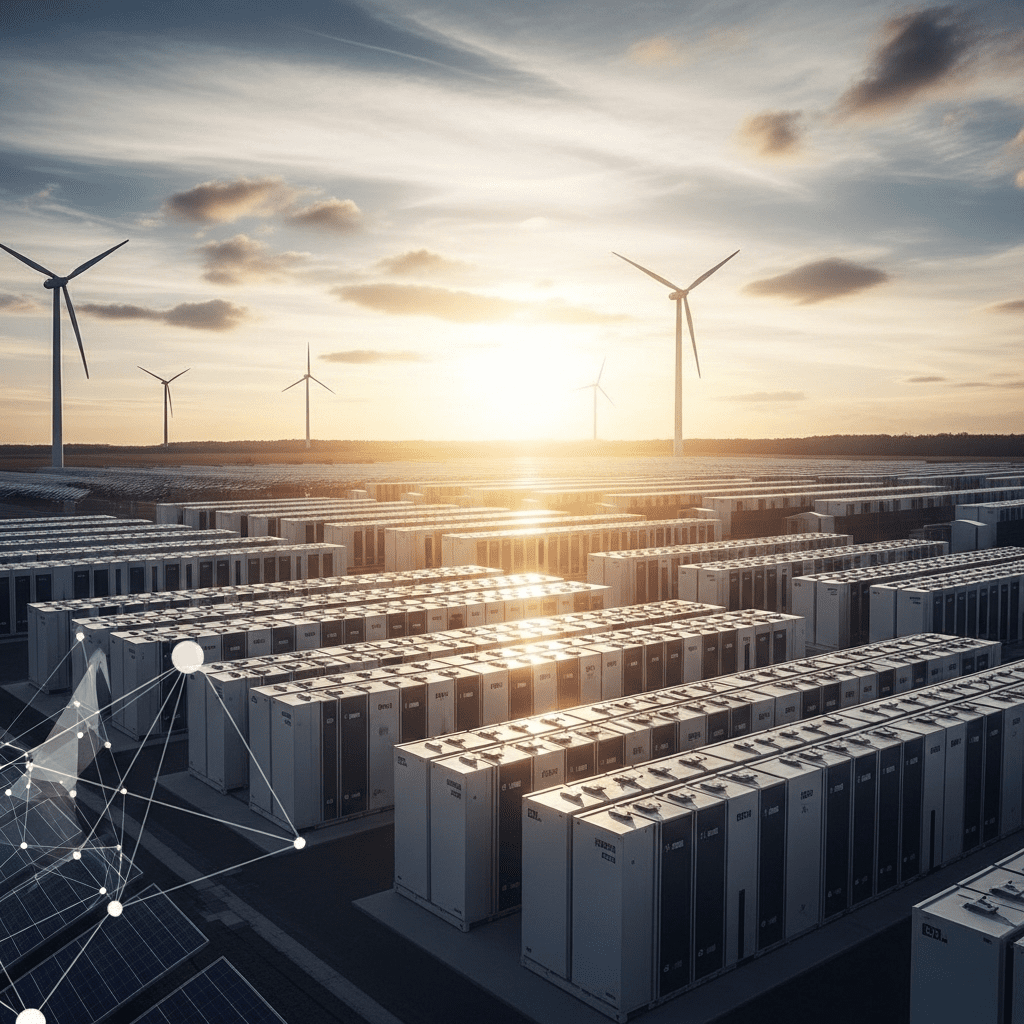

As the world accelerates towards a low-carbon future, mega-batteries are powering the clean energy revolution by transforming how we generate, store, and consume electricity. Investors, policymakers, and energy companies alike are looking to large-scale battery storage technologies as a cornerstone of renewable energy integration and grid stability.

Mega-Batteries Are Powering the Clean Energy Revolution: Scaling Energy Storage

The rapid growth of solar and wind power has created an urgent need for reliable storage to balance their inherent variability. Mega-batteries—utility-scale lithium-ion and alternative battery installations—are emerging as vital infrastructure, capable of supplying electricity during peak demand, stabilizing grids, and lowering emissions. According to BloombergNEF, global stationary battery storage capacity surpassed 60 GW in 2024, and is projected to more than double by 2027, highlighting investor confidence in this sector.

Why Scale Matters in Energy Storage

Unlike traditional smaller batteries, mega-batteries can power thousands of homes for several hours or serve as vital backup for entire cities during blackouts. For instance, giant battery farms in California and China now represent some of the world’s most significant energy infrastructure projects. Their ability to store and dispatch renewable energy on command is pivotal for achieving national and corporate net-zero targets.

Investment Trends in Mega-Batteries and Clean Energy

Investor demand for exposure to the energy storage value chain is surging in 2025. Clean energy ETFs and dedicated infrastructure funds are allocating record capital to battery manufacturing, installation, and software companies. In addition, partnerships between utilities, technology providers, and state governments are unlocking new market opportunities for innovation and scale. For readers interested in deeper investment insights into emerging sectors, energy storage sits at the crossroads of technology and sustainability.

Grid Resilience and Reliability

The reliability and flexibility provided by mega-batteries are redefining the economics of electricity. By preventing grid overloads, managing frequency regulation, and enabling time-shifting of renewable energy, these systems help utilities avoid costly power outages. According to the U.S. Department of Energy, grid-scale batteries contributed to a 38% decrease in grid instability events in high-renewables regions from 2022 to 2024. This is particularly critical as global electricity demand is forecasted to rise by 3% annually through 2030.

Challenges and Opportunities for Mega-Battery Deployment

While the momentum is undeniable, scaling mega-battery deployment faces several challenges. Raw material supply chains, especially for lithium, nickel, and cobalt, remain volatile and susceptible to geopolitical risk. Moreover, regulatory hurdles and grid integration complexities require innovative policy frameworks and cross-sector collaboration. However, advancements in alternative chemistries like sodium-ion, as well as breakthroughs in recycling and re-use of battery components, are fast-tracking sustainable growth. For those tracking sustainable finance, the intersection of technology, policy, and capital is creating a dynamic landscape of opportunity and risk management.

Regional Leaders and Global Expansion

China, the United States, and the European Union are leading the global buildout of mega-battery projects. China’s “new-type energy storage” installations topped 25 GW by the close of 2024, driven by robust policy incentives. Meanwhile, the U.S. Inflation Reduction Act has catalyzed a new wave of battery gigafactories and cross-sector investments. In Europe, increased emphasis on energy security and decarbonization is accelerating large-scale battery tenders, especially in Germany, Spain, and the Nordics.

The Future of Mega-Batteries in the Clean Energy Revolution

Looking ahead to 2025 and beyond, mega-batteries will remain instrumental in global efforts to decarbonize the electricity sector. The International Energy Agency forecasts that to meet net-zero targets by mid-century, annual battery storage installations must quadruple relative to 2023 levels. This trajectory presents unprecedented opportunities for both institutional and retail investors.

Integrating AI and Smart Grid Solutions

Artificial intelligence and advanced software are making mega-batteries even more effective. Machine learning algorithms optimize battery dispatch, forecast energy generation, and assess market opportunities, ensuring that storage resources deliver maximum economic and environmental value. For more on the role of AI in modern infrastructure, see our coverage of technology trends.

In summary, mega-batteries are powering the clean energy revolution by enabling renewables to become a reliable, primary energy source. As storage capacity grows and costs fall, batteries will anchor the world’s transition to a more resilient, sustainable, and investable energy future.