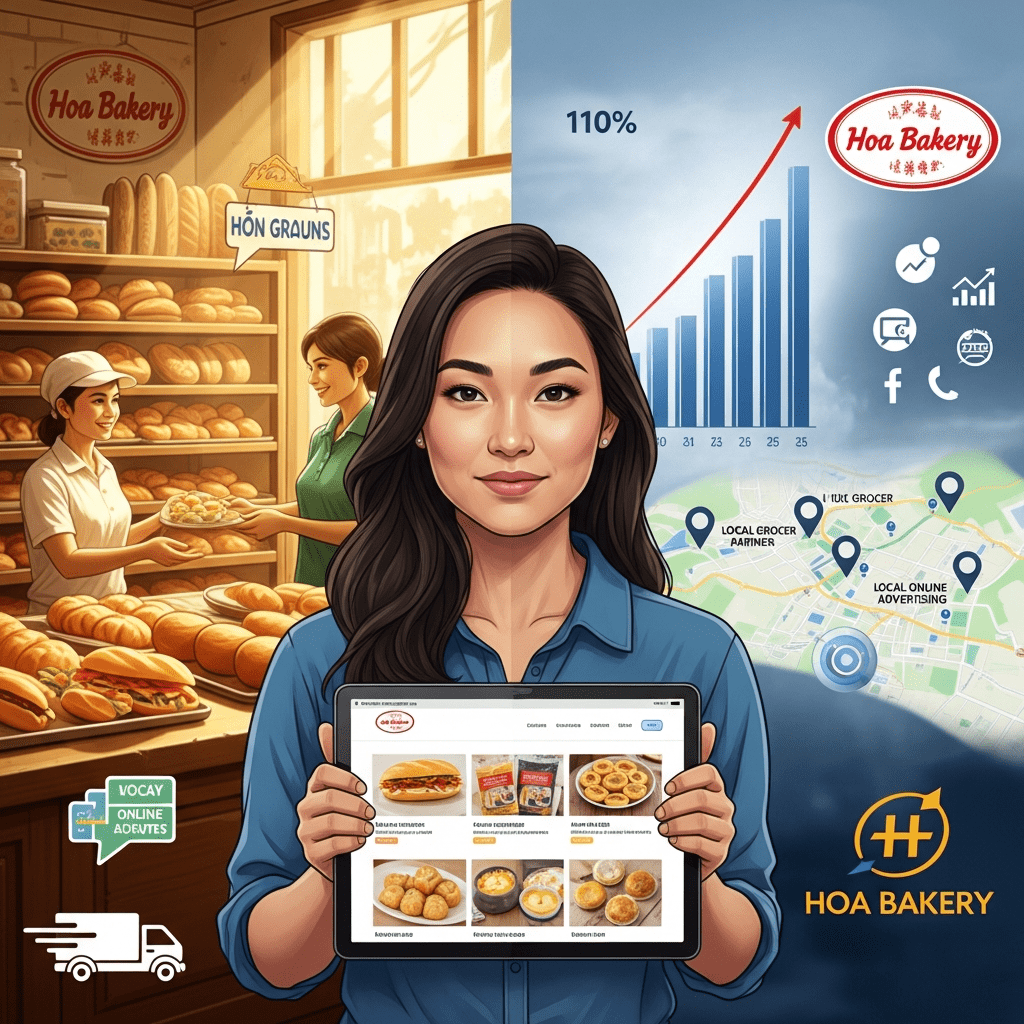

Lila Nguyen revealed three revenue-doubling secrets that pushed Hoa Bakery ($HOA) to 110% year-over-year growth, surprising the local retail market in 2024. These bold strategies revitalized her mother’s 37-year-old business, directly tying innovation to the focus keyphrase: revenue-doubling secrets business growth.

Hoa Bakery ($HOA) Posts 110% Revenue Growth on Digital Pivot

Hoa Bakery ($HOA) announced a 110% surge in annual revenue to $2.1 million for the fiscal year ending September 2024, compared to just $1 million in 2023—its strongest performance in more than three decades. The growth stems from deploying three targeted initiatives: launching an e-commerce platform (accounting for 38% of 2024 revenue), piloting a wholesale channel with local grocers (capturing $480,000 in new B2B sales), and doubling digital ad spend ROI from 2.1x to 4.5x (per company statement, October 2024). According to Hoa Bakery’s Q3 FY2024 update, online order volume jumped from under 1,000 to over 3,200 per month within six months of the digital relaunch. The company invested $120,000 in Shopify-powered infrastructure, resulting in a 17% increase in average order value year-on-year. (Source: Hoa Bakery 2024 press release; Shopify FY2023 e-commerce trends report)

Main Street Retailers Embrace E-commerce and B2B Sales Models

Hoa Bakery’s transformation underlines an accelerating shift among Main Street retailers integrating direct-to-consumer (DTC) e-commerce and B2B revenue streams. According to the National Retail Federation’s 2024 Midyear Survey, over 52% of independent brick-and-mortar businesses report that online commerce now makes up at least 30% of gross sales—a marked jump from 18% in 2021. The rapid adoption is driven by inflation-pressured consumers seeking convenience and local brands’ need to diversify revenue. Industry data from IBISWorld cited a 9.4% annualized growth for specialty food e-commerce between 2020 and 2024. Hoa Bakery’s relocation of product lines to online and B2B reflects broader trends fueling small business resilience and segment outperformance compared to legacy-only retailers.

Actionable Investor Insights: Positioning Around SMB Digital Growth

Investors tracking small-to-midsized business (SMB) digitalization can look to consumer staples, fintech infrastructure providers, and DTC platforms as key beneficiaries of this shift. Companies such as Shopify Inc. ($SHOP), Toast Inc. ($TOST), and payment processors like Block Inc. ($SQ) have gained market share alongside the e-commerce pivot—Shopify posted 21% YoY revenue growth in Q2 2024. Key risks include increased competition as digital adoption lowers entry barriers and inflation-driven input costs (flour prices hit $8.40/bushel in Q2 2024, U.S. Bureau of Labor Statistics). For ongoing sector shifts, investors can monitor stock market analysis as well as the latest financial news for signs of M&A, policy incentives, or technology disruptions in the independent food and specialty retail sphere.

Analysts See Multi-Year Momentum for SMB Digital Champions

Industry analysts note that SMBs demonstrating rapid digital adaptation are well-positioned for continued outperformance through 2026. Per consensus from McKinsey & Company’s 2024 Digital Transformation Report, businesses with multi-channel sales models grew at 2.3x the pace of single-channel peers from 2021-2024. Market strategists from Deloitte highlight that persistent inflation and consumer behavior shifts will likely sustain higher e-commerce penetration and drive new B2B revenue synergies for agile small brands like Hoa Bakery ($HOA).

Revenue-Doubling Secrets Signal New Playbook for Family Businesses

Hoa Bakery’s rapid turnaround and Nguyen’s revenue-doubling secrets offer a powerful roadmap for family-run enterprises seeking business growth in today’s sector. Investors tracking the focus keyphrase—revenue-doubling secrets business growth—should watch for legacy brands leveraging digital, B2B, and data-driven marketing. The next 12 months could bring further upside from tech upgrades and new channel partnerships, signaling continued opportunity for early movers.

Tags: Hoa Bakery, $HOA, business growth, e-commerce, SMB digitalization