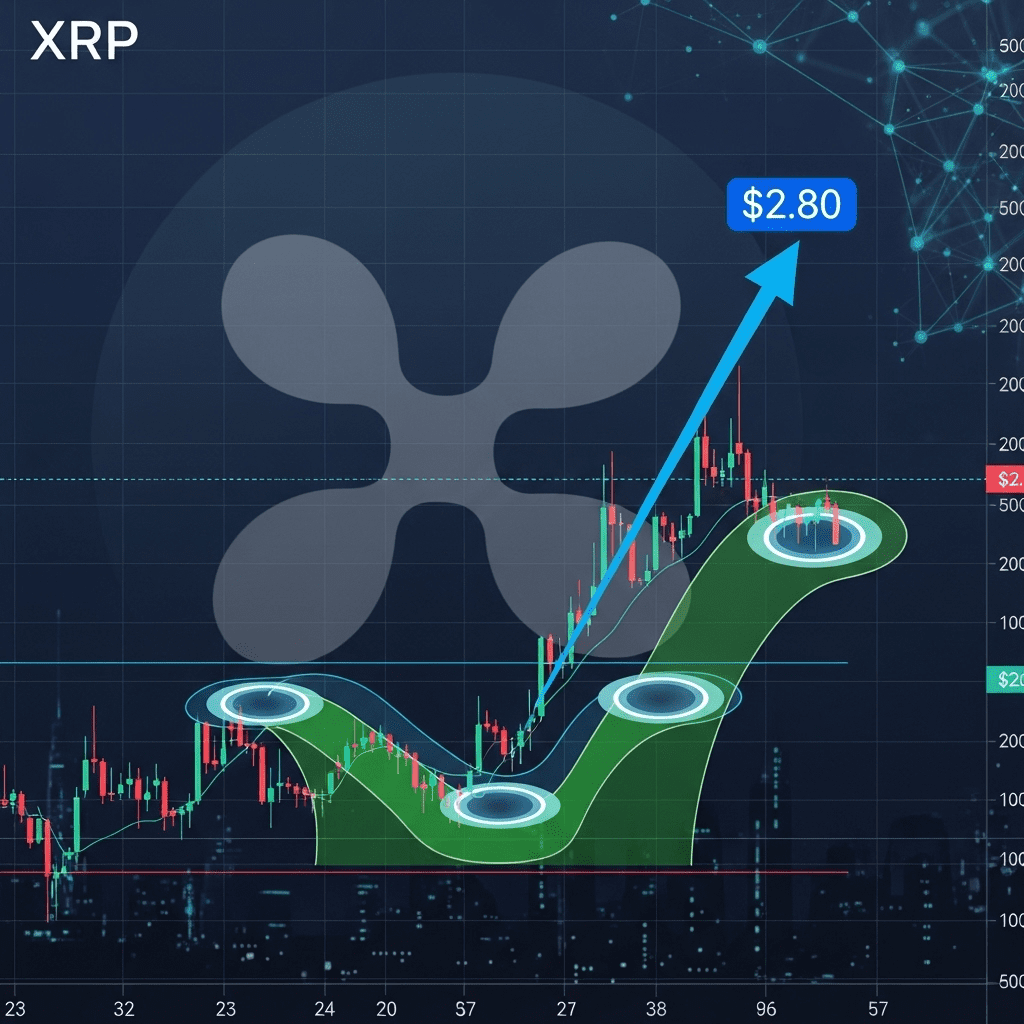

TL;DR: XRP has triggered an inverse head-and-shoulders breakout, a bullish technical pattern, suggesting a possible test of the $2.80 level in coming months. This could catalyze renewed momentum for the Ripple token, drawing investor attention back to altcoins.

What Happened

Ripple’s XRP surged above key resistance levels in early June after confirming an inverse head-and-shoulders breakout XRP traders have monitored for weeks. On June 10, XRP climbed 13% intraday — reaching $0.72 — as daily trading volumes spiked above $2.6 billion, according to CoinMarketCap data. The breakout followed a multi-month consolidation between $0.48 and $0.62, with the neckline at $0.62 breached on higher-than-average volume. Data from CryptoQuant indicates the pattern has increased bullish positioning among both spot and derivatives traders. “Technical setups like this can rapidly shift sentiment, especially in a market focused on trend reversals,” said digital asset analyst Fiona Chen of BlockMetrics.

Why It Matters

The significance of this inverse head-and-shoulders breakout XRP chart pattern lies in its strong historical track record as a bullish technical reversal signal. In crypto markets, such breakouts often precede outsized moves as algorithmic and discretionary traders enter in tandem. With the digital asset sector recovering in 2025 after a volatile 2024, renewed interest in major altcoins like XRP could signal broader risk appetite returning. Moreover, Ripple’s ongoing regulatory progress — including more clarity on its legal status in U.S. courts — provides a supportive backdrop. Analyst outlooks, as covered in recent market analysis, point to technical breakouts as key inflection points in crypto market cycles.

Impact on Investors

For investors, the inverse head-and-shoulders breakout XRP move introduces near-term opportunity and higher volatility risk. Historically, similar breakout patterns in XRP have led to rallies of 40–60% from their neckline level, suggesting a technical price target of $2.80, if historical correlations hold. Traders may watch for trading volume follow-through and sustained closes above $0.75 as confirmation, while position sizing and stop-loss discipline remain prudent given sector-wide headwinds. This development is also relevant for altcoin sector ETFs, such as those tracking the Top 10 Digital Assets, and may influence fund flows across the crypto landscape. For broader context, see investment insights on trending digital assets.

Expert Take

Analysts note that breakout volatility is likely to remain elevated, especially as XRP approaches psychological resistance near $1. “A confirmed inverse head-and-shoulders breakout in XRP often attracts fresh capital from both retail and institutional investors,” market strategists suggest in their latest crypto outlook, “but price action may be sensitive to macro headlines and regulatory updates.”

The Bottom Line

The inverse head-and-shoulders breakout XRP technical pattern puts Ripple’s token on track for a major upward test, with $2.80 in sight if bullish momentum sustains. Investors should weigh the pattern’s historical reliability with the crypto market’s ongoing volatility as they position for the second half of 2025.

Tags: XRP, inverse head-and-shoulders, technical analysis, crypto breakout, Ripple.