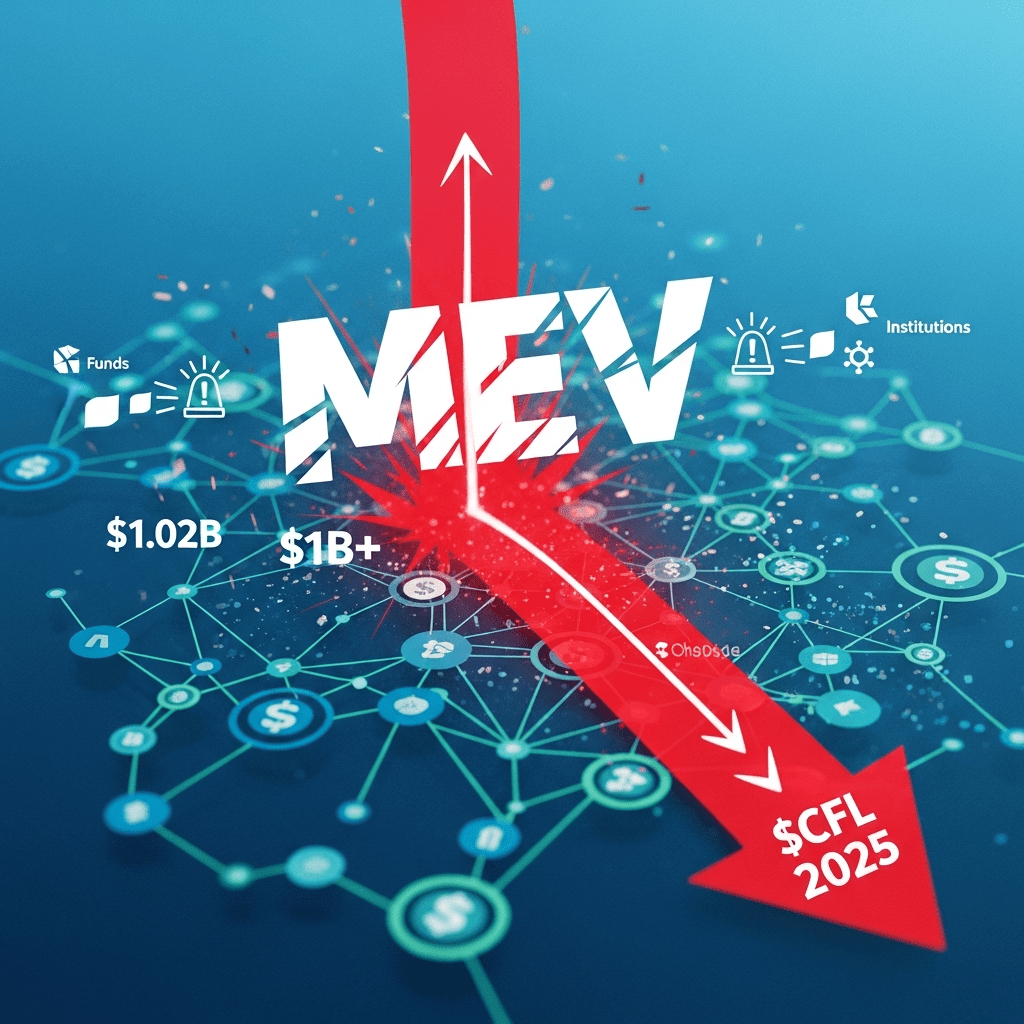

Crypto exchange leader ChainFlow ($CFL) revealed that MEV driving institutions away DeFi now costs retail users over $1 billion in 2025 losses. Despite a surge in DeFi adoption, rising MEV extraction is rapidly reshaping market participation—leaving analysts and investors alarmed.

MEV-Driven Losses Top $1B as ChainFlow ($CFL) Tracks DeFi Exodus in 2025

ChainFlow ($CFL) has disclosed that MEV (Maximal Extractable Value) activities led to over $1.02 billion in user losses on decentralized exchanges (DEXs) between January and October 2025, per data compiled from Dune Analytics and Messari. The losses grew 34% year-over-year, outpacing DeFi user growth. The number of institutional participants in major DEX pools fell 28% during the same period, with several funds withdrawing assets after high-profile MEV incidents in May and July. According to ChainFlow’s public statement on October 28, “MEV-driven bots front-ran over 6.4 million trades this year, significantly eroding user returns.”

Why DeFi Market Faces Institutional Retreat Amid Mounting MEV Risks

The MEV surge is creating volatility and trust issues within the DeFi sector, especially for institutional liquidity providers. Institutional assets in Uniswap ($UNI) and Curve ($CRV) shrank to $16.7 billion by October 2025, down from $23.5 billion in early 2024 per DeFiLlama. This retreat follows a pattern established after the 2022-23 cross-chain bridge exploits, but the sheer scale of MEV extraction marks a new challenge. According to crypto market intelligence firm Kaiko, DeFi volumes dropped 19% quarter-on-quarter in Q3 2025, with much of the capital shifting to centralized venues or moving offshore. Regulatory uncertainty surrounding MEV practices further accelerates this pullback, intensifying the need for credible, transparent infrastructure within DeFi.

How Investors Can Navigate MEV-Driven Volatility in DeFi Markets

For active crypto investors, MEV mitigation strategies have become critical. Exposure to high-frequency trading bots and sandwich attacks puts DeFi portfolios at heightened risk, particularly on high-volume DEX platforms. Long-term allocators are increasingly diversifying into managed liquidity pools and protocols that adopt MEV-resistance measures, such as Flashbots or MEV Blocker. Traders seeking alpha are advised to track emerging protocols implementing verifiable random functions (VRFs) or private mempools. Institutional funds are reallocating toward platforms with strong governance frameworks—a trend consistent with broader shifts observed in cryptocurrency market trends found on ThinkInvest’s cryptocurrency market trends coverage. Additionally, investors can stay informed through latest financial news regarding regulatory developments and risk disclosures. With DeFi innovation accelerating, careful protocol selection and ongoing risk assessment are more vital than ever for portfolio resilience.

What Analysts Expect Next as MEV Threatens DeFi Participation

Industry analysts observe that unless DeFi protocols adapt, MEV will continue to deter institutional inflows and undermine user confidence. Research from Delphi Digital and Galaxy Digital in September 2025 highlights the mounting tension between innovation and fair market dynamics. Analysts expect decentralized governance to prioritize MEV mitigation in upcoming protocol upgrades, while regulators in the US and EU assess policy responses to maintain investor protection in DeFi.

MEV Driving Institutions Away DeFi Signals Shifting Crypto Landscape

With MEV driving institutions away DeFi at an accelerating pace, investors should brace for continued volatility, uneven liquidity, and heightened regulatory scrutiny in the sector. Monitoring initiatives in MEV mitigation, transparent governance, and institutional engagement will be crucial as the DeFi ecosystem evolves. Proactive risk management and careful platform selection remain the best defense as the crypto landscape undergoes this transformation.

Tags: MEV, DeFi, institutional investors, $CFL, crypto risk