In 2025, investors and the broader energy sector are closely examining whether space-based solar power is finally ready to shine. This transformative technology, long hailed as the next frontier in renewable energy, offers the promise of near-limitless clean power. But is commercial viability now within reach? Here, we dissect the latest developments, opportunities, and challenges shaping the future of space-based solar power and its potential to disrupt global energy markets.

Space-Based Solar Power: Advancing Toward Practical Deployment

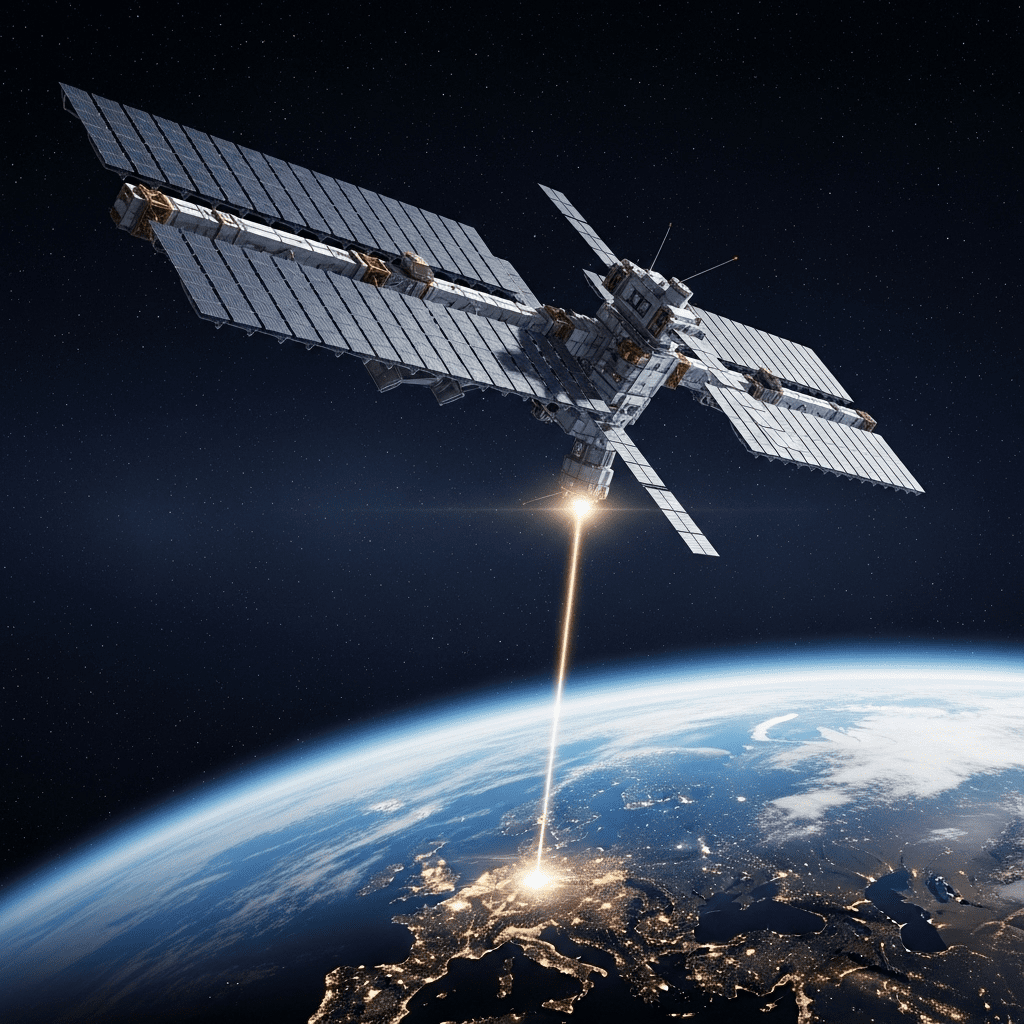

Space-based solar power (SBSP), the concept of collecting solar energy in space and transmitting it wirelessly to Earth, has moved from science fiction to a prospective solution in the clean energy revolution. As terrestrial solar reaches new efficiencies, the allure of SBSP lies in its ability to capture uninterrupted solar radiation, free from atmospheric interference and weather variability. In the last few years, aerospace companies, government agencies, and energy investors have funneled significant resources into demonstration projects and feasibility studies, igniting renewed optimism that the technology is approaching readiness.

Notably, several space agencies and private players have reported successful wireless power transmission tests, indicating technical hurdles may soon be overcome. Policy makers, too, are showing interest, seeing SBSP as a path to sustainable energy security and decarbonization. According to market trends tracked by industry analysts, SBSP advancements are capturing the attention of forward-thinking investors looking to diversify their portfolios.

Driving Innovation: Technology and Investment in 2025

The core of SBSP involves positioning massive solar arrays in geostationary orbit, where sunlight is nearly constant, and transferring collected energy back to Earth using microwave or laser transmission. Recent innovations in lightweight materials, modular satellite design, and high-efficiency solar cells are rapidly reducing launch and operation costs. In 2025, these breakthroughs are drawing increasing venture capital and private equity into SBSP start-ups, as highlighted in recent market research reports.

Another turning point has been international collaboration. Nations such as Japan, China, and the United States are pursuing pilot programs, aiming to demonstrate gigawatt-scale power delivery by the end of the decade. These initiatives are not only technological showcases but also critical signals to institutional investors and energy conglomerates that SBSP is transitioning from research to pre-commercial demonstration stages.

Space-Based Solar Power: Opportunities and Risks for Energy Investors

The potential rewards of space-based solar power are enormous. Providing round-the-clock clean electricity with minimal land use could drastically shift global energy dynamics and create new markets worth trillions of dollars. The ability to power remote areas or industrial complexes without reliance on fossil fuels is a tantalizing prospect for nations and companies striving for net-zero goals.

Investment Risks and Market Dynamics

However, SBSP still carries significant risks. The capital intensity of deploying large orbital infrastructures, regulatory uncertainties around frequency allocation and space debris management, and technological bottlenecks in energy transmission all represent hurdles yet to be fully addressed. Prudent investors are carefully weighing these factors, often seeking guidance from trusted investment insights to balance the high-reward ambitions with potential long-term risks.

Another consideration is the competitive backdrop posed by rapidly advancing terrestrial renewables and energy storage. With onshore wind, solar PV, and battery costs continuing to fall in 2025, SBSP will need to prove its cost advantage at scale to attract mainstream capital. Nonetheless, the pursuit of energy diversification, national security, and climate-driven mandates ensures that SBSP remains a compelling long-term play.

What’s Next for Space-Based Solar Power in 2025?

Looking ahead, the ongoing operational pilot projects and the maturity of power-beaming technology will determine the timeline for space-based solar power’s commercial rollout. Watch for announcements regarding multi-megawatt space arrays, partnerships between space and utility companies, and the emergence of new business models leveraging cloud-based AI to optimize energy collection and transmission.

For forward-looking investors, staying informed of policy frameworks, international collaborations, and public-private partnerships is critical. As the sector evolves, SBSP could move from a promising prototype to a mainstream asset class in the global clean energy portfolio by the end of the decade.

Conclusion: In 2025, space-based solar power is closer to becoming an investable reality than ever before. While the challenges are formidable, the intersection of technological maturity, rising energy demand, and sustainability imperatives may soon propel SBSP from an ambitious vision to a real driver of clean energy markets.