Japan’s largest labor union group Rengo ($N/A) demanded a 6% wage hike in 2025, outpacing last year’s settlement and surprising analysts monitoring the Japan union wage hike BOJ dynamic. This bold move intensifies Bank of Japan scrutiny as wage gains drive persistent inflation.

Rengo Calls for 6% Pay Rise, Pressuring BOJ Policy in 2025 Talks

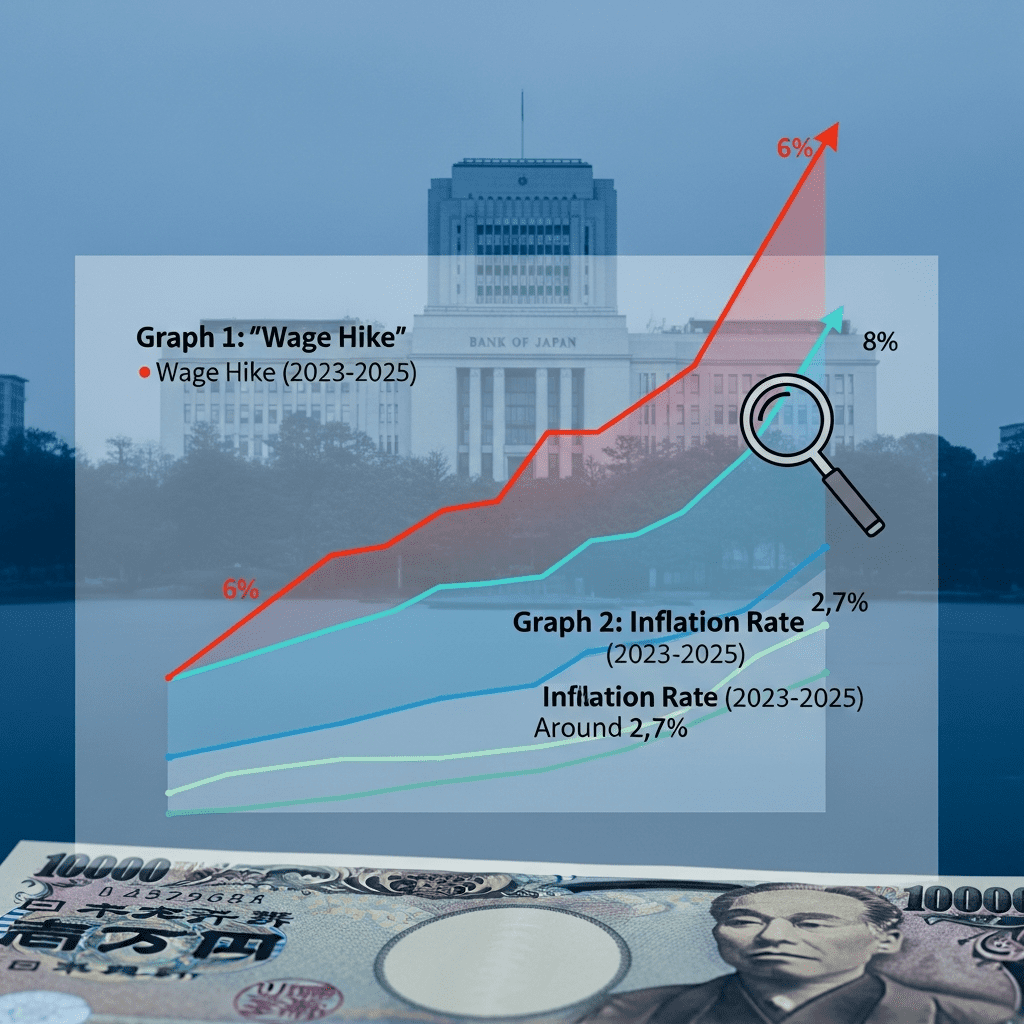

Rengo, representing over 7 million workers, officially seeks a 6% base salary increase for 2025, according to its November 6 announcement (Japan Times). This exceeds the 5.3% rise achieved in 2024, marking the largest request since at least 1993. The new wage demand comes amid annual shuntō spring negotiations, directly challenging the Bank of Japan’s ($N/A) monetary easing stance after its first rate hike in March 2024. Japan’s core consumer inflation rose 2.7% year-over-year in September 2025 (Ministry of Internal Affairs and Communications), sustaining the above-target price growth that BOJ Governor Kazuo Ueda has cited as necessary for considering further rate normalization.

Why Wage Demands Heighten Inflation Risks Across Japanese Markets

Escalating wage demands could feed a wage-price spiral, pressuring Japanese equities and bond markets. The Topix index has traded flat in recent weeks, rising just 0.7% in October amid uncertainty over BOJ moves (stock market analysis). Meanwhile, the 10-year Japanese government bond yield hovered above 1% for the first time since 2012, reflecting anticipation of tighter monetary policy (Bloomberg, Oct 2025). Persistent wage growth above 5% increases the odds that consumer inflation will remain elevated well into 2025, complicating the BOJ’s delicate balancing act and keeping the yen volatile near 150 per U.S. dollar (Reuters exchange data).

Portfolio Moves: How Investors Can Navigate BOJ Wage-Policy Shifts

Investors holding Japanese financials, exporters, and consumer discretionary stocks may face a more volatile landscape. Higher labor costs could erode manufacturers’ margins, while a strong yen might weigh on exporter earnings. Conversely, sustained wage gains support domestic consumption, potentially benefiting retail and services sectors. Active managers should monitor upcoming corporate guidance on wage costs and inflation pass-through effects. Those trading Japanese bonds or yen pairs should brace for increased volatility as the BOJ weighs further rate hikes. For the latest cross-market implications and central bank strategy, see latest financial news and ongoing forex trading insights.

Market Outlook: Expert Views on BOJ and Japanese Wage Inflation

Industry analysts observe that Rengo’s 6% demand could serve as a benchmark, prompting other unions and employers to adjust expectations upward. Market consensus now sees the BOJ on alert for accelerating wage-led inflation, with some strategists from Nomura and Daiwa Securities forecasting another policy tightening if inflation remains above 2% into Q1 2025. However, the BOJ has also signaled caution given global headwinds and geopolitical risks. Investors will closely watch both the March shuntō outcome and upcoming BOJ meetings for policy signals.

Japan Union Wage Hike BOJ Talks Signal 2025 Market Crossroads

Japan union wage hike BOJ negotiations may set the tone for the nation’s economic trajectory in 2025. Persistent wage pressure raises stakes for both inflation and monetary policy. Investors should track union demands, BOJ statements, and inflation data for tactical opportunities and risks as Japan enters a new wage-inflation era.

Tags: Japan, BOJ, wage inflation, Rengo, yen