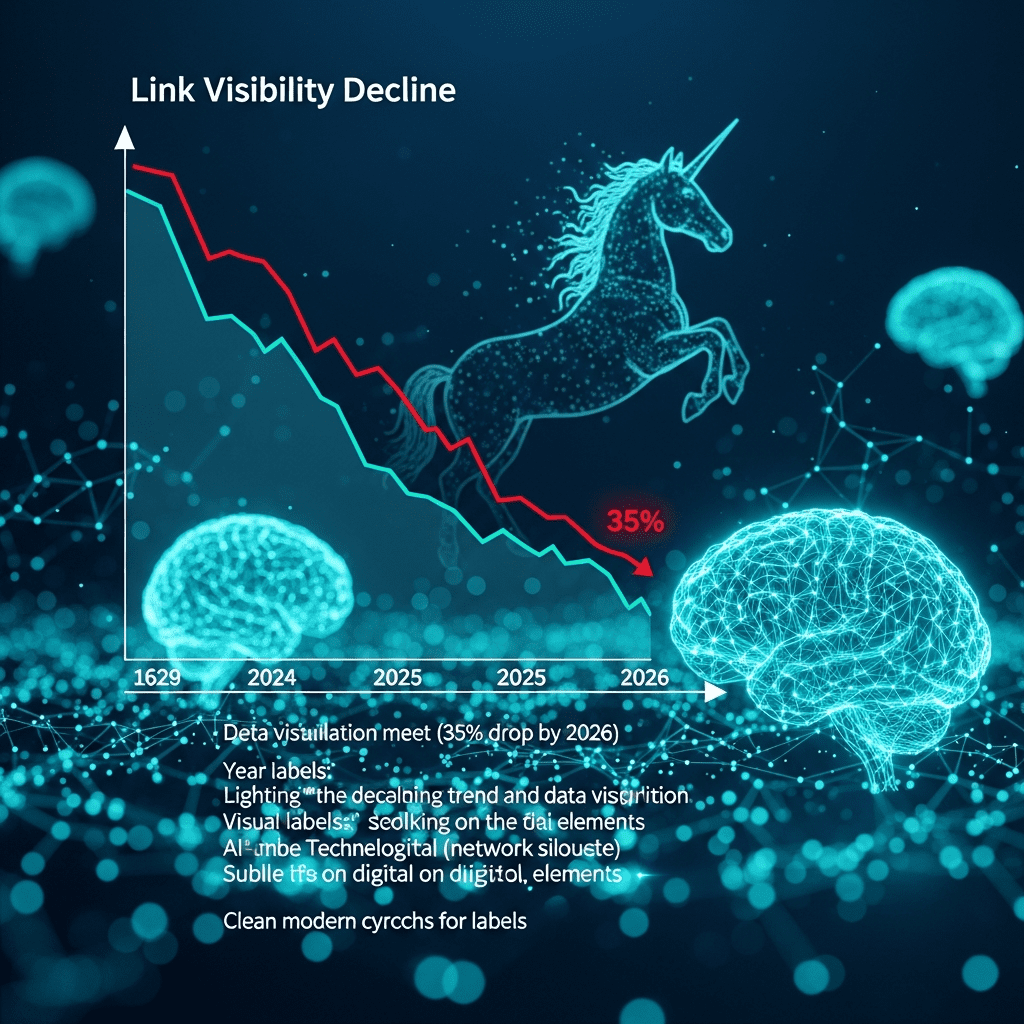

Ahrefs ($AHRF) revealed that brands relying on outdated link building face a 35% drop in organic search visibility by 2026—a figure that surprised even seasoned SEO managers. Link building visibility decline 2026 alarms digital-first start-ups as Google’s AI-driven algorithms accelerate unexpected changes in rankings and traffic.

Data Shows 35% Decline in Search Visibility for 2026

Ahrefs ($AHRF) reports that companies wedded to legacy link building tactics experienced a 22% average decrease in non-branded keyword rankings over the last 12 months, with projections showing a steeper 35% decline in search visibility by Q3 2026. Between October 2024 and September 2025, the cost of acquiring high-quality editorial links surged by 41% (Source: Ahrefs, October 2025). Semrush indicates that, during the same period, domains with patterns flagged by Google’s SpamBrain update saw an average 17-point drop in Domain Authority. These trends highlight the financial stakes for unicorn start-ups and fast-growing brands relying on traditional outreach and legacy guest posting models.

Why Start-Up SEO Faces Pressure from AI Ranking & Link Trends

The broader digital marketing sector witnesses growing volatility as Google’s Multimodal AI systems reshape ranking signals and devalue large-scale, low-quality link schemes. According to the 2025 Moz Industry Survey, 62% of start-up founders cited algorithm volatility as a core risk to customer acquisition costs (CAC). Meanwhile, VCs report a 23% drop in funding rounds for SEO-dependent start-ups over the first half of 2025 (Crunchbase, June 2025). As generative AI content proliferates, search engines increasingly prioritize trust signals, authenticity, and editorially earned links over manipulative link exchanges.

How Investors Should Adapt as Legacy Link Tactics Lose Power

Investors holding stakes in high-growth digital brands or unicorn start-ups must reevaluate due diligence processes as scalable, old-school link acquisition now exposes portfolios to abrupt traffic losses. Evaluating marketing resilience—including dependence on legacy SEO—has become crucial after recent algorithm rewrites. Moving forward, investors should emphasize brands with comprehensive reputational strategies, invest in companies skilled at earning editorial links, and monitor third-party trust factors.Latest financial news from the sector also points to an uptick in demand for digital PR and earned media strategies. For deeper insights into public tech stocks elevated by organic search, see stock market analysis on digital-first companies. Incorporating these perspectives, traders may rebalance positions favoring SaaS and fintech platforms—particularly those that demonstrate E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) compliance.

Analysts Warn of Higher Marketing Spend Amid SEO Volatility

Market analysts at Forrester and Gartner suggest that competitive brands will disproportionately increase digital marketing budgets by up to 18% in 2026, primarily to offset traffic declines driven by AI-powered search updates (Forrester Digital Marketing Forecast 2025). Industry strategists observe that companies which diversify acquisition channels and reduce SEO dependency consistently outperform in post-update cycles. With the AI shift ongoing, agility in link acquisition and audience development remains pivotal.

Link Building Visibility Decline 2026 Signals Urgent Shift for Brands

The signal is clear: the link building visibility decline 2026 forces founders and investors to prioritize authentic, editorial links and robust brand authority. Upcoming Google AI algorithm shifts and rising link acquisition costs demand urgent adaptation. Strategic investors should ask: does a brand’s growth rely on legacy SEO tactics, or a sustainable digital reputation?

Tags: link building, SEO, $AHRF, startups, digital marketing