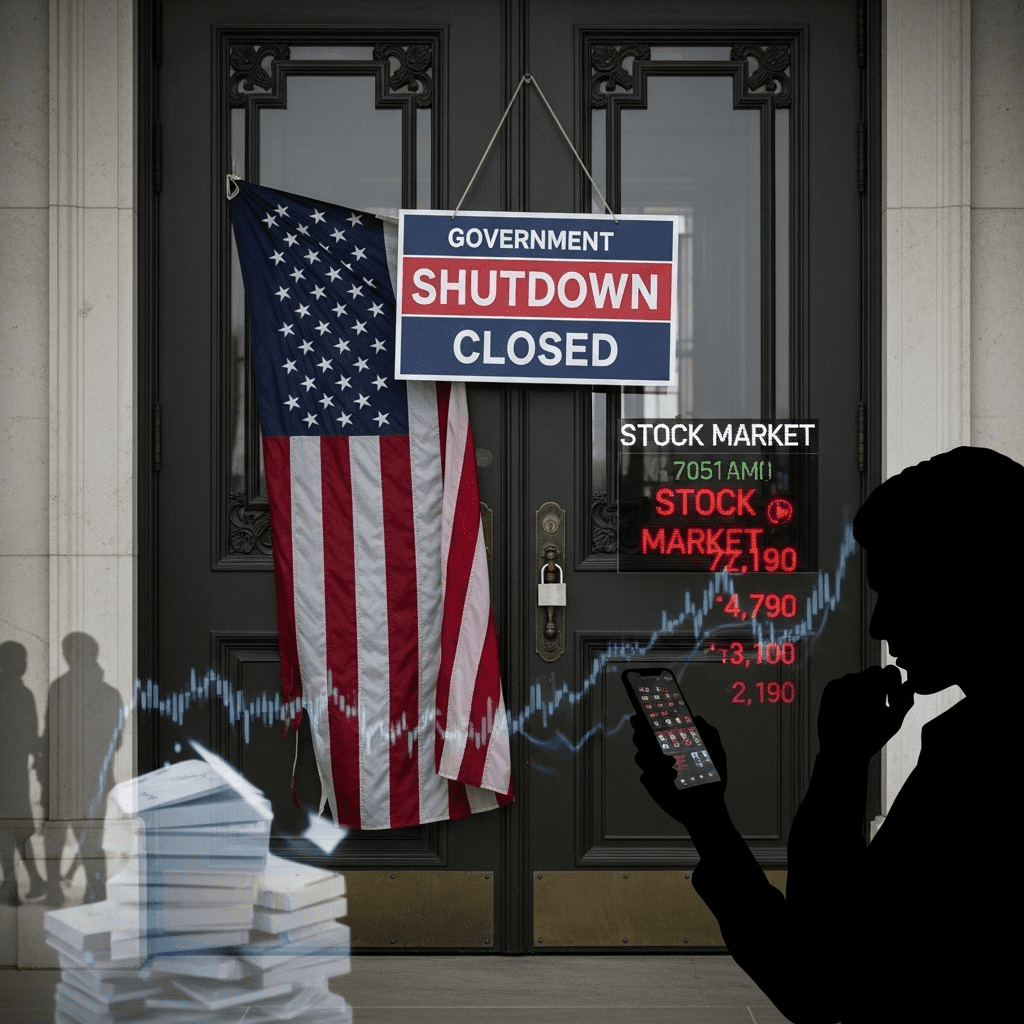

The government shutdown starts as deadline passes without deal, igniting concerns across financial markets, federal agencies, and American households. As negotiations faltered before the funding cutoff, the ramifications are being felt across the nation. In this article, we break down the causes, immediate effects, and lasting consequences of this significant 2025 government event, while examining strategic responses for individuals and investors.

Primary Reasons Why Government Shutdown Starts as Deadline Passes Without Deal

This federal impasse began as Congressional leaders failed to reach a bipartisan agreement on key appropriations bills. Disagreements centered on spending caps, allocation of funds to healthcare and defense, and contentious policy riders. As midnight approached, neither chamber acted swiftly enough to prevent a lapse in funding, resulting in a partial federal shutdown. The financial community closely monitored these developments, anticipating wide-ranging effects on economic stability and market sentiment.

Immediate Economic Impact of the Federal Shutdown

The sudden cessation of government operations triggers significant ripple effects:

- Federal Employee Furloughs: Over 800,000 non-essential workers are furloughed, with another 1.2 million required to work without immediate pay.

- Financial Market Response: Stock markets opened lower, reflecting uncertainty over fiscal stability and potential credit rating risks for the U.S. government.

- Disrupted Services: National parks, museums, and regulatory agencies announced closures, while critical services like TSA screening and border security continue but with reduced staff and morale.

Small businesses, contractors, and communities dependent on federal programs are already reporting adverse effects, amplifying economic anxiety nationwide.

How the 2025 Shutdown Differs from Previous Years

Unlike prior shutdowns, the 2025 government funding standoff is occurring amidst lingering post-pandemic economic recovery. This context magnifies vulnerabilities, especially for gig workers, federal contractors, and industries relying on government approvals (such as housing, transportation, and healthcare). The extended nature of this gridlock could risk downgrades in the U.S. credit rating, increased borrowing costs, and potential delays in tax refunds.

Key Stakeholders Hit Hardest by the Government Shutdown

The wide-reaching scope of the shutdown is being felt beyond Capitol Hill:

- Federal Employees: Facing uncertainty over paychecks, benefits, and job security.

- Social Program Recipients: Possible delays in SNAP, Medicaid, and housing assistance threaten millions of low-income families.

- Investors and Businesses: Market volatility and reduced consumer confidence complicate financial planning for the coming months.

Financial advisors are urging Americans to build emergency savings and minimize non-essential expenditures until government operations resume.

What Happens Next: Possible Paths to Resolution

The current gridlock could end swiftly if political leaders compromise or could persist for weeks, deepening economic pain. Analysts anticipate several possible outcomes:

- Short-term funding extension (continuing resolution)

- Comprehensive budget overhaul

- Increased executive action to prioritize essential services

For real-time updates and financial strategies, investors can consult trusted resources like economic news portals and financial planning sites.

Advice for Individuals and Investors Amid the Shutdown

Experts recommend a cautious approach during the government stoppage:

- Review and adjust budgets to prepare for delayed federal payments or services.

- Monitor financial markets, but avoid panic-selling investments.

- Stay informed through reputable sources, as the situation evolves rapidly.

While uncertainty abounds, strategic planning and diversification remain key financial principles during periods of governmental disruption and market stress.

Conclusion: Preparing for Future Government Shutdowns in 2025

The government shutdown starts as deadline passes without deal is a reminder of how political stalemates can disrupt everyday life and economic wellbeing. As the nation waits for a resolution, proactive financial management and staying informed can help households and businesses weather the storm. Savvy investors, meanwhile, are already analyzing opportunities and risks as market dynamics adjust to the new fiscal landscape.