The International Solar Alliance (ISA) has highlighted renewable energy, storage solutions, and floating solar projects as central green energy drivers for 2025, signaling advancing global decarbonization and shifting capital flows. The focus keyphrase ISA renewable energy drivers underscores new market dynamics amid rising infrastructure investments.

What Happened

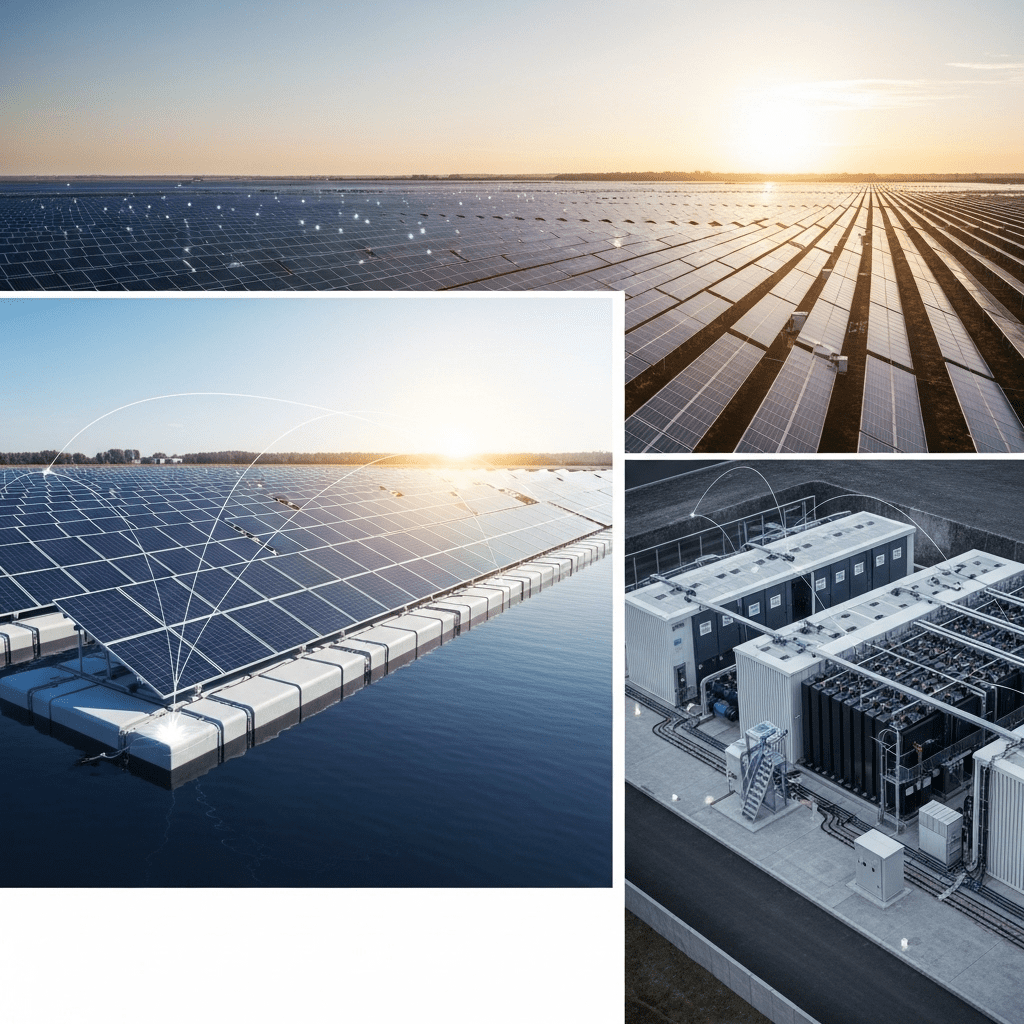

This week, the International Solar Alliance (ISA), a coalition of 120 countries dedicated to promoting solar energy, released its annual report pinpointing renewable energy, long-duration storage, and floating solar as pivotal forces shaping the next wave of global green energy expansion. According to the report, worldwide renewable energy capacity additions reached a record 507 GW in 2024, a 45% year-over-year increase. Significantly, the ISA stated that floating solar installations—solar panels deployed on reservoirs and lakes—are on track to exceed 20 GW of cumulative capacity by 2025, up from 13 GW in late 2023 (source: BloombergNEF).

Alongside surging solar and wind deployment, energy storage capacity—both battery and pumped hydro—grew 28% last year. “Integrating storage and scaling floating solar provides nations with resilient, flexible clean energy solutions, especially where land constraints exist,” said Dr. Ajay Mathur, Director General of the ISA. The ISA’s findings spotlight Asia-Pacific and Africa as critical regions leveraging these technologies to accelerate electrification, meet climate targets, and attract green capital.

Why It Matters

The ISA renewable energy drivers signal a clear inflection point for the global energy mix as investors and policymakers expedite net zero strategies. Robust growth in renewable power—particularly when coupled with reliable storage—is transforming the grid and unlocking new investment opportunities. According to the International Energy Agency, renewables are expected to constitute over 60% of new power capacity through 2025, up from 40% a decade ago.

Floating solar, though less than 3% of total solar capacity, is drawing attention for its high yield and dual-use benefits, especially in densely populated or water-scarce regions. Similarly, advances in battery energy storage systems (BESS) are enabling the firming of renewables, stabilizing prices, and reducing reliance on fossil peaking plants. Major investment insights point to a convergence between government subsidies, supply chain innovation, and institutional capital supporting this trajectory, particularly across emerging economies.

Impact on Investors

For investors, the ISA renewable energy drivers highlight both sector rotation potential and diversification opportunities. Publicly traded players in solar (NYSE: FSLR, NASDAQ: ENPH), storage (NYSE: STEM, NASDAQ: ENS), and infrastructure funds with floating solar exposure may see tailwinds amid accelerated green mandates. Meanwhile, countries leading in floating solar—such as India, China, and Vietnam—are attracting a rising number of cross-border partnerships and green bond issuance.

“As policy frameworks mature, technologies like floating solar and grid storage are moving from niche to mainstream. Investors should watch for regulatory clarity, cost declines, and capex scalability in these areas,” said Priya Desai, sustainable energy strategist at BEV Capital. However, supply chain volatility and policy delays remain short-term risks. Given the dynamics, diversified and geographically balanced market analysis is key for risk management.

Expert Take

Analysts note that utility-scale floating solar and grid storage are emerging as the linchpins of next-generation renewables, offering higher project yields and price stability. Market strategists suggest maintaining an overweight stance in vetted clean energy ETFs with a focus on technology and regional leaders.

The Bottom Line

The ISA’s identification of renewable energy, storage, and floating solar as green energy drivers for 2025 reaffirms their centrality in the transition to a low-carbon economy. As project pipelines and funding momentum accelerate, the ISA renewable energy drivers are set to reshape sector leadership, diversify infrastructure portfolios, and define the next phase of global energy investment. Staying informed via authoritative sector research remains crucial for strategic positioning.

Tags: renewable energy, floating solar, energy storage, green investment, ISA.