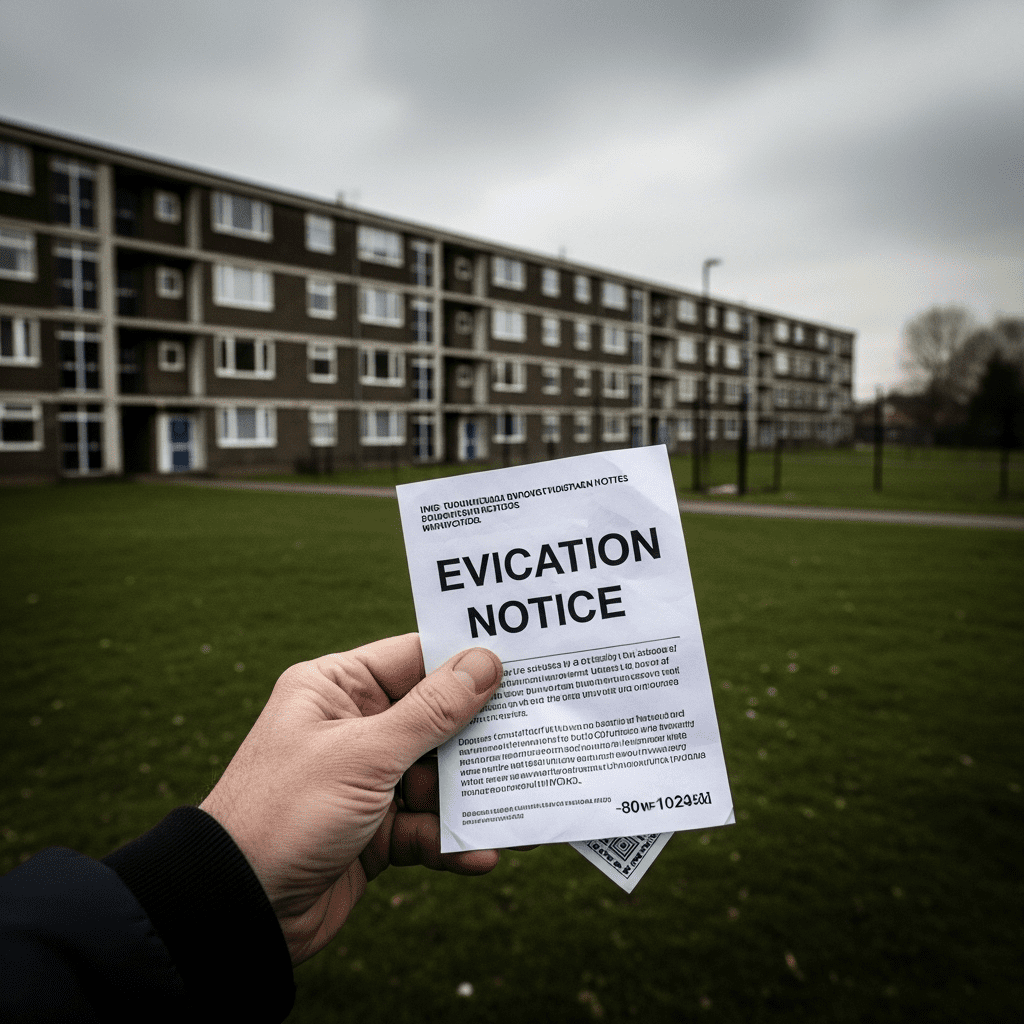

Labour’s housing hypocrisy is under the spotlight as financial data reveals that nearly 200 households have been served with no-fault eviction notices by Labour-run councils, despite the party’s vocal condemnation of such policies. The stark reality calls attention to the complexity of the UK housing crisis and challenges facing investors, landlords, and affected communities alike.

Labour’s Housing Hypocrisy: Eviction Notices By Councils Raise Questions

The issue of Labour’s housing hypocrisy emerges at a critical time for the UK real estate market. Labour has repeatedly campaigned against Section 21 ‘no-fault’ evictions—legal measures that allow landlords to reclaim property without proving tenant fault—criticizing the instability they create for renters. Despite these public commitments, recent investigative reporting reveals that Labour-led councils themselves have served almost 200 Section 21 notices over the past year, affecting hundreds of vulnerable families and individuals. This contradiction is provoking strong reactions from investors, housing advocates, and policy analysts concerned about property market stability and governance transparency.

Background: The Section 21 Landscape and Political Promises

The UK government’s pledge to abolish no-fault evictions was a core part of Labour’s 2024 election manifesto, resonating strongly with younger renters and urban voters. Section 21 was positioned as a policy that enables “revenge evictions” and undermines long-term housing security. However, financial pressures facing local councils, including the squeeze on social housing resources, have left Labour-run councils resorting to the very measures they publicly oppose. This duality poses reputational risks and raises questions about the effectiveness and consistency of housing policy implementation at the local vs. national level.

The Financial and Social Impact for Investors and Tenants

The controversy around Labour’s housing hypocrisy has significant implications for market participants. Investors tracking housing policy should note that local authorities are among the largest landlords in the UK, and council-generated evictions can directly affect housing supply, rental growth, and social stability in key markets. For instance, analysts warn that a spike in council-initiated no-fault evictions could further constrain affordable housing, push up private rents, and lead to increased demand for temporary accommodation—a factor weighing on council budgets and the wider economy.

Moreover, this policy contradiction may feed into greater political uncertainty, impacting real estate forecasts and risk models for buy-to-let investors. Financial strategists advise closely monitoring council-level housing activity and policy enforcement trends to anticipate potential shocks and regulatory adjustments in 2025.

Investment Implications of Labour’s Housing Hypocrisy

For investors and market analysts, Labour’s housing hypocrisy underscores the importance of scrutinizing not only national policy pledges but also local authority practices. The gap between rhetoric and reality can introduce unexpected risks for portfolios exposed to UK residential assets and social housing providers. Transparency, rigorous due diligence, and multi-scenario planning remain paramount, especially as new regulations are debated and enacted in response to evolving market pressures. Above all, understanding how councils balance competing demands for social responsibility, fiscal discipline, and property management is crucial for accurate asset valuation and risk mitigation.

Looking Ahead: Critical Questions for 2025

As the debate over no-fault evictions continues, observers should watch for potential legislative changes, council-level resource realignments, and shifts in party strategy ahead of next year’s elections. Investor sentiment toward the UK property sector will likely remain sensitive to headlines exposing inconsistencies like Labour’s housing hypocrisy. Meanwhile, tenants face continued uncertainty, highlighting the urgent need for coherent and enforceable housing reform.

To stay ahead of these market dynamics, leverage trusted resources such as investment insights to inform strategic decisions and safeguard long-term capital in the evolving UK real estate landscape.