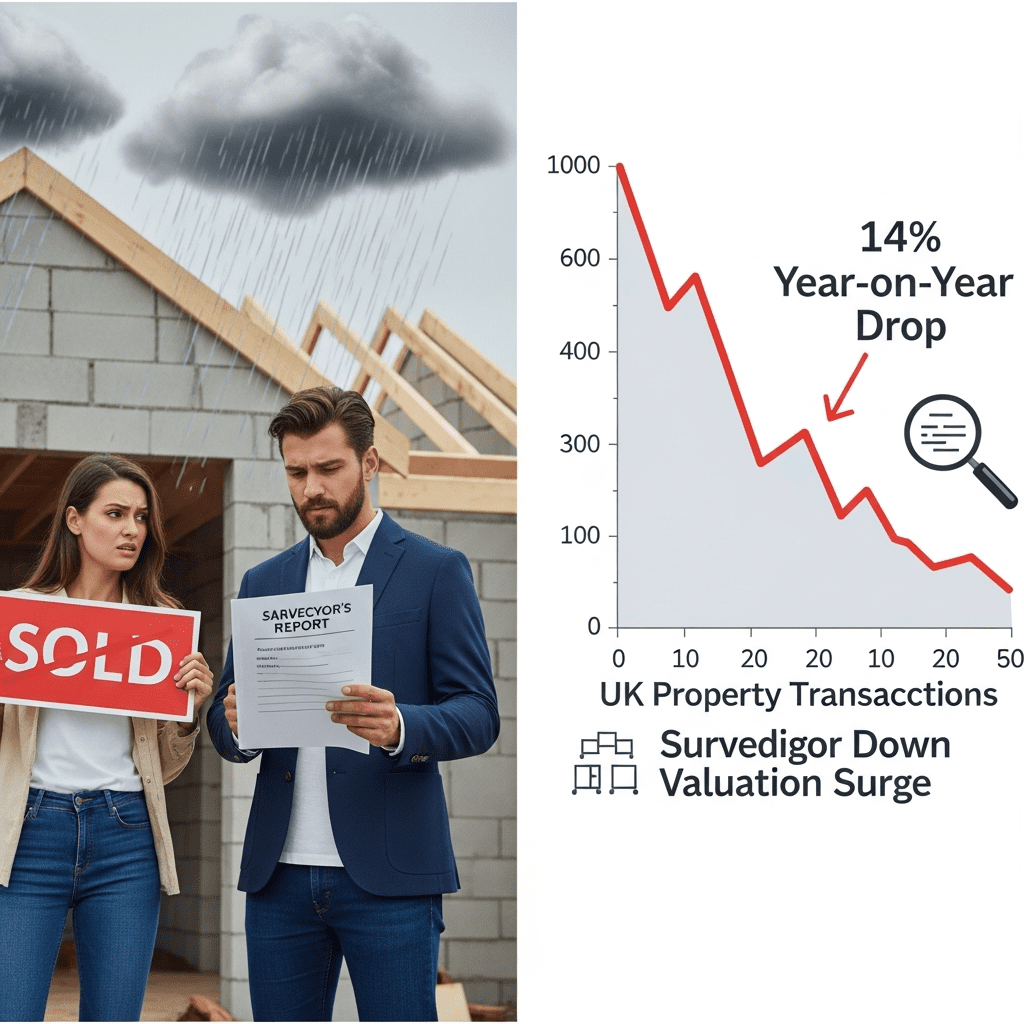

UK property transactions have plummeted by 14% year-on-year, alarming mortgage brokers and homebuyers after a surge in housing surveyor ‘down valuing,’ reports Nationwide ($NBS). The focus keyphrase, house buying at risk from surveyor down valuing, has come to define a mounting challenge for purchasers as deals increasingly falter due to rigorous property assessments.

Surveyor Down Valuations Surge, Threatening Home Sales Volume

Across the UK housing market, mortgage brokers have reported that 28% of mortgage applications in Q3 2025 faced ‘down valuations,’ according to UK Finance data cited by Bloomberg on November 15, 2025. This marks a significant climb from 18% in Q3 2024. In practical terms, Rightmove data shows that agreed sales for October 2025 totalled 78,400 properties, down sharply from 91,200 a year prior—a 14% decrease.

A down valuation occurs when a surveyor provides a lower-than-offered valuation, causing lenders to restrict loan amounts or withdraw offers. Nationwide ($NBS) highlighted in their October 2025 housing review that average mortgage loan-to-value (LTV) ratios fell from 84% (Q2 2024) to 78% (Q3 2025). This signals stricter risk controls by lenders, echoing caution amid market uncertainty. As reported by Reuters, over £3.8 billion in agreed sales were renegotiated or collapsed in the past three months due to down valuations.

The data-driven spike in down valuations highlights tightening lender risk appetite and increasing scrutiny from surveyors. According to Zoopla’s August 2025 market report, 1 in 6 property deals now face re-negotiation at the survey stage—up from 1 in 9 in the same period last year.

UK Real Estate Market Faces Headwinds from Lending Tightness

This trend carries significant macroeconomic and sector-wide implications. First, the Bank of England’s monetary tightening—maintaining benchmark rates at 5.25% through Q3 2025—has dampened buying power and buyer sentiment. Data from the Office for National Statistics (ONS) released in October 2025 showed UK house prices posted only a 0.8% annual rise, compared to 3.2% in 2024, a direct reflection of buyers’ constrained borrowing abilities.

Reduced borrowing means buyers either renegotiate offers below initial asking prices or face transaction collapse. Halifax, via Reuters, found 24% of potential homebuyers withdrew purchase offers in Q3 2025 after down valuations forced them to find larger deposits. Lenders like Lloyds Banking Group ($LLOY) reported a 7% drop in new mortgage approvals in the same period, citing heightened caution in risk assessment.

Consequently, estate agents and property developers report slower inventory turnover. Savills estimates 2025’s completed transactions will land at under 950,000 units, down from 1.13 million in 2024. Market participants warn that extended market weakness could ripple into construction, retail, and consumer confidence indices. The tightening is also impacting the buy-to-let market, with UK Finance noting a 22% drop in rental property mortgage applications since mid-2024, partly attributed to tougher valuation policies.

Investor Strategies Amid Mortgage Lending and Valuation Headwinds

For investors, the sharp uptick in surveyor down valuations brings both risk and opportunity. Residential real estate investment trusts (REITs) such as Grainger Plc ($GRI) and property service firms are exposed to revaluation-driven downside. Yet, history shows that market corrections can unlock value for patient, cash-rich buyers seeking discounted assets.

Active investors may consider rotating exposure towards sectors less reliant on high LTV financing, such as logistics-focused REITs, or pivoting into short-term rental platforms which face less stringent mortgage criteria. Meanwhile, homebuilder equities like Persimmon ($PSN) are likely to remain sensitive to both volumes and price changes, with volumes already down 13% year-on-year, as detailed in their November 2025 trading update.

Strategic opportunities exist in monitoring macro-triggers—Bank of England rate moves, regulatory interventions, or signs of price stabilization. Investors can supplement analysis via stock market insights related to real estate shares and follow broader financial news trends for actionable sector signals.

Market participants and brokers recommend enhanced due diligence, negotiation tactics with sellers to manage valuation risk, and deeper engagement with mortgage advisors skilled at navigating survey adjustments. Multi-asset investors may also hedge property exposure through correlated UK financials or fixed income positions.

Analysts See Market Pressures Persisting into Early 2026

Analysts and market strategists, referencing recent Halifax and Savills reports, project that surveyor conservatism and rigorous valuation controls will persist through at least Q1 2026. This outlook aligns with the latest Q3 RICS Residential Market Survey, showing that 41% of chartered surveyors expect further downwards pressure on prices and volumes into next year.

JP Morgan’s August 2025 European Housing note highlighted a “structurally high cost of capital” and “regulatory uncertainty” remaining key deterrents for mortgage lenders. Macro frameworks, such as the FCA’s enhanced affordability assessments (in place since July 2024), have resulted in mortgage rejections or reductions for over 65,000 applicants year-to-date, mostly due to valuation shortfalls.

Expert commentary from the Council of Mortgage Lenders, as reported by Bloomberg, suggests a stabilization is unlikely until the Bank of England signals rate easing or wage growth meaningfully narrows the housing affordability gap. Until then, experts forecast continued stress for buyers relying on maximum borrowing and a challenging pipeline for estate agents.

House Buying at Risk from Surveyor Down Valuing: Strategic Watch

House buying at risk from surveyor down valuing is no longer a niche concern, but a systemic challenge reshaping the UK real estate market’s near-term horizon. In the months ahead, sellers, buyers, and investors should prioritize flexibility in negotiations, improved financial buffers, and robust due diligence before committing to deals.

For actionable guidance, informed readers can leverage ThinkInvest’s expert market coverage and ongoing updates on UK property and stock market analysis. The key investor takeaway: track valuation trends, monitor Central Bank policy, and assess sectoral risk as the impact of surveyor down valuing continues to ripple through the market in 2025 and beyond.

Tags: house buying, mortgage brokers, down valuation, UK property market, real estate 2025