Interest in homes for sale in England with a grand design is surging in 2025, capturing the attention of high-net-worth individuals and global investors. The English luxury property market features some of the world’s most unique architectural marvels, from contemporary masterpieces to stately period estates. In this feature, we showcase prime homes for sale, accompanied by expert insights into why these properties represent sophisticated investment opportunities.

Why Invest in Homes for Sale in England with a Grand Design?

The allure of grand design homes in England goes beyond exquisite aesthetics; these properties blend architectural innovation with enduring value. According to Knight Frank’s 2024 Luxury Property Report, demand for iconic English residences surged by 9% year-on-year, driven by international buyers seeking security, lifestyle, and diversification. Portfolio diversification has become increasingly important, especially as UK real estate remains a relatively stable asset class amid global economic fluctuations.

Exceptional Design Meets Prime Locations

Homes for sale in England with a grand design are often situated in coveted postcodes—think Kensington, Oxfordshire, and the Cotswolds. These properties command premium prices, averaging £2.7 million for design-led homes in Greater London according to Savills, underscoring their exclusivity. Owners enjoy not only architectural distinction but also proximity to world-class schools, arts, and commerce—making these homes attractive for both primary residence and luxury rental markets.

Pictorial Tour: English Homes with a Grand Design

This year’s listings reveal an eclectic mix of styles and eras, all defined by their grand aesthetic and bespoke craftsmanship. Let’s take a visual journey through some of the most noteworthy homes for sale in England with a grand design in 2025:

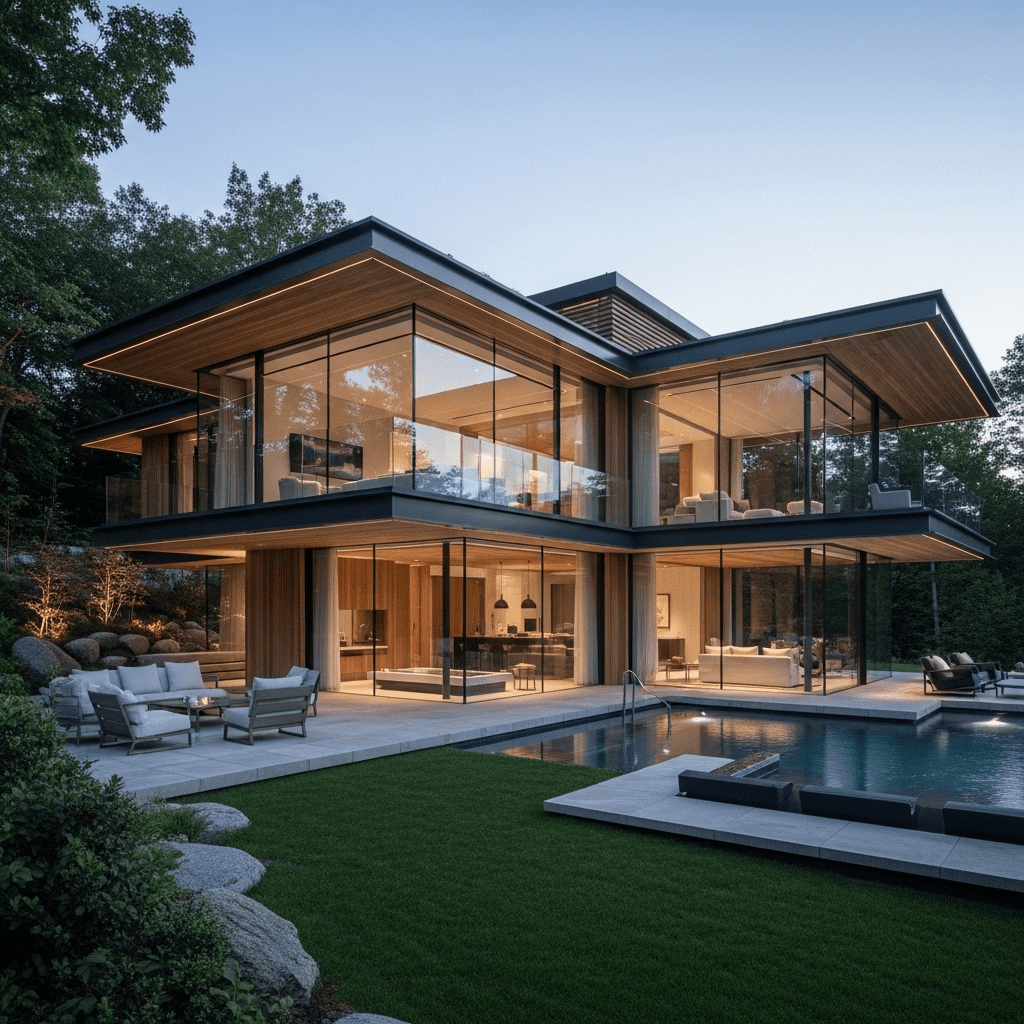

1. Contemporary Glass & Timber Retreat, Surrey

This newly-built Surrey residence marries sustainability with dramatic design. Featuring cantilevered living spaces, full-height glass walls, and an indoor spa, the home sits within landscaped gardens and offers seamless indoor-outdoor living. With environmental performance certifications and smart home systems, it captures the future-facing ethos dominating luxury real estate markets.

2. Georgian Revival Mansion, Bath

In the heart of Bath, a Grade II-listed, Georgian-inspired mansion has been reimagined with modern luxury interiors while retaining period details such as ornate plasterwork and sash windows. Its formal gardens, indoor pool, and wine cellar cater to discerning buyers seeking both heritage and comfort.

3. Minimalist Urban Loft, London

For those who appreciate cutting-edge design, this East London loft delivers with double-height ceilings, exposed concrete, and modular living areas. Its location in the fast-evolving Shoreditch district assures both lifestyle appeal and investment upside—an attractive proposition highlighted in our urban property growth analysis.

The Financial Case for Investing in Grand Design Homes

Aside from visual grandeur, these properties represent sound long-term investments. Luxury homes in England often appreciate more resiliently than standard market segments, buoyed by limited inventory and strong international demand. Factors propelling these homes’ enduring value include:

- Prestigious Locations: Highly sought-after areas often outpace the general market in price growth, according to JLL’s 2025 forecast.

- Unique Architecture: Iconic designs drive scarcity value and tend to hold or increase in desirability over time.

- Rental Yield Potential: Luxury short-lets, especially for architecturally significant homes, garner premium rents from executives and celebrities.

Financial advisors often recommend grand design homes as part of a diversified high-value property portfolio, combining lifestyle enjoyment with tangible asset growth.

Market Trends and Buyer Insights in 2025

The English grand design home market is adapting to changing buyer preferences. Energy efficiency, wellness amenities, and flexible layouts are key priorities for 2025’s property investors. Brexit and currency fluctuations have also made UK real estate more attractive to overseas buyers, particularly from the U.S., Middle East, and Asia-Pacific. Experienced agents report that listings with professional photography—including picturesque galleries—achieve up to 17% faster sales, supporting the use of ‘in pictures’ tours for digital-savvy investors.

How to Secure a Grand Design Property

Acquiring homes for sale in England with a grand design requires expertise and timing. It’s essential to work with reputable estate agents, secure due diligence on architectural provenance, and consult with dedicated investment advisors. For detailed guidance, visit our resource center on property tax strategies and enjoy peace of mind as you explore England’s most extraordinary homes.

Conclusion: England’s finest grand design homes are more than just remarkable residences—they’re assets that combine lifestyle enhancement with robust financial prospects. For investors and homebuyers alike, the 2025 market presents new opportunities to own a piece of Britain’s architectural legacy.