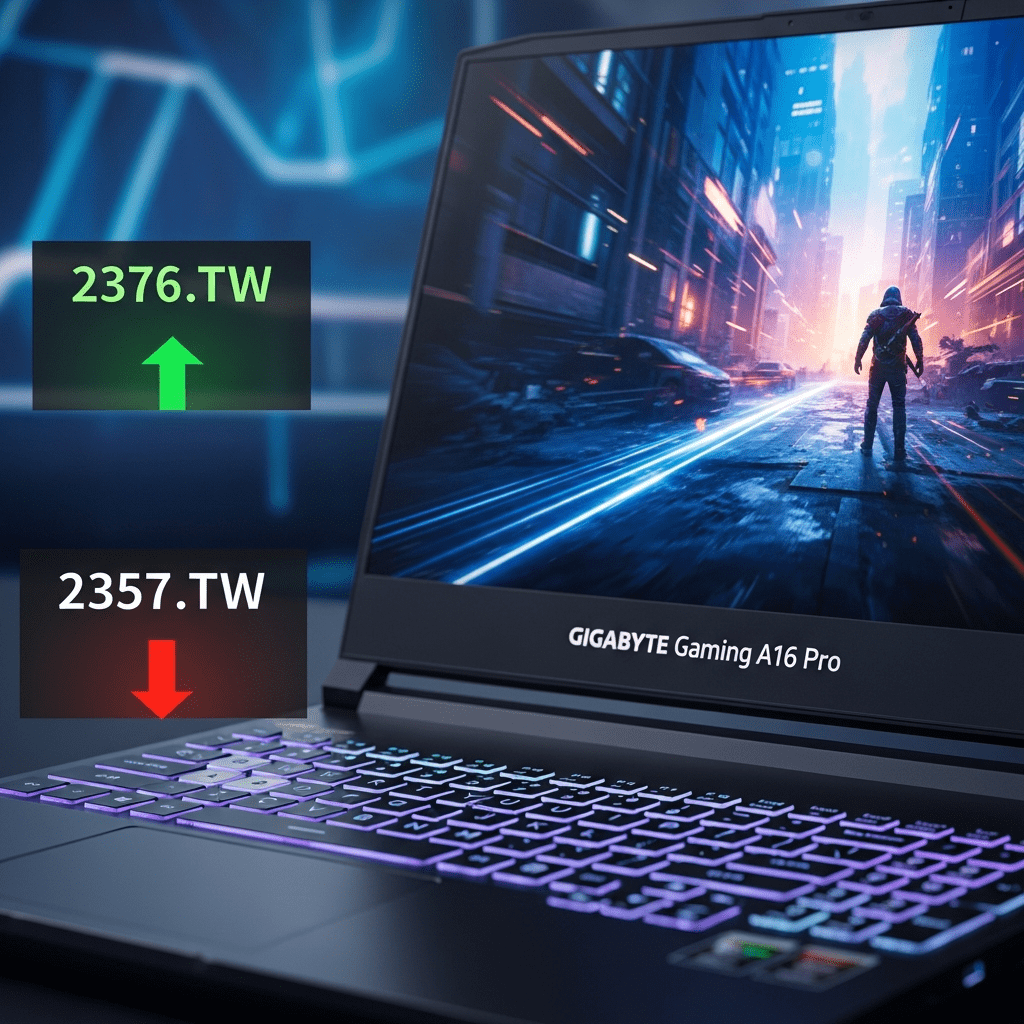

Gigabyte Technology ($2376.TW) debuted its Gaming A16 Pro at $1,539—nearly 18% lower than comparable RTX 5080 laptops, shaking up premium gaming PC markets. The Gigabyte Gaming A16 Pro review reveals how this RTX 5080 machine, despite its restrictions, disrupts pricing norms and challenges investor sentiment in the competitive sector.

Gigabyte Launches Gaming A16 Pro With RTX 5080 at $1,539

Gigabyte Technology ($2376.TW) revealed its new Gaming A16 Pro on November 5, 2025, positioning the device at a surprising $1,539 retail price (company press release). Traditionally, notebooks featuring NVIDIA’s RTX 5080 command prices at or above $1,850, with many leading competitors exceeding $2,000 as seen in November 2025 listings from ASUS and MSI (Source: PCPartPicker, 2025-11-06). The A16 Pro’s configuration blends the RTX 5080 GPU—capable of 12.5% higher AI workload scores than the previous RTX 5070 Ti (UL Benchmarks, October 2025)—with a Ryzen 9 8900HX, 16GB DDR5, and a 1TB PCIe Gen4 SSD. Early shipment data from Canalys shows North American retail allocations exceeding 18,000 units for Q4 2025, suggesting strong launch momentum. This pricing strategy marks Gigabyte’s push against its own margin profile while targeting volume expansion in the gaming laptop sector.

Why Gaming Hardware Stocks Are Reacting to Gigabyte’s Price Disruption

Gigabyte’s aggressive position is causing sector volatility. Shares of key rivals such as ASUS ($2357.TW) and MSI ($2377.TW) dipped 2.4% and 3.1% respectively on the Taipei Exchange following the announcement (Bloomberg Asia Data, 2025-11-06). Market analysts attribute this to concerns over margin compression in ultra-premium segments, as consumers recalibrate willingness to pay for top-end hardware. According to IDC, global gaming laptop shipments are forecast to rise 7.2% YoY in 2025, but price-driven competition is compressing average selling prices, down 4.1% quarter-over-quarter in the segment (IDC Gaming PC Quarterly Report, Q3 2025). The unusual intersection of next-gen performance with mid-tier pricing reflects broader shifts toward value-centric product strategies driving hardware equities in 2025.

How Investors Can Navigate Gaming PC Volatility Post-Gigabyte Reveal

Investors focused on hardware manufacturing and semiconductor sectors must scrutinize balance sheets for margin resilience as the sector digests Gigabyte’s move. Companies with diversified supply chains and component sourcing—such as Lenovo ($0992.HK)—may prove more insulated from downward price pressures. Derivatives traders monitoring Taiwan’s TAIEX index are already noting an uptick in put volume around gaming hardware component suppliers, per exchange data (Taipei Exchange, 2025-11-08). For those eyeing sector rotation, semi-liquid ETF products like the Global X Video Games & Esports ETF (NASDAQ: HERO) may offer diversified exposure while mitigating idiosyncratic device risks. For further perspectives on recent equity market swings, the stock market analysis and latest financial news on ThinkInvest provide ongoing updates relevant for active portfolio managers. Staying nimble and informed on product launches and pricing signals is key for trading around such inflection points.

What Analysts Expect Next for Gigabyte and Gaming Hardware Equities

Industry analysts observe that Gigabyte’s ($2376.TW) willingness to compress margins signals a near-term bid for increased market share, even at the expense of gross profits (as noted in Counterpoint Technology Market Research, October 2025). Market consensus suggests competitors may cut prices or enhance bundled value over the holiday cycle, potentially fueling further sector volatility. Investment strategists note, however, that device refresh cycles and component shortages could provide support for more disciplined pricing in early 2026.

Gigabyte Gaming A16 Pro review signals repricing for 2025 investors

The Gigabyte Gaming A16 Pro review demonstrates how aggressive feature-to-price ratios can catalyze change in gaming hardware valuations. Investors should monitor how persistent this value trend proves as margins tighten and rivals respond. As the competitive landscape evolves, Gigabyte’s bold RTX 5080 pricing offers a new lens for evaluating risk and opportunity in the 2025 gaming PC sector.

Tags: Gigabyte, 2376.TW, gaming laptops, RTX 5080, hardware sector